89th Legislature, Biennial Revenue Estimate

Texas Comptroller Glenn Hegar Releases 2026-27 Biennial Revenue Estimate

January 13, 2025

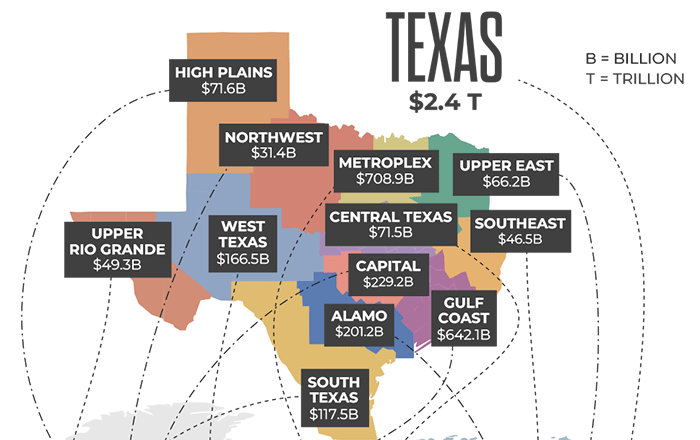

Texas Comptroller Glenn Hegar released the Biennial Revenue Estimate (BRE) the Biennial Revenue Estimate (BRE) (PDF) today, showing the state is projected to have $194.6 billion in revenue available for general-purpose spending during the 2026-27 biennium, a 1.1 percent decrease from the 2024-25 biennium.

This decrease is attributable to a smaller beginning balance in the 2026-27 biennium ($23.76 billion) compared with 2024-25 ($39.43 billion).

As state lawmakers prepare for the 89th Legislature, Regular Session, which is set to kick off Tuesday, Hegar said Texas is in good financial shape and that revenue collections will continue to increase in the upcoming biennium.

Texas Economic Spotlight

There’s more than meets the eye when it comes to the state’s budget. Fiscal Notes, the agency’s flagship publication, provides an informative review of trends and events affecting Texas government and the state economy. We invite you to take a deep dive into Fiscal Notes articles that examine the growing financial demands and forces that drive Texas’ budget.

The Making of the Biennial Revenue Estimate

Months of intense work go into the making of the BRE. It's one of our constitutional responsibilities, and it's an essential part of Texas' budget process.