Main Search

A Closer Look: The 2016-17 Certification Revenue Estimate

View the latest Certification Revenue Estimate.

Why It Matters:

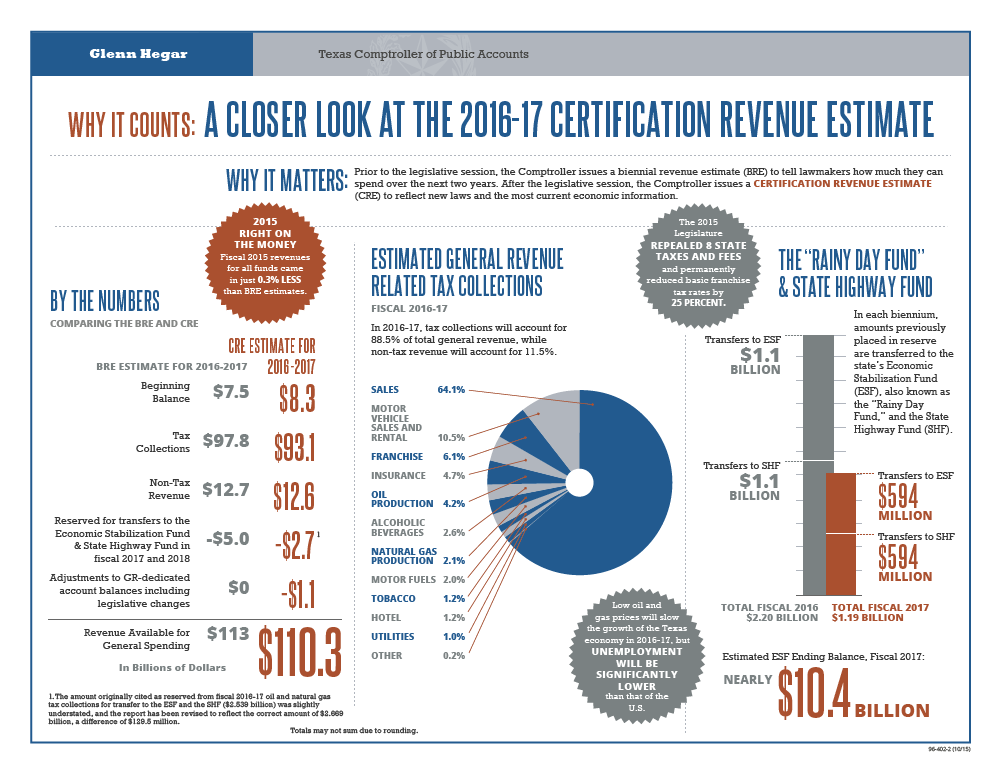

Prior to the legislative session, the Comptroller issues a biennial revenue estimate (BRE) to tell lawmakers how much they can spend over the next two years. After the legislative session, the Comptroller issues a CERTIFICATION REVENUE ESTIMATE (CRE) to reflect new laws and the most current economic information.

Low oil and gas prices will slow the growth of the Texas economy in 2016-17, but unemployment will be significantly lower than that of the U.S.

2015 Right on the Money

Fiscal 2015 revenues for all funds came in just 0.3% LESS than BRE estimates.

By the NumbersComparing the BRE and CRE

| Revenue Source | BRE Estimate for 2016-17 | CRE Estimate for 2016-17 |

|---|---|---|

| Beginning Balance | $7.5 | $8.3 |

| Tax Collections | $97.8 | $93.1 |

| Non-Tax Revenue | $12.7 | $12.6 |

| Reserved for transfers to the ESF & SHF in fiscal 2017 and 2018 | −$5.0 | −$2.7* |

| Adjustments to GR-dedicated account balances including legislative changes | $0 | −$$1.1 |

| Revenue Available for General Spending** | $113.0 | $110.3 |

* The amount originally cited as reserved from fiscal 2016-17 oil and natural gas tax collections for transfer to the ESF and the SHF ($2.539 billion) was slightly understated, and the report has been revised to reflect the correct amount of $2.669 billion, a difference of $129.5 million.

** Totals may not sum due to rounding.

The 2015 Legislature repealed 8 state taxes and fees and permanently reduced basic franchise tax rates by 25 percent.

Estimated General Revenue-Related Tax CollectionsFiscal 2016-17

In 2016-17, tax collections will account for 88.5% of total general revenue, while non-tax revenue will account for 11.5%.

| Tax | Percent of Revenue |

|---|---|

| Sales Tax | 64.1% |

| Motor Vehicle Sales and Rental | 10.5% |

| Franchise | 6.1% |

| Insurance | 4.7% |

| Oil Production | 4.2% |

| Alcoholic Beverages | 2.6% |

| Natural Gas Production | 2.1% |

| Motor Fuels | 2.0% |

| Tobacco | 1.2% |

| Hotel | 1.2% |

| Utilities | 1.0% |

| Other | 0.2% |

The “Rainy Day Fund” and State Highway Fund

In each biennium, amounts previously placed in reserve are transferred to the state's Economic Stabilization Fund (ESF), also known as the "Rainy Day Fund," and the State Highway Fund (SHF).

| Transfers to: | Fiscal 2016 | Fiscal 2017 |

|---|---|---|

| Economic Stabilization Fund | $1.1 Billion | $594 Million |

| State Highway Fund | $1.1 Billion | $594 Million |

| Total | $2.2 Billion | $1.19 Billion |

Estimated ESF Ending Balance, Fiscal 2017:

Nearly $10.4 Billion