Local Sales and Use Tax Collection – A Guide for Sellers

When you sell taxable goods or services in Texas, or sell to Texas customers, you must collect the 6.25 percent state sales or use tax and the appropriate local sales or use tax. The local tax due cannot be more than 2 percent, so the most tax you can collect is 8.25 percent. Both state and local sales and use taxes are reported on your Texas Sales and Use Tax Return. Use the Comptroller’s online Sales Tax Rate Locator to search for sales tax rates by address.

This summary guide will help you collect and remit local taxes, but you should consult Texas Tax Code Subtitle C (Local Sales and Use Taxes) and Comptroller Rule 3.334 for compliance details.

In general, local sales tax is based on the seller’s place of business. Local use tax is based on the location where the customer first stores, uses, or consumes the item. If you ship or deliver goods to your customers, you may have to collect local sales tax, local use tax, or both.

Local sales tax is imposed on each sale of a taxable item consummated within the local taxing jurisdiction’s boundaries. Often, sales are consummated at the seller’s place of business in Texas.

A "place of business" is a store, office or other location operated by the seller to sell taxable items where sales personnel receive three or more orders during the calendar year. These orders must come from persons other than employees, independent contractors, and people affiliated with the seller. The definition does not include computer servers, internet protocol addresses, websites, domain names, or software applications.

Call centers, showrooms, and clearance centers can be places of business of the seller if they meet the requirements listed above. However, the warehouse from which the person ships those items is not a place of business, unless the warehouse qualifies as a place of business.

A seller can have a single place of business in Texas, multiple places of business in Texas, or possibly no place of business in Texas, depending on its operations. A seller can also have a temporary place of business in Texas, such as a booth at a craft fair or art show or a parking lot sale outside a warehouse.

Local sales taxes for temporary places of business are collected in the same manner as other places of business.

Determining the Place of Business of the Seller

Orders received by a salesperson (by mail, email, or telephone) while the salesperson is not at his or her normal work location will be treated as being received at the salesperson’s normal work location, only if that location meets the definition of a place of business.

Orders not received by sales personnel are considered to be received at locations that are not places of business of the seller.

- If these orders are not fulfilled by a place of business of the seller, they are consummated at the destination location.

- If these orders are fulfilled by a place of business of the seller, then they are consummated at that place of business.

Pursuant to an agreed temporary injunction, the agency has agreed not to enforce the provision relating to orders not received by sales personnel while its validity is being challenged in district court. The temporary injunction does not change the effective date of the rule. If the courts ultimately determine that the rule follows the statute, taxpayers as well as the agency will be bound by that determination.

Determining Which Local Taxes Are Due

The following examples illustrate where a local sale or use is "consummated," based on whether the order is received at a place of business of the seller in Texas, whether the order is placed in person, and whether the order is fulfilled from a place of business of the seller in Texas. You must collect local tax at the location where the sale or use is "consummated," which may be where the order is received, fulfilled, delivered, or stored, used, or consumed. These examples do not apply to the "Special Situations" that are subsequently described.

Order Received at a Place of Business of the Seller in Texas

Orders Placed in Person

When an order is placed in person at a seller's place of business in Texas, the sale is consummated at that place of business of the seller, regardless of the location where the order is fulfilled.

Example: A customer walks into a shoe store and buys shoes. Local sales tax is due at the location of the shoe store.

Orders Not Placed in Person

When an order is received at a place of business of the seller in Texas and is fulfilled at a place of business of the seller in Texas, the sale is consummated at the place of business where the order is fulfilled.

Example: A retailer has two places of business, Office Supply Store A and Office Supply Store B. Office Supply Store A receives an order from a customer over the telephone. Office Supply Store B fulfills the order. This order is consummated at Office Supply Store B because it is the place of business where the order was fulfilled. Local sales tax is due based on the retailer’s location that fulfilled the order, Office Supply Store B. If the retailer ships or delivers into a location with a higher local sales and use tax rate than Office Supply Store B, the retailer has to collect the additional local use tax due.

When an order is received at a place of business of the seller in Texas and is fulfilled at a location that is not a place of business of the seller in Texas, the sale is consummated at the place of business where the order is received.

Example: A retailer sells discount merchandise. Customers place orders over the phone with the seller at the seller’s sales office. The sales office where the seller receives these orders is a place of business because the seller receives more than three orders there during a calendar year. The seller has contracted for a third party to store, pick, pack and ship merchandise on the seller’s behalf, so orders are not fulfilled at the seller’s place of business. The sales are consummated at the seller’s office location where the orders are received, and local sales tax is due based on the seller’s office location. If the seller ships or delivers into a location with a higher local sales and use tax rate than their office location, the seller has to collect the additional local use tax due.

Order Not Received at a Place of Business of the Seller in Texas

Order Fulfilled at a Place of Business of the Seller in Texas

When an order is received at a location that is not a place of business of the seller in Texas or is received outside of Texas, and is fulfilled from a place of business of the seller in Texas, the sale is consummated at the place of business where the order is fulfilled.

Order not Fulfilled from a Place of Business of the Seller in Texas

When an order is received at a location that is not a place of business of the seller in Texas and is fulfilled from a location in Texas that is not a place of business of the seller, the sale is consummated at the location in Texas where the order is shipped or delivered, or where the purchaser takes possession of the item. You also have to collect additional local use tax due if you ship or deliver items to an address in another local taxing jurisdiction with a higher local sales and use tax rate.

Example: A seller operates stores in Texas and Arkansas. The seller also maintains a warehouse that is not a place of business in Texas where it stores merchandise. A customer visits the seller’s store in Arkansas and buys an item that is out of stock. The seller agrees to ship the item from its Texas warehouse to the customer’s Texas address. The sale is consummated at the customer’s address because the order was not received at a place of business in Texas (it was received at an Arkansas store), and it was not fulfilled at a place of business in Texas (it was fulfilled at the warehouse). Local sales tax is due based on the customer’s address.

When an order is received by a seller at a location outside of Texas or by a remote seller, and is fulfilled from a location outside of Texas, the sale is not consummated in Texas. However, local use tax is due in this state to where the item is shipped or delivered or where the purchaser takes possession of the item.

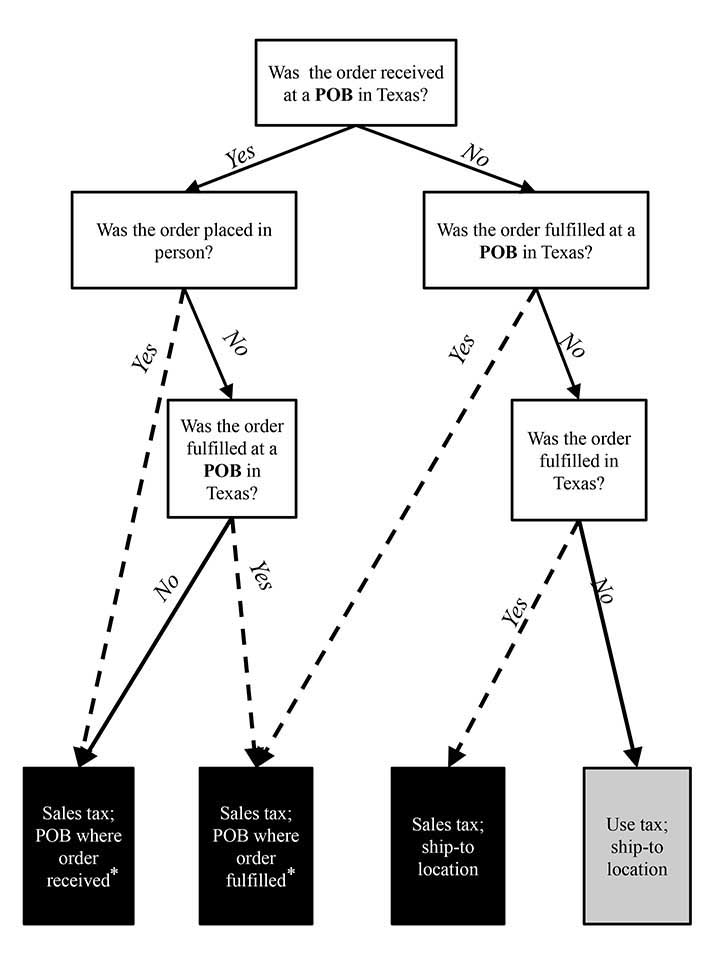

The following table and flow chart show generally what local tax you should collect based on where a sale is consummated. You can find examples in the "In-Depth Look at Local Sales and Use Tax" section.

Note: The following table and flow chart do not apply to special situations, including marketplace sales. See the "Special Situations" section.

| If your order was… | and the order was… | then you'll collect… |

|---|---|---|

| received at a Texas place of business | placed in person | local sales tax where the order was received |

| not placed in person and not fulfilled at a Texas place of business | ||

| not placed in person, but was fulfilled from a Texas place of business | local sales tax where the order was fulfilled | |

| not received at a Texas place of business | fulfilled from a Texas place of business | local sales tax where the order was fulfilled |

| fulfilled from a Texas location that is not the seller's place of business | local sales tax at the "ship-to" location | |

| not fulfilled in Texas | local use tax at the "ship-to" location |

* Plus any local use tax due if you ship or deliver into a local jurisdiction with a higher local sales and use tax rate.

In-Depth Look at Local Sales and Use Taxes

Local Taxing Entities

There are four types of local taxing entities in Texas:

- cities (including incorporated towns and villages);

- counties;

- special purpose districts; and

- transit authorities.

Each taxing entity has its own boundaries. Different types of taxing entities can cross or share boundaries. The combined local sales tax rate cannot be more than 2 percent.

Example: A business located inside the city limits of Corpus Christi is within the boundaries of three types of local taxing jurisdictions: the city of Corpus Christi, the Corpus Christi Crime Control and Prevention District and the Corpus Christi Regional Transit Authority. The total rate of local sales tax imposed at the business location is 2 percent.

Local taxing jurisdiction boundaries do not follow U.S. postal codes (ZIP codes). Many cities in Texas share a common ZIP code, and many ZIP codes encompass an area both inside and outside a taxing jurisdiction.

If you are not sure of the local taxes in effect at a given location, use the Comptroller’s online Sales Tax Rate Locator to search for sales tax rates by address.

Combined Areas

There are several areas in Texas where city boundaries are allowed to overlap the boundaries of another taxing jurisdiction, even though the total local tax rate in these combined areas technically exceeds 2 percent.

The Comptroller maintains a 2 percent rate in these areas and shares the revenues between the overlapping taxing jurisdictions. These combined areas are listed on the Comptroller’s website.

Sellers collecting local tax in one of these areas must use the combined area local code when reporting sales and use taxes, instead of the regular city or SPD code.

Local Use Tax

Local use tax is due on the storage, use or other consumption of a taxable item within local taxing jurisdiction boundaries. Sellers are responsible for collecting local use tax if they ship or deliver a taxable item into a local taxing jurisdiction with a higher local sales and use tax rate than the location where the sale is consummated.

Every local taxing jurisdiction with a local sales tax also has a local use tax. Use tax rates are the same as sales tax rates.

Local sales tax and local use tax may be due on the same taxable item when:

- the total amount of local sales tax is less than 2 percent (the total amount of local tax imposed on any transaction cannot be more than 2 percent); and

- the local sales tax and local use tax are not the same type of local tax. If a city sales tax is due on a taxable item, for example, there will be no city use tax, even if the item is shipped or delivered to a different Texas city. In other words, local use tax is not due if a local sales tax of the same type is due.

When state use tax is due on a taxable item, local use tax is also due at the location where the taxable item is shipped or delivered. If the ship-to location is not in a local taxing jurisdiction, local use tax is not due.

Example: A taxable item purchased at a store in Seattle is shipped to an address in Austin. State use tax of 6.25 percent is due on the taxable item. Local use tax of 2 percent is due based on the ship-to address.

When state sales tax is due on a taxable item, local sales tax is due where the sale is consummated. Local use tax may also be due if the item is shipped or delivered into a local taxing jurisdiction with a higher local sales and use tax rate than the location where the sale is consummated.

Example: Pipe Creek and Bandera are cities in Bandera County, Texas. Pipe Creek does not have a city sales tax, Bandera has a 1.5 percent city sales tax and Bandera County has 0.5 percent county sales tax.

A person buys a rocking chair at a store in Pipe Creek. Bandera County sales tax of 0.5 percent is due on the sale. If the seller ships the rocking chair from the Pipe Creek store to the person’s home in the city of Bandera, the seller must collect the additional 1.5 percent Bandera city use tax that is due.

Note: The customer is responsible for paying directly to the Comptroller any local taxes you do not collect.

Example: A furniture seller has a store with an attached warehouse located outside the city limits of Corsicana, in Navarro County. Customers place orders in person at the store, and the seller fulfills the orders at its warehouse. The seller offers free delivery service to locations within 50 miles of the store/warehouse.

A customer shopping at the Navarro County store orders furniture for delivery to a location inside the city limits of Ennis, which imposes a 1.5 percent city sales and use tax. Since the store where the order is received is outside the city limits of Corsicana, no city sales tax is due. The seller must, however, collect county sales tax of 0.5 percent for Navarro County. Because the total amount of local sales tax due is less than 2 percent, the furniture seller has to also collect additional local use taxes due based on the point of delivery.

Since the seller is delivering the furniture to the buyer, the seller must collect the city’s use tax. Therefore, the total amount of sales and use tax that the seller must collect on the transaction is 8.25 percent, consisting of 6.25 percent state sales tax, 0.5 percent Navarro County sales tax and 1.5 percent Ennis city use tax.

A second customer places an order in person at the store for delivery to an address in Waxahachie, which imposes a local city sales and use tax of 2 percent. Again, the seller must collect Navarro County sales tax of 0.5 percent.

Since the seller is delivering the furniture to the buyer, the seller must collect any taxes due in the city of Waxahachie. The seller cannot, however, collect the total amount of the Waxahachie city use tax (2 percent) without exceeding the 2 percent cap. Therefore, the total amount of sales and use tax that the seller must collect on the transaction is 6.75 percent, consisting of 6.25 percent state sales tax and 0.5 percent Navarro County sales tax.

You can use the Comptroller’s online Sales Tax Rate Locator to search for sales and use tax rates by address.

Rules to Follow

Use these rules to determine if local use tax is due in addition to local sales tax.

- 2 percent cap

The maximum amount of local sales and use tax due on a sale in Texas is 2 percent. You cannot collect more than a total of 2 percent combined local sales and use taxes. If a local use tax cannot be collected or accrued at its full rate without going over 2 percent, you cannot collect it. You must collect applicable local use taxes when you ship or deliver a taxable item into a local taxing jurisdiction with a higher rate of local use tax when the 2 percent cap is not reached at the location where the sale is consummated. - Tax type order

You must collect applicable local use taxes in the following order:- City

- County

- Special purpose districts (SPDs)

- Transit authorities

- Different tax type

You cannot collect a local use tax if a local sales tax of the same tax type is due.

Special Situations

Amusement Services

Collect local taxes on amusement services where the performance or event occurs.

Cable and Satellite TV Services

Collect local taxes on cable television services where the customer receives the service. Satellite service, commonly known as "direct-to-home" satellite service, is exempt from local tax under the Federal Telecommunications Act of 1996.

Florists

Florists collect local taxes based on the location of the place of business that takes the order, regardless of where the order is fulfilled or delivered.Marketplace Sales

Marketplace providers that are engaged in business in Texas must collect and remit tax on all third-party sales. The tax is based on the shipping destination. Examples include Amazon, eBay, Walmart Marketplace, and Etsy. Marketplace providers are not eligible to use the single local use tax rate.

Marketplace sellers are not responsible for collecting and remitting sales and use tax on their sales through the marketplace if the marketplace provider has certified they will collect any applicable tax, but they must retain sales records.

Motor Vehicle Parking and Storage

Collect local taxes based on the location where the parking service occurs.

Natural Gas and Electricity

Collect local taxes based on where the customer receives the gas or electricity. Residential use of gas and electricity is exempt from county, transit and most special purpose district taxes, and in many cities, city tax. Lists of all cities and special purpose districts currently imposing sales tax on the residential use of gas and electricity and those cities and special purpose districts eligible to do so are available online.

Nonresidential Real Property Repair and Remodeling Services

If you provide repair or remodeling services on nonresidential improvements to realty, the entire charge is subject to local tax, regardless of whether it is billed as a separated or lump-sum charge. Collect local taxes for labor and materials based on the location of the job site.

Separated Contracts for New Construction or Residential Repair and Remodeling Projects

If you perform new residential construction, new commercial construction, or residential repair and remodeling under a separated contract, you must collect local taxes on the separately stated charge for materials based on the location of the job site.

Telecommunications Services

Telecommunications services are subject to the state sales tax, but are not automatically subject to local sales tax. By federal law, all interstate telecommunications are excluded from the tax. A list of jurisdictions that impose tax on telecommunications services is available online.

Landline Telecommunications Services

Collect local taxes, when due, on landline telecommunications services sold on a call-by-call basis based on the location of the telephone or other device where the call or other transmission originates. If you cannot determine where the communication originates, collect local tax based on the address where the service is billed.

Mobile Telecommunications Services

Collect local taxes on mobile telecommunications services (such as cell phones) based on the place of primary use. The place of primary use must be the customer’s residential street address or the primary business street address within the service provider’s licensed service area. If the person who contracts for the service with the service provider is not the end user, the end user’s place of primary use determines which local taxes are due.

Waste Collection and Waste Removal Services

Collect local taxes where the waste is collected or picked up for removal.

Itinerant Vendors

A seller who does not have a place of business in Texas, and who travels to various locations to receive orders and make sales, is an itinerant vendor. Itinerant vendors collect sales tax for all local taxing jurisdictions in Texas where deliveries are made or where the customer takes possession of the items.

Example: A person who only receives orders and makes sales in San Antonio and has no place of business in the state must collect all applicable local San Antonio sales taxes due on each sale.

Vending Machine Sales

Vending machine operators are considered itinerant vendors and must collect local sales tax for the taxing jurisdictions where the vending machines are located.

Kiosks

A "kiosk" is a booth, stall or similar small, stand-alone area located within another seller’s place of business (such as a department store or shopping mall) that is used solely to display merchandise or submit orders for taxable items from a data entry device. A seller can take orders at a kiosk, but a kiosk does not have inventory in stock to transfer directly to customers. Although the kiosk itself is not a place of business, if you operate a kiosk, you are engaged in business in this state.

When items ordered at a kiosk are shipped or delivered to a customer from the seller’s place of business in Texas, then local sales tax is due at the seller’s place of business. If the total local sales tax is less than 2 percent, local use tax may also be due based on the location in Texas where the customer receives the taxable items.

When items ordered at a kiosk are shipped or delivered from a location that is not a Texas place of business of the seller, or from a location outside of Texas, local sales or use tax is due based on the location where the taxable items are shipped or delivered.

Remote Sellers

A remote seller is a seller whose only activities in Texas are remotely soliciting sales. Remote sellers with total Texas revenue of $500,000 or more, in the preceding 12 calendar months, must have a permit and collect and remit use tax.

A remote seller may choose to collect either

- local use tax based on the ship-to location; or

- the single local use tax rate.

The Comptroller’s office will compute the single local use tax rate and publish it in the Texas Register prior to the beginning of each calendar year. The current single local use tax rate is 1.75 percent.

Note: To collect the single local use tax rate, you must notify the Account Maintenance Division via email or mail using Form 01-799, Remote Seller’s Intent to Elect or Revoke Use of Single Local Use Tax Rate (PDF).

The email address is sales.applications@cpa.texas.gov.

The mailing address is:

Comptroller of Public AccountsP.O. Box 149354

Austin, TX 78714-9354

Additional Resources

- Sales and Use Tax

- Sales Tax Rate Locator

- Remote Sellers

- Marketplace Providers and Marketplace Sellers

- Texas Online Sales Tax Registration Application

94-105

(04/2022)