Property Tax System Basics

Texas has no state property tax. Local governments set tax rates and collect property taxes to provide many local services including schools, streets, roads, police and fire protection. Texas law requires property values used in determining taxes to be equal and uniform. It establishes the process for local officials to follow in determining property values, setting tax rates and collecting property taxes.

Who administers the property tax system?

The property tax system consists of officials who administer the process, property tax agencies, and the laws or regulations that govern what they do.

Texas law requires property values used in determining taxes to be equal and uniform. It establishes the process for local officials to follow in determining property values, setting tax rates and collecting property taxes. Cities, counties, and junior colleges can access other revenue sources, including a local sales tax. School districts rely on local property tax, state, and federal funding.

The property owner, whether residential or business pays taxes and has a reasonable expectation that the taxing authorities administer the taxing process fairly. The property owner is also referred to as the taxpayer.

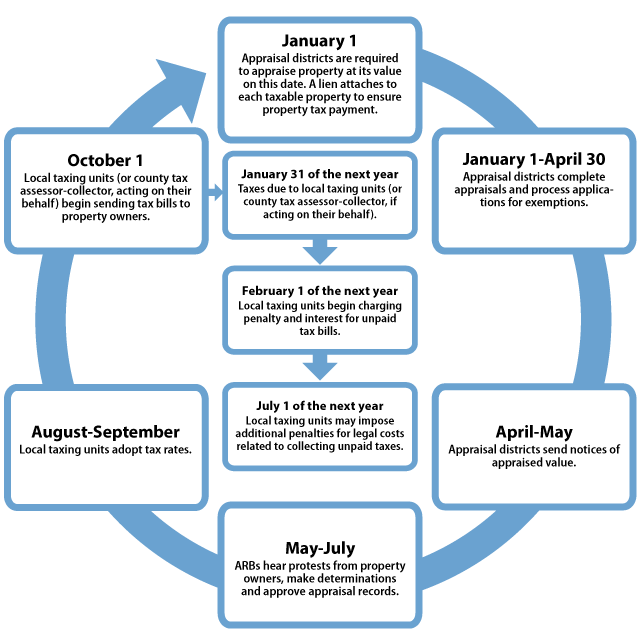

Appraisal districts, administered by a chief appraiser, appraise your property’s value as of Jan. 1 each year. Market conditions and who owns the property on that date determine whether the property is taxable, the value at which it can be taxed and who is responsible for paying the tax. A board of directors governs the appraisal district. Appraisal districts process applications for tax exemptions, special appraisals and other tax relief. Please contact your local appraisal district for more information about your local appraisal process.

In counties with a population of less than 75,000, local taxing units elect the board of directors and fund the appraisal district based on the taxes levied in each taxing unit. In counties with a population of 75,000 or more, local taxing units elect five members of the board of directors, three members are elected by the public, and the county tax assessor-collector serves as an ex officio member.

An appraisal review board (ARB) is a board of local citizens that hears disagreements between property owners and the appraisal district about a property’s taxability and value. The applicable appointing authority in the county in which the appraisal district is located appoint the ARB members. The appointing authority for counties with a population of less than 75,000 is the local administrative district judge. The board of directors appoints ARB members in counties with a population of 75,000 or more.

Around May 15, the ARB begins hearing protests from property owners who either believe their property values are incorrect or the chief appraiser denied an exemption or special agricultural appraisal. When the ARB finishes its work, the appraisal district gives each taxing unit a list of taxable property.

In counties with a population greater than 120,000, the appraisal district board of directors must appoint a taxpayer liaison officer (TLO). The TLO is responsible for assisting taxpayers in understanding the appraisal process and protest procedures, resolving disputes not involving matters subject to protest, and administering public access functions.

In many counties, taxing units contract with the county tax assessor-collector to collect all property taxes due in that county around Oct. 1. The assessor-collector then transfers the appropriate amounts to each taxing unit. Although some taxing units may contract with an appraisal district to collect their taxes, the appraisal district does not levy a property tax.

Generally, taxpayers have until Jan. 31 of the following year to pay their property taxes. On Feb. 1, penalty and interest charges begin accumulate on most unpaid tax bills. For information about local taxing unit budgets and tax rates, please contact the individual school district, county, city, junior college or special district, or visit texas.gov/propertytaxes.

The Comptroller's Property Tax Assistance Division (PTAD) is primarily limited to educating, advising and monitoring services. PTAD conducts a biennial School District Property Value Study (SDPVS) for each school district for state funding purposes. The SDPVS, an independent estimate mandated by the Texas Legislature, ensures that property values within a school district are at or near market value for equitable school funding. The Comptroller's values do not directly affect local values or property taxes.

Texas law also requires the Comptroller's office to conduct an Appraisal District Ratio Study (ADRS) to measure the performance of each appraisal district in Texas every two years. This study measures the uniformity and median level of appraisals performed by an appraisal district within each major property category.

PTAD also performs Methods and Assistance Program (MAP) reviews of all appraisal districts every two years. These reviews address four issues: governance, taxpayer assistance, operating standards and appraisal standards, procedures and methodologies. PTAD reviews approximately half of all appraisal districts each year. School districts located in counties that do not receive a MAP review in a year will be subject to an SDPVS and ADRS in that year.

What is a property tax?

Property tax is measured by the value of a taxpayer's property. It is also called ad valorem tax, a Latin phrase meaning "according to value." The tax consists of two parts:

- a base amount, against which the tax is imposed;

- and a rate, a percentage that determines the amount of tax due.

More than 4,796 local taxing units in Texas — school districts, cities, counties and various special districts — assess property tax to fund local public services.

Several types of taxing units may tax your property. Texas counties and local school districts tax all nonexempt property within their jurisdictions. You also may pay property taxes to a city and special districts such as hospital, junior college or water districts.

The governing body of each of these local governments determines the amount of property taxes it wants to raise and sets its tax rate. Many, but not all, local governments contract with their county’s tax assessor-collector to collect the tax on their behalf.

When do they do it?

The property tax process for each tax year includes a series of steps.

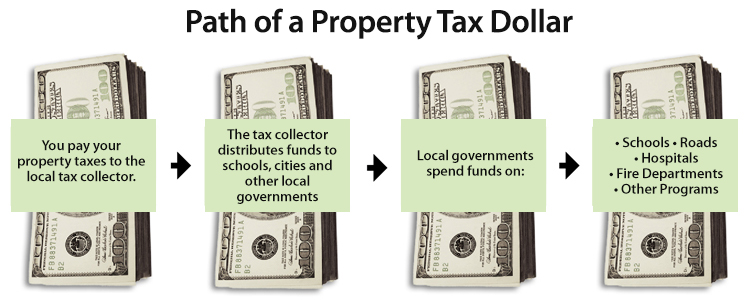

Where does the money go?

Local property tax is the largest single funding source for community services. State government receives no benefit from these local taxes. Your local property taxes help to pay for your public schools, city streets, county roads, police departments, fire protection and many other vital programs.

Why do they do it?

The Texas Constitution sets out five basic rules for property taxes in our state:

- Taxation must be equal and uniform. No single property or property type should pay more than its fair share. The property taxes you pay are based on your property's value less any exemptions applied. If, for instance, your property is worth half as much as your neighbor's property (after any exemptions that apply), your tax bill should be one-half of your neighbor's - meaning that uniform appraisal is critical.

- Generally, taxing units must tax all property based on its current market value. That's the price it would sell for when both buyer and seller seek the best price, and neither is pressured to buy or sell. The Texas Constitution provides certain exceptions to this rule, such as using productivity values for agricultural and timberland valuation- meaning that the land is taxed based on the value of what it produces, such as crops and livestock, rather than its current market value. This special valuation lowers the tax bill for such land.

- Each property in a county must have a single appraised value to which you pay property taxes cannot assign different values to your property-all must use the same value. The use of appraisal district guarantees this.

- All property is taxable unless federal or state law exempts it from the tax. These exemptions may exclude all or part of your property's value from taxation.

- Property owners have a right to reasonable notice of increases in their property's appraised value.

You can direct questions about the nature and purpose of property taxation in Texas to your local state representative or senator. You can find contact information for all members of the Texas Legislature at Texas Legislature Online.

How can I challenge what they do?

If you are dissatisfied with the results of a decision by your local ARB, you have the right to appeal its decision to district court in the county where the property is located. Alternatively, you may appeal the ARB's determination to regular binding arbitration (RBA) or to the State Office of Administrative Hearings (SOAH) provided you meet certain criteria.

An independent third party conducts RBA. The Comptroller’s office maintains a registry of qualified arbitrators and processes requests for arbitration and accompanying deposits, but plays no other role in this process.

If the ARB determines the property value is over $1,000,000, you may file an appeal with SOAH. The decisions of SOAH administrative law judges are final and may not be appealed. For more information on this process, visit the SOAH website.

Who do I contact if I want to file a complaint against

the ethics or professional conduct of a chief appraiser,

appraiser or tax assessor collector (TAC)?

You can file a written complaint with the Texas Department of Licensing and Regulation (TDLR). TDLR regulates the registration and professional conduct of persons in the appraisal occupation. You may contact TDLR by calling 800-803-9202, or by mail at:

P.O. Box 12157

Austin, Texas 78711