Biennial Revenue Estimate 2010-2011

Revenue Overview

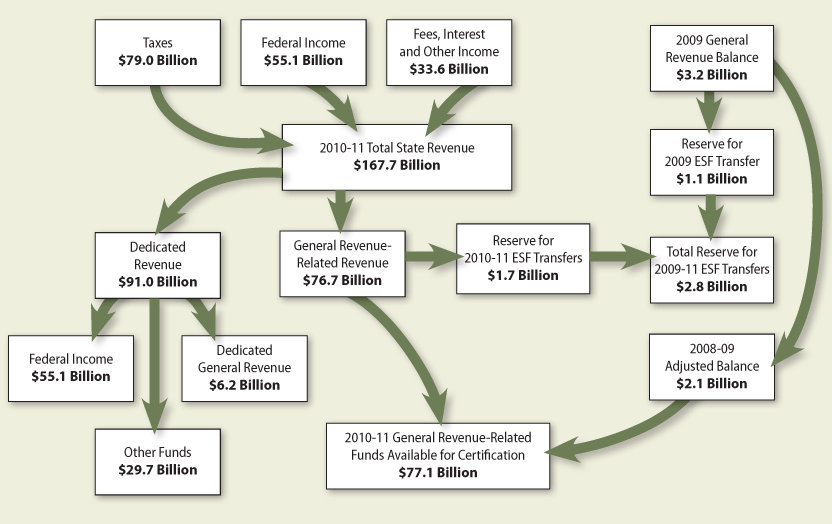

The State of Texas will have an estimated $77.1 billion available for general purpose spending in the 2010-11 biennium, 10.5 percent below the corresponding amount of funds availablefor 2008-09. This figure represents the sum of the 2008-09 ending balance, 2010-11 tax revenue, and 2010-11 non-tax receipts, less estimated transfers to the Economic Stabilization Fund (ESF) and adjustments to General Revenue-related dedicated account balances.

Aside from certain fund balances, only four funds affect the discretionary spending detailed in the General Appropriations Act. These funds, which are referred to as “general revenue-related funds,” are the General Revenue Fund, the Available School Fund, the State Textbook Fund, and the Foundation School Fund Account. The remaining funds depend upon federal receipts or revenues that are dedicated by the constitution or by statute. A prime example is the constitutionally dedicated Permanent University Fund.

FIGURE 1:

Flow of Major Revenues

for the 2010–2011 Biennium

Note: Totals may not sum because of routing.

Source: Susan Combs, Texas Comptroller of Public Accounts.

Text alternative for Flow of Major Revenues for the 2010–2011 Biennium

The state’s tax system is the main source of general revenue-related funding. Tax collections in 2010-11 will generate $68.5 billion; and non-tax revenues will produce an additional $8.2 billion. Factoring in the estimated $2.1 billion ending balance carried forward from 2008-09, these three sources total $78.7 billion. Against this amount, $1.7 billion must be placed in reserve for future transfers to the ESF.

Taking all state revenue sources into account, the state is expected to collect $167.7 billion in revenue for all state funds in 2010-11.

As a footnote, and given the uncertainty surrounding the immediate future course of the economy, it goes without saying that any attempt to forecast the state’s fiscal condition beyond 2010-11 is problematic at best.

However, this might be a good time to review current revenue and spending patterns and their implications on the 2012-13 budget.

In 2007, lawmakers had a sizable General Revenue fund balance on hand for use in crafting the 2008-09 budget. That balance ultimately reached $9 billion by September 1, 2007. Adding to that was a balance of over $700 million in the Property Tax Relief Fund (PTRF) – not part of General Revenue, but an integral part of funding property tax relief to school districts.

The Legislature wisely saved $3 billion and sent it to the PTRF to support school property tax reductions in future years. And slightly over $2 billion is estimated to remain in General Revenue when 2008-09 comes to a close in August 2009, a nearly $7 billion difference from the previous biennium.

The remaining General Revenue balance, approximately $4.5 billion, went to fill a gap which has opened between the state’s (smaller) current revenue stream and (larger) current spending – including General Revenue funding needed to augment the PTRF for the purpose of providing property tax relief to school districts.

In 2009, those writing the budget will have to revisit the revenue/spending gap, which still remains. Put simply, if revenues grow at the same pace as spending, this gap will continue. If, however, revenues outpace spending, the gap will narrow. Likewise, if revenues lag spending, the gap will widen.

If the state could always count on having large balances on hand to supplement current revenues for spending, the gap might not be a problem. But in a situation where the economy begins to tighten and revenues fall off, to the point where the balances shrink significantly, the gap could become a problem.

Speaking purely hypothetically, and thinking simply about the larger pieces of the Texas fiscal picture going into the future, if the state were to enter a budget period without large fund balances and/or a significant balance in the Rainy Day Fund, then policymakers and shareholders would have to consider cuts, perhaps tough cuts, to the budget. Why? Because of the revenue/spending gap. Without the continuation of healthy ending balances, current revenues would have to cover spending for current services, but the arithmetic of the gap would require that cuts be made so as to maintain the state’s constitutionally-mandated balanced budget.

Small changes, even small changes made somewhat slowly, can bear fruit in future years. By monitoring state spending, making sure it does not outgrow our means of funding the programs supported by that spending, and working towards joining the revenue and spending sides of the gap back together will help ensure we stay on our pay-as-you-go basis – without the need for periodic and sometimes dramatic budget swings to bring us into balance.