Main Search

The Texas Legacy FundMaintaining the AAA Rating

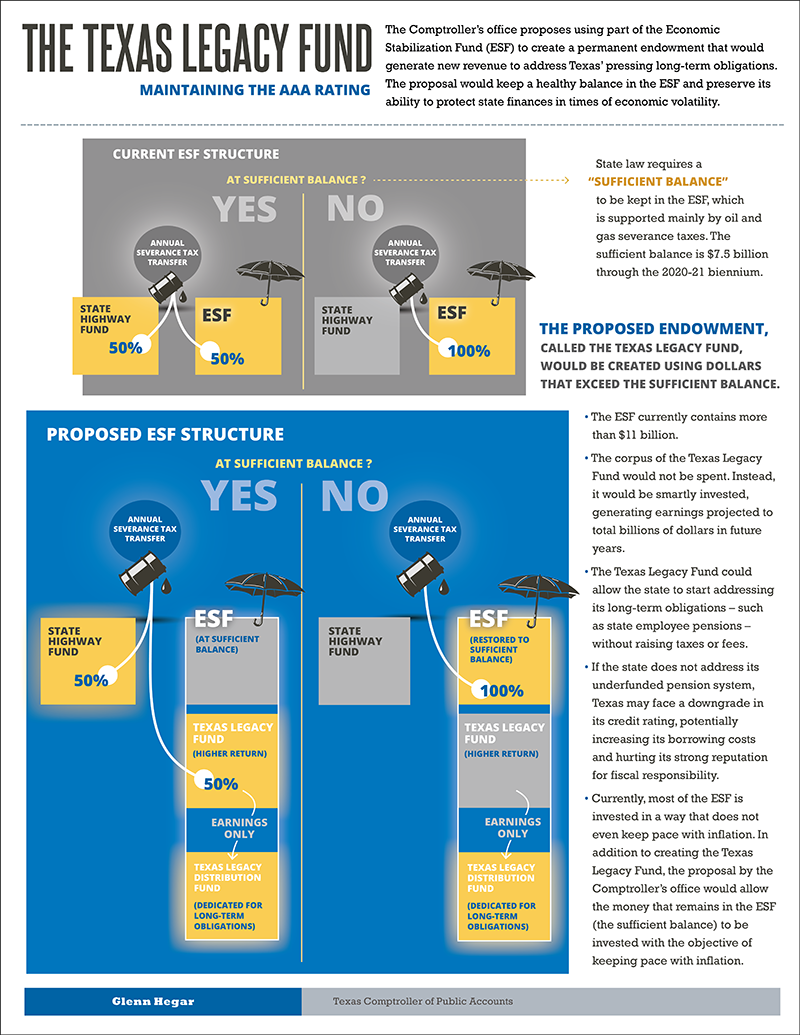

The Comptroller’s office proposes using part of the Economic Stabilization Fund (ESF) to create a permanent endowment that would generate new revenue to address Texas’ pressing long-term obligations. The proposal would keep a healthy balance in the ESF and preserve its ability to protect state finances in times of economic volatility

Current ESF Structure

50% of the annual severance tax is transferred to the State Highway Fund (SHF), and the other 50% is transferred to the ESF.

State law requires a “SUFFICIENT BALANCE” to be kept in the ESF, which is supported mainly by oil and gas severance taxes. The sufficient balance is $7.5 billion through the 2020-21 biennium.

The proposed endowment, called the Texas Legacy Fund, would be created using dollars that exceed the sufficient balance.

Proposed ESF Structure

As long as the Texas Stabilization Fund contains the required reserve balance, 50% of the annual severance tax would be transferred to the ESF, and any additional new dollars headed for the ESF would flow into a second tier, the Texas Legacy Fund, which would function much like an endowment, creating investment earnings dedicated to addressing the state's long-term obligations.

The ESF currently contains more than $11 billion.

The corpus of the Texas Legacy Fund would not be spent. Instead, it would be smartly invested, generating earnings projected to total billions of dollars in future years.

The Texas Legacy Fund could allow the state to start addressing its long-term obligations – such as state employee pensions – without raising taxes or fees.

If the state does not address its underfunded pension system, Texas may face a downgrade in its credit rating, potentially increasing its borrowing costs and hurting its strong reputation for fiscal responsibility.

Currently, most of the ESF is invested in a way that does not even keep pace with inflation. In addition to creating the Texas Legacy Fund, the proposal by the Comptroller’s office would allow the money that remains in the ESF (the sufficient balance) to be invested with the objective of keeping pace with inflation.