Skip navigation

Top navigation skipped.

Notes:

Notes:

Notes:

Auditing Fundamentals

Appendix

- Tax Chart

- Sales and Use Taxes

- Franchise Taxes

- Motor Fuels Taxes

- Minerals Taxes

- Hotel Taxes

- Motor Vehicle Taxes

- Miscellaneous Taxes

- Pari-Mutuel Wagering

- Petroleum Product Delivery Fee

- Controlled Substance

- Battery Sales Fee

- Automotive Oil Sales

- Cigarette/Cigar

- Insurance

- Mixed Beverage

- Reasons for Assignment

- Audit Flowchart Timelines

Tax Chart

| Tax/Fund | Tax Code | Statute Reference | Tax Rate | Origination Date of Tax |

|---|---|---|---|---|

| State | 26 | Texas Tax Code, Chapter 151 | 6.25% | September 1, 1961 |

| Direct Pay | 27 | Texas Tax Code, Chapter 151 | 6.25% | September 1, 1961 |

| Maquiladora | 28 | Texas Tax Code, Chapter 151 | 6.25% | June 14, 1989 |

| City | 26 | Texas Tax Code, Chapter 321 | 1% - 2% | January 1, 1968 |

| MTA | 26 | Texas Tax Code, Chapter 322 | ||

| San Antonio MTA: 1/2% | January 1, 1978 | |||

| Houston MTA: 1% | October 1, 1978 | |||

| Dallas MT A: 1% | January 1, 1984 | |||

| Fort Worth MTA: 1/2% | April 1, 1984 | |||

| Austin MTA : 1% | July 1, 1985 | |||

| CTD | 26 | Texas Tax Code, Chapter 322 | El Paso CTD: 1/2% | April 1, 1988 |

| Laredo CTD: 1/4% | July 1, 1991 | |||

| CTA | 26 | Texas Tax Code, Chapter 322 | El Paso CTD: 1/2% | April 1, 1988 |

| Laredo CTD: 1/4% | July 1, 1991 | |||

| ATD | 26 | Texas Tax Code, Chapter 322 | San Antonio ATD: 1/4% | April 1, 2005 |

| County | 26 | Texas Tax Code, Chapter 323 | 1/2% - 1 1/2% | January 1, 1987 |

| SPD | 26 | Various | 1/8% - 2% | January 1, 1991 |

| Interest Earned on Financed Sales Tax |

48 | Texas Tax Code, Chapter 151.428 | See State Sales & Use Tax Rule 3.302(f) | September 1, 1989 |

| Texas Emissions Reduction Plan Surcharge |

50 | 09/01/2001 - 06/30/2003: 1% 07/01/2003 - Present: 2% |

September 1, 2001 |

- Due date for all the sales taxes is: 20th of the month. If the 20th is a weekend or holiday, the due date is the next working day.

- Discount for timely filing: 1/2%

- Late returns are assessed a 5% penalty for 1-30 days late, and an additional 5% if over 30 days late. Minimum penalty is $1 per period. Interest is assessed beginning 61 days after the due date. Interest rate varies annually, set at one percent over the prime rate as published in the Wall Street Journal on the first business day of the year.

- Refund claims filed by a taxpayer on or after September 1, 2005 will accrue credit interest at either the Treasury Pool rate or Prime +1%, whichever is less. For refund claims filed prior to September 1, 2005, credit interest will accrue at Prime + 1%.

- For credits due on audits, if the entrance conference is prior to September 1, 2005, the credit interest rate will accrue at the Prime plus 1%: if the entrance conference is on or after September 1, 2005, credit interest accrues at either the Treasury Pool rate or Prime + 1%, whichever is less.

- For a complete listing of all the cities, counties, SPDs, or Transits and their applicable tax rates, please see Publication #96-132 - Texas Sales and Use Tax Rates

- The Texas Emissions Reduction Plan Surcharge is due on the sale, lease, or rental price heavy-duty, of off-road diesel-powered equipment. The surcharge is in addition to the sales & use tax due; however, if the sale, lease, or rental of the equipment is not subject to sales tax, the surcharge is not due.

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Franchise Bank Franchise |

13 16 |

171.001 171.001 |

.25% of net taxable capital or 4.5% of net taxable earned surplus - no minimum tax Corporations owing less than $100 are not required to pay, but must file a report Due Date: Annual Reports - May 15th of each year |

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Gasoline | 90 - 06 | 153.101 | Regular: 20¢/gallon |

| Diesel Fuel | 90 - 07 | 153.201 | Regular: 20¢/gallon |

| Liquefied Gas | 90 - 08 | 153.301 | All: 15¢/gallon |

| International Fuel Tax Agreement (IFTA) | 56 | 162.001 | Set by each member jurisdiction |

Notes:

- Gasoline - due date: 25th of month following end of previous month for distributors, and the 25th of month following the end of the quarter for interstate truckers, or 25th of January for the previous year if annual filer

- Gasoline - discount: 2% of taxable gallons for distributors. 1/2% of taxable gallons for interstate truckers. Timely filing is not required for discount.

- Liquefied Gas - due date: 25th of January after each calendar year

- Liquefied Gas - discount: A permitted dealer retains 1% of the tax on the taxable gallons and an interstate trucker is entitled to 1/2% of the tax on the taxable gallons

- Diesel Fuel - due date: 25th of month following end of previous month for suppliers and 25th of month following end of quarter for interstate truckers and bonded users. Certain bonded users and interstate truckers may report annually.

- Diesel Fuel - discount: 2% of taxable gallons for suppliers. 1/2% of taxable gallons for interstate truckers and bonded users.

- IFTA is reported quarterly by the last day of the month following the end of the calendar quarter. Interstate carriers based in Texas report fuel tax paid in all member jurisdictions.

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Crude Oil Production | 10 | 202.001 | 4.6% of value per barrel of 42 standard gallons Discounts: N/A Due date: 25th of first month after production |

| Natural Gas Production | 11 | 201.001 | 7.5% of market value of gas produced and saved in Texas Discounts: N/A Due date: 20th of 2nd month after production |

| Miscellaneous Occupation Tax (Oil & Gas Well Servicing) |

19 | 191.081 | 2.42% of the receipts for the services performed Due date: 20th of month following the end of each calendar month Discounts: N/A |

| Sulphur Production | 20 | 203.001 | $1.03 per long ton (2240 lbs.) or fraction thereof of sulphur produced in Texas Due Date: Last day of the month after each calendar quarter Discounts: N/A |

| Oil Regulatory Tax | 21 | 81.111(E) Nat. Res.Code |

$0.001875 per barrel (42 standard gallons) of oil Due Date: 25th of the month following production Discounts: N/A |

| Cement Production | 22 | 181.001 | $0.55 per ton (2000 lbs.) Due date: 25th of month for business conducted in previous month Discounts: N/A |

| Coastal Protection Fee | 66 | 40.155a Nat. Res.Code |

2¢ per barrel (42 standard gallons) of crude oil Due Date: Last day of the month for the previous month Discounts: N/A |

Notes:

- Crude Oil Production

- Producers who do not pay the production tax are required to file only an annual report, which is due on or before March 1st of each year. All others are required to file monthly returns.

- Special lower tax rates apply for wells located in new or expanded enhanced recover sites. Please consult Sections 202.056 and 202.059 of the Oil Production Tax Statute for those rates.

- Natural Gas Production - producers who have an average monthly tax liability of less than $200 must file an annual producer's report, which is due on or before February 20 of each year. If the producer's cumulative annual liability exceeds $2,400 at any time during the year, he is required to begin filing monthly returns at that time. Natural gas classified as high-cost natural gas is exempt from the gas production tax.

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Hotel Occupancy | 75 | 156.001 | 6% Due Date: 20th of the month Discount: 1% for timely filing |

Only state taxes are administered by the Comptroller

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Motor Vehicle Sales and Use |

89 | 152 | 6.25% Due date: 20 working days after delivery of vehicle in Texas Discount: N/A |

| Motor Vehicle Gross Rental Receipts |

15 | 152 | Rentals for 30 days or less are taxed at 10%. Rentals for more than 30 days are taxed at 6.25% Due date: Monthly, Quarterly or Yearly : 20th of the month following end of reporting period Discount: ½% for timely filing |

| Motor Vehicle Seller-Financed Sales Tax |

70 | 152 | 6.25% Due Date: Monthly or Quarterly: 20th of the month following end of reporting period Discount: ½% for timely filing |

| Motor Vehicle Sales and Use (County Tax Assessor) |

14 | 152 | 6.25% |

- Motor Vehicle Gross Rental Receipts - there is an additional 1.25% discount of the estimated tax if a prepayment is filed by the 15th of second month of quarter.

- Motor Vehicle Sales & Use (County Tax Assessor) - County Tax Assessor-Collector must report all tax and penalties collected, less a 5% commission. Due date: deposits are due either the 10th of the month, or weekly, or daily, depending on the volume of taxes collected. Penalty and interest is not assessed on any audit deficiency.

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Misc. Gross Receipts (Utility Co) | 23 | 182.021 | Tax rate is dependent upon the population of the incorporated city

Discount: N/A |

| Public Utility Commission Gross Receipts Assessment |

47 | Chapter 16 of Utilities Code | .1667% of gross receipts of electric and telephone utilities

Assessment Period: Due Date:

July, Aug, Sept Nov. 15

Oct, Nov, Dec Feb. 15

Jan, Feb, Mar May 15

April, May, June Aug. 15

Annual (July of prior year Aug. 15

- June of current year) |

| Local Revenue Funds (City) (County) |

32 | V.T.C.A. V.T.C.A. |

See the Local Revenue Funds Manual for a description of the applicable funds, due dates, and fund amounts. |

| Inheritance | 17 | 211.001 | Per Federal Tax Tables. Due Date: 9 months after date of death. Discount: N/A No Texas Inheritance Tax return is required on dates of death on or after January 1, 2005 |

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Horse Racing | 61 | Art. 179e. Texas Racing Act |

Live Racing Pools 1% : $100 million but less than $200 million 2% : $200 million but less than $300 million 3% : $300 million but less than $400 million 4% : $400 million but less than $500 million 5% : in excess of $500 million Tax is due by the end of the next business day following a race performance Simulcasting Pools 1% due by the end of the next business day following a race performance |

| Greyhound Racing | 62 | Art. 179e. Texas Racing Act |

Live Racing Pools 1% : $100 million but less than $200 million 2% : $200 million but less than $300 million 3% : $300 million but less than $400 million 4% : $400 million but less than $500 million 5% : in excess of $500 million Tax is due by the end of the next business day following a race performance Simulcasting Pools 1% due by end of the next business day following a race performance |

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Petroleum Product Delivery Fee | 64 | Texas Water Code, Section 26.3574 |

Bracket system based on the number of gallons delivered. Due Date: 25th of the month following the withdrawal and delivery Discount: None |

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Controlled Substance | 65 | Texas Tax Code, Chapter 159 | $200.00 per gram of a controlled substance, counterfeit substance, or a mixture of marihuana and another taxable substance $3.50 per gram of marihuana $2,000.00 per fifty dosage units of controlled substances not sold by weight Due Date: Immediately |

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Battery Sales Fee (lead-acid batteries) | 67 | 361.131-361.140 Health & Safety Code |

$2.00 for each battery > 6 volts and < 12 volts $3.00 for each battery 12 volts or more Discounts: >$.025 credit per battery sold. Due Date: 20th day of month following report period. Reporting periods are monthly or quarterly. |

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Automotive Oil Sales | 69 | 371.001-371.062 Health & Safety Code |

1¢ for each quart on first importation into Texas Discount: 1% credit of fee due Due Date: 25th day of month following end of quarter |

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Cigarette Distributor and Cigarette Manufacturer |

88-31 88-84 |

Chapter 154 | $20.50 per thousand on cigarettes weighing three pounds or less per thousand $22.60 per thousand on cigarettes weighing more than three pounds per thousand |

| Cigars: Tobacco Distributor and Tobacco Manufacturer |

88-18 88-85 |

Chapter 155 |

Discounts: Cigarettes - 3% on purchases of tax stamps Cigars - N/A Due Dates: Cigarettes - 15th of the month Cigars - 30th of the month |

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Insurance Premium | 71 | Texas Insurance Code Tax rates vary depending on type of insurance: life, accident & health, HMO's property,

and casualty or title insurance - if obtained from insurers licensed by the Texas Department of Insurance If independently procured by a policyholder domiciled or headquartered in Texas on risks located in Texas from insurers not licensed in Texas: 4.85% of taxable premiums - assessed on the policyholder |

|

| Insurance Maintenance | 72 | Texas Insurance Code Tax rates vary depending on the lines of insurance written: life, accident & health,

motor vehicle, casualty and fidelity, title, HMOs, worker's compensation, third-party administrators, and prepaid legal Discounts: N/A Due Dates: March 1 of the year following the issuance of insurance coverage - insurers licensed by the Texas Department of Insurance May 15th of the year following the issuance of insurance coverage - due by policyholder from insurance independently procured from non-licensed insurers |

| Tax/Fund | Tax Code | Statute Reference | Tax Rate |

|---|---|---|---|

| Mixed Beverage Gross Receipts Tax | 73 | Chapter 183 | 14% of gross receipts Discounts: N/A Due Date: 20th of the month following the end of each calendar month |

| Boat & Boat Motor Sales & Use | 60 | 160.001 | 6.25% Due Date: Within 20 working days from date of purchase or when boat or motor first brought into Texas Discount: N/A |

| Manufactured Housing Sales & Use | 46 | 158.001 | 5% of 65% of manufacturer's sales price Due Date: Monthly: Last day of the month following each calendar month Discount: N/A |

| Fireworks Sales Tax | 30 | 161.001 | 2% - in addition to the sales tax Due Date: Twice a year - February 20th and August 20th Discount: N/A |

- Boat & Boat Motor Sales & Use Tax is paid to either the local County Tax Assessor-Collector or the Texas Parks & Wildlife Department

- The mixed beverage tax is imposed on the person or organization holding the mixed beverage permit and not the customer. It may not be added to the selling price as a separate charge and may not be backed out from the amount received.

Reasons for Assignment

- Additional Info Supplied by TP

- Admin. Tax Policy Change

- Associated Insurance Group

- Audit Lead Card

- Audit Select Query

- Bankruptcy

- Certificate of No Tax Due (NTD) Request

- Certificate Related Issue

- External Source

- Final Audit Request

- Headquarters Select

- Incorrect Tax Rate Charged

- Informant Program

- Lead from an Audit Assignment

- No Tax Charged

- Not Permitted

- Operating from Open Register

- Other - See Comment

- Prior Productive Audit

- Priority I Audit

- Refund Request

- Resale or Exempt. Certificates

- Results of a Court Case

- Results of a Hearing

- ROP Project

- Taxpayer Request/Complaint

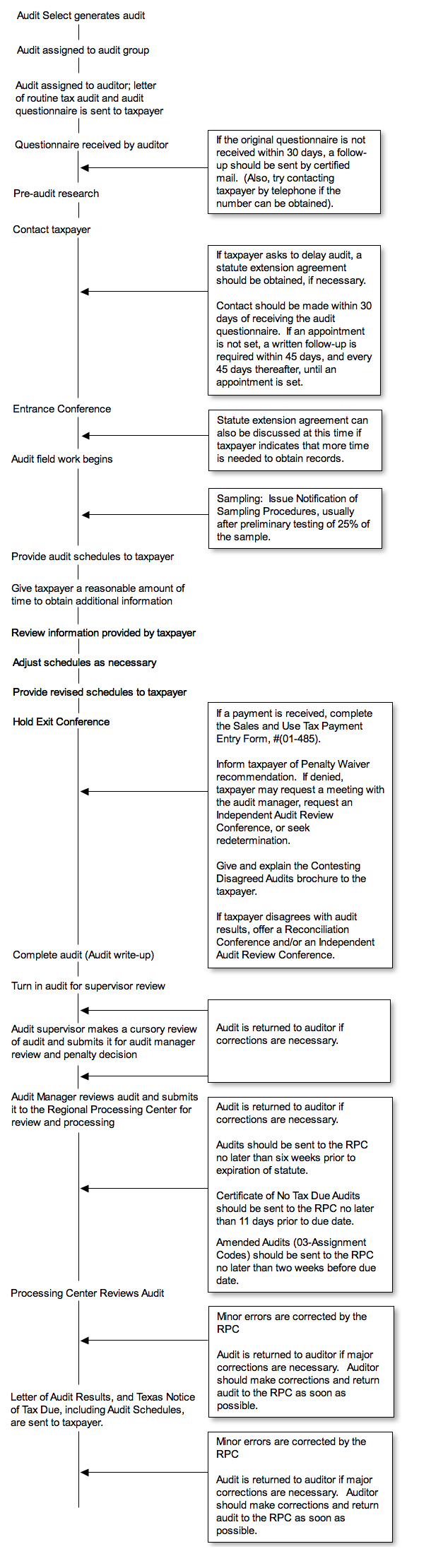

Audit Flowchart Timelines

This flowchart is intended to show how an audit flows from the time the audit is generated, to the time when the audit is completed and leaves the audit office.

A detailed explanation of all the items in the flowchart is discussed in the various chapters of this manual.

View alternate text for Audit Flowchart Timelines.

TOC | Preface | 1 | 2 | 3 | 4| 5 | 6 | 7 | 8 | 9 | 10 | Appendix | Glossary | Timelines

(Revised 02/2026)