Fraud and Consumer Alerts

Together, Let's Fight Suspected Fraud, Theft, Waste, Abuse and Scams!

We are dedicated to coordinating the reporting and investigation of suspected fraud, theft, waste, abuse and scams impacting you and our agency. By playing your part in reporting suspected fraud, theft, waste, abuse and scams, you’ll safeguard state programs and the financial resources that have been appropriated to serve you, your family and your fellow Texans.

The Comptroller’s office also is committed to providing you with information that will help protect you from fraud and scams. If you need legal advice, please contact a licensed Texas attorney or the State Bar of Texas legal hotline at 800-504-7030. Please report suspected fraud, theft, waste, abuse and scams concerning the Comptroller’s office by contacting stop.spoofing@cpa.texas.gov.

If you suspect tax-avoidance or falsified records, visit the agency's Criminal Investigations Division Contact Us page. You may remain anonymous.

Fraud Alerts

Consumer Alerts

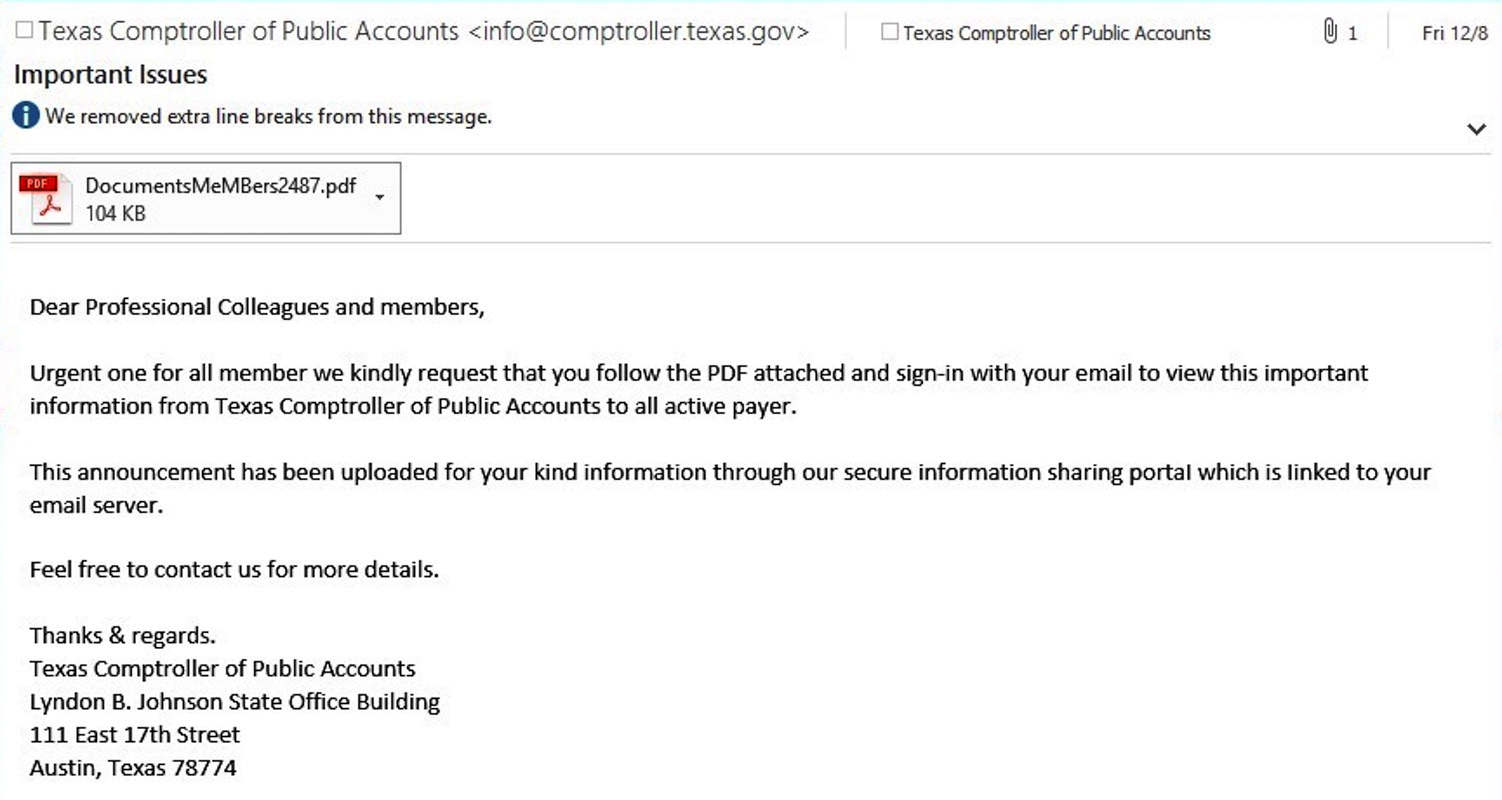

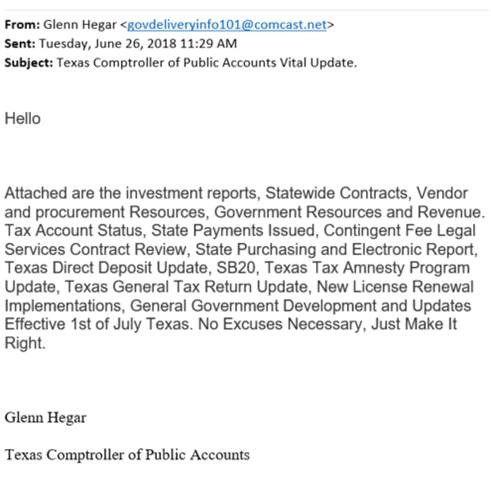

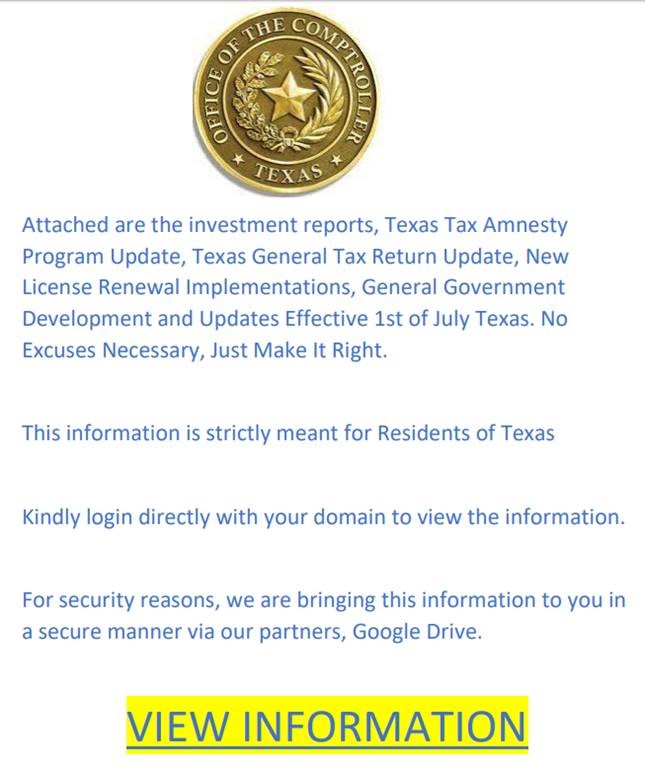

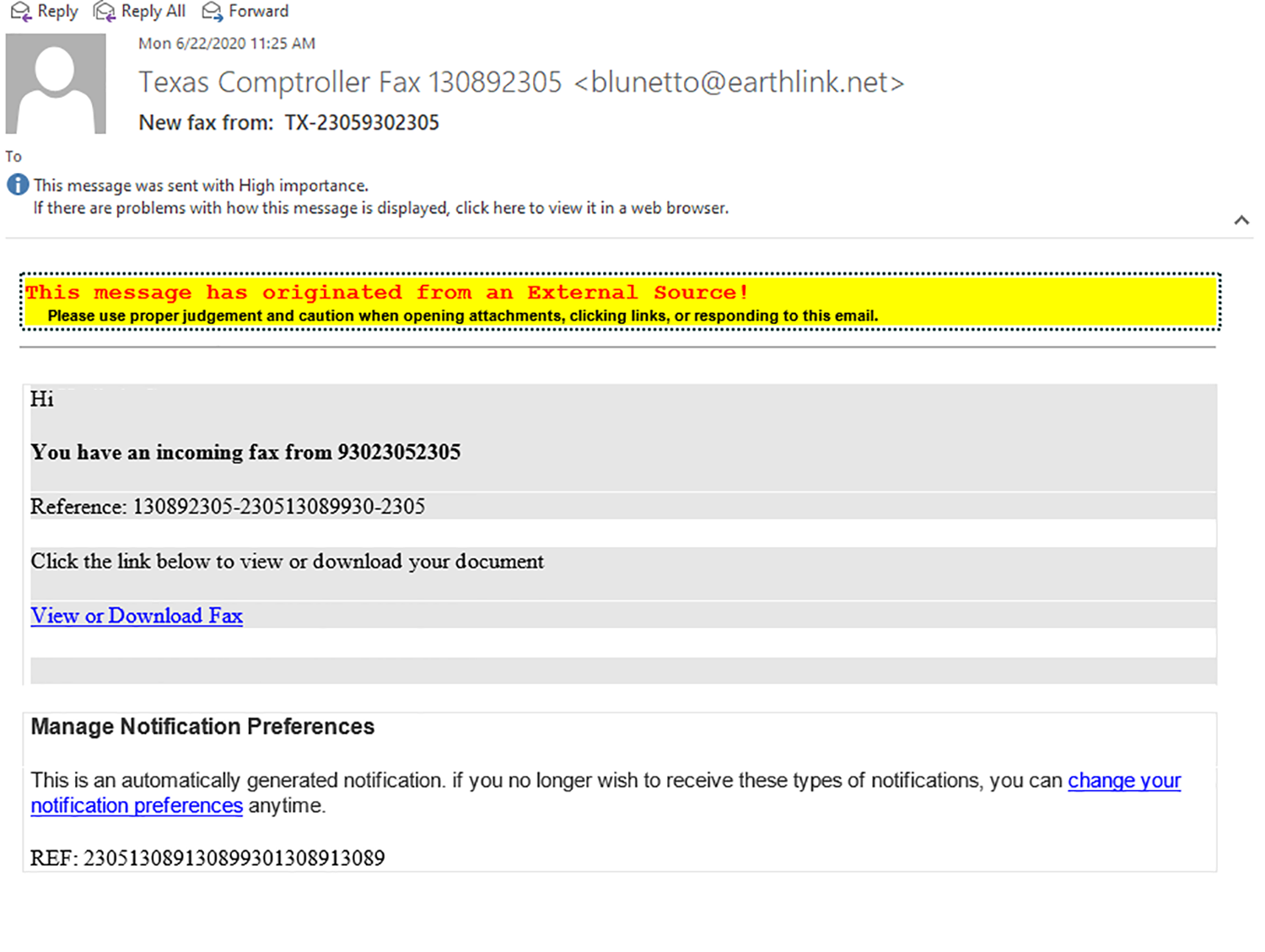

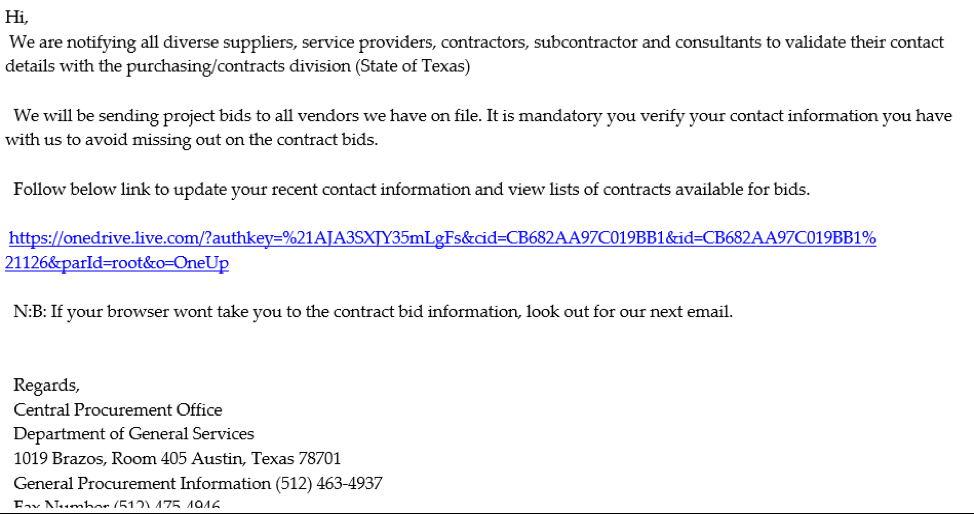

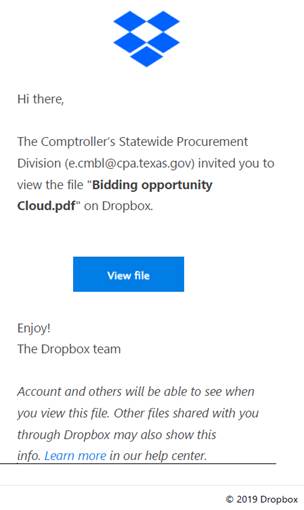

Fraud Alert: DocuSign Scam

The Texas Comptroller of Public Accounts issues this fraud alert to prevent Texans from being defrauded by criminals who are using a DocuSign response email message.

Criminals posing as the agency or Comptroller’s office employees are sending emails to individuals and businesses asking that they review and sign a document via DocuSign. The hyperlinks in the email may steal your personal information and/or DocuSign credentials and inject a virus into your computer.

If you receive such an email (view example), please take the following actions immediately:

- Forward the entire email as an attachment to security@docusign.com.

- Do not respond to the email.

- Block the sender of the email.

- Change your password to any account (e.g., Comptroller’s office electronic systems, DocuSign) identified in the email.

- Update your antivirus software and run a diagnostic.

- If you have already opened the email and clicked on a hyperlink, report the fraud to the Federal Trade Commission at ReportFraud.ftc.gov and follow its instructions on how to avoid subsequent identity theft.

IFTA License Agent Application and Decal Fees

Some third party agents charge taxpayers a fee to submit an application for IFTA licenses and request the decals on their behalf. Individuals willing to pay a fee to third parties, should be aware the Comptroller issues these licenses and decals at no cost and does not charge an application fee. Please visit https://comptroller.texas.gov/taxes/fuels/ifta.php for additional information.

Unclaimed Property Asset Recovery Company Fees

The Comptroller’s office offers assistance with recovering unclaimed property at no cost to claimants. Individuals willing to pay a fee to third parties offering assistance with unclaimed property should be aware that in most cases, fees cannot exceed 10% of the value of the property being claimed. Additional information is available at ClaimItTexas.org.

Third-Party Fees For Free Comptroller Services

We recently became aware that the following website is charging taxpayers for services our office provides at no cost: http://statetaxcertificates.com/texas/. This third party is not claiming to be a state agency but the website is not secure, meaning data shared between you and this website is not encrypted. In addition the website contains the following misinformation:

- Taxpayers are not “issued an annual resale certificate” as the website claims. Instead taxpayers may download a resale certificate (Form 01-339) from our website and give this to their vendor or supplier to purchase items for resale, rent or lease. Taxpayers are required to have an active sales tax permit. The 11-digit Texas Taxpayer ID # that is assigned when an application for a sales tax permit is processed must be listed on the resale certificate.

- The “State Tax Certificate” this website is referring to is the Texas Sales Tax Permit. This does not expire unless the taxpayer ceases to do business in Texas.

Additional Resources

- Report a vulnerability in one of our information systems. Email us at:

Report.Vulnerable@cpa.texas.gov - Report suspected fraud, theft, waste and abuse concerning state government agencies:

State Auditor's Office - Report suspected fraud, theft, waste and abuse concerning state government agencies:

State Auditor's Office - Report suspected ethical issues:

Employee.Hotline@cpa.texas.gov - Report suspected identity theft:

Federal Trade Commission - Report suspected workers' compensation fraud:

Texas Workforce Commission - Report suspected securities fraud:

Texas State Securities Board - Report suspected health care and Medicare-Medicaid fraud:

Texas Health and Human Services - Inspector General - Report suspected mail fraud scams:

United States Postal Inspection Service