industryMeasuring industries’ strength in Texas by LQ, labor market

July 2024 | By Moise Julot

A look at the state’s 12 economic regions

What keeps Texas running? You might naturally think of the economically vital oil- and gas-related industries, since Texas leads the nation in energy production, or the services industries that are important to Texas’ diversified economy. But other industries are important, too.

To help understand an industry’s significance, data analysts use a location quotient (LQ), which compares an industry’s size in a particular area (based on employment) with its size in the national economy. The LQ is one economic indicator highlighting the industries that are concentrated and specialized in a region, a consequential factor for those areas even when the industries aren’t as prominent statewide. An LQ of 1.25 or higher indicates that the region may have a competitive advantage in the industry and that the industry is highly concentrated and unique to the regional economy. Though high LQs can identify regional industry strengths, an LQ that is too high may portend overconcentration and reliance on an industry. If that industry suffered a sustained downward shift, economic resilience in the area could be a problem.

Using Texas’ oil and gas sector as an example, the “support activities for mining” industry — which includes exploration, surveying and mapping services for the extraction of oil and gas — registered an LQ value of 5.37 in 2022, meaning the industry is nearly five-and-a-half times more concentrated in Texas than the U.S. average. To have a balanced state economy, some regions will have industries that are more prominent than others, but taken together, they provide for a diversified state economy.

The 2024 regional reports identify industries that are concentrated in each of the 12 Comptroller-designated economic regions, as measured by their LQ. Some regions show expected results, such as a heavy concentration of cattle ranching and farming in the High Plains and mining (oil and gas) activity in West Texas. Others showcase another side of Texas.

The industries highlighted were selected based on a combination of uniqueness in the region, number of industry employees in the region, industry job growth, average annual wages and number of establishments. LQs and employment data for each industry are based on 2022 numbers.

National Security and International Affairs

Military installations protect our country and are crucial to the Texas economy; the Alamo Region contains one of the nation’s biggest concentrations of bases.

- Region: Alamo

- Employment: 17,346

- Location Quotient: 3.53

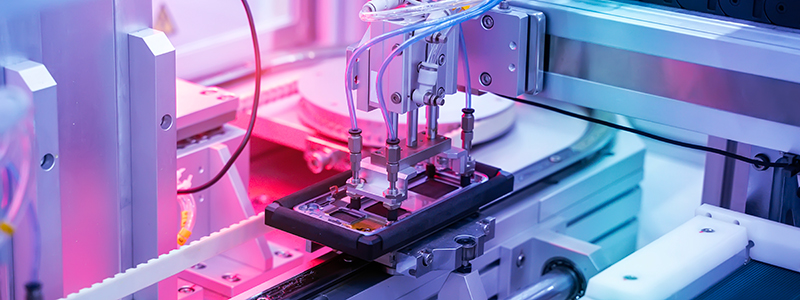

Semiconductor and Other Electronic Component Manufacturing

Texas is a world-class destination for advanced manufacturing companies; the Capital Region is a prime example, earning the sobriquet, “Silicon Hills.”

- Region: Capital

- Employment: 15,965

- Location Quotient: 5.00

Colleges, Universities and Professional Schools

Central Texas is home to four universities, six community colleges and one health science school – key employers offering a variety of options for higher education achievement.

- Region: Central Texas

- Employment: 33,235

- Location Quotient: 3.48

Oil and Gas Extraction

The Gulf Coast Region has a high concentration of virtually all segments of the energy industry, of importance to the regional economy and beyond. Fittingly, Houston often is called “The Energy Capital of the World.”

- Region: Gulf Coast

- Employment: 28,815

- Location Quotient: 11.91

Cattle Ranching and Farming

The High Plains Region alone accounts for about half the agriculture industry’s gross domestic product statewide.

- Region: High Plains

- Employment: 9,575

- Location Quotient: 23.21

Communications Equipment Manufacturing

The Metroplex Region is a national leader in the information industry, which includes telecommunications. The Metroplex region’s information industry accounted for 49 percent of the industry’s total state gross domestic product in 2022.

- Region: Metroplex

- Employment: 7,934

- Location Quotient: 3.44

Lime and Gypsum Product Manufacturing

Lime and gypsum products are used in construction projects. Lime stabilizes roadways and building foundations, while gypsum is used to make plaster and wallboards.

- Region: Northwest

- Employment: 538

- Location Quotient: 23.97

Freight Transportation Arrangement

South Texas’ proximity to key trade partner Mexico makes freight transportation arrangement among the industries with the greatest LQ and total employment growth in the region.

- Region: South Texas

- Employment: 8,695

- Location Quotient: 5.52

Petroleum Products Manufacturing

This subsector of nondurable goods manufacturing transforms crude petroleum into a seemingly endless list of products (PDF) including car parts, eyeglasses, ballpoint pens, laptops, fertilizers and footballs.

- Region: Southeast

- Employment: 4,456

- Location Quotient: 23.69

Motor Vehicle Body and Trailer Manufacturing

Automobile manufacturing, including motor vehicle body and trailer manufacturing, makes an important contribution to Texas’ jobs, trade and economic growth.

- Region: Upper East

- Employment: 4,181

- Location Quotient: 8.17

General Freight Trucking

The Upper Rio Grande’s proximity to the Mexican border and its four direct trade official ports of entry help make general freight trucking among the largest industries by employment in the region.

- Region: Upper Rio Grande

- Employment: 2,505

- Location Quotient: 3.25

Support Activities for Mining

In West Texas, this subsector has the highest LQ, is the largest by employment and has the largest total employment growth.

- Region: West Texas

- Employment: 38,840

- Location Quotient: 72.23