Biennial Revenue Estimate 2010-2011

Economic Outlook

Although the Texas economy showed some signs of contraction in fiscal 2008 and early fiscal 2009, the losses proved relatively modest, especially when considering that the national economy entered into recession in December 2007. The current outlook, however, is that the Texas economy – in terms of real (inflation adjusted) Gross State Product (GSP) – will exhibit weakness throughout fiscal 2009 before initiating recovery the following year. (See Table 1.)

Up until now, two factors have worked to insulate Texas from the national economic downturn. First, oil and natural gas prices soared in fiscal 2008, resulting in rapid job growth in the energy sector, which, despite higher fuel costs at the pump, benefited the state’s economy and tax revenues through increased exploration and production and the addition of high-paying jobs. Second, Texas exports, which were boosted by a weak U.S. dollar, grew at double-digit rates through the past five fiscal years.

Fuel prices have fallen dramatically while the dollar has fluctuated, chilling the state’s energy and export-dependent industries, particularly manufacturing. On top of these concerns, the deepening national recession and the ongoing weakness in the nation’s housing and finance sectors have exerted increasing pressure on our state economy.

Table 1:

Texas Economic History and Outlook for Fiscal Years 1999-2011

Winter 2008-09 Forecast

| Indicator | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008* | 2009* | 2010* | 2011* |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Real Gross State Product (Billions, 2000 $) |

$691.3 | $722.6 | $740.8 | $757.1 | $767.3 | $796.6 | $821.9 | $855.5 | $894.0 | $931.5 | $948.4 | $966.1 | $1,002.9 |

| Annual Percentage Change in Real Gross State Product | 5.3% | 4.5% | 2.5% | 2.2% | 1.3% | 3.8% | 3.2% | 4.1% | 4.5% | 4.2% | 1.8% | 1.9% | 3.8% |

| Gross State Product (Billions, Current $) |

$658.0 | $713.0 | $754.6 | $779.7 | $813.4 | $882.5 | $959.1 | $1,047.2 | $1,123.0 | $1,196.1 | $1,245.9 | $1,280.9 | $1,354.2 |

| Annual Percentage Change Gross State Product | 5.6% | 8.4% | 5.8% | 3.3% | 4.3% | 8.5% | 8.7% | 9.2% | 7.2% | 6.5% | 4.2% | 2.8% | 5.7% |

| Personal Income (Billions, Current $) |

$530.3 | $581.3 | $615.6 | $624.0 | $641.4 | $681.3 | $741.7 | $806.6 | $869.2 | $931.2 | $960.4 | $1,000.4 | $1,064.1 |

| Annual Percentage Change personal income in billions of current dollars | 6.5% | 9.6% | 5.9% | 1.4% | 2.8% | 6.2% | 8.9% | 8.8% | 7.8% | 7.1% | 3.1% | 4.2% | 6.4% |

| Nonfarm Employment (Thousands) |

9,111.6 | 9,365.9 | 9,532.0 | 9,426.2 | 9,375.4 | 9,450.5 | 9,667.7 | 9,984.3 | 10,293.2 | 10,538.0 | 10,537.3 | 10,637.6 | 10,889.4 |

| Annual Percentage Change in nonfarm employment | 2.8% | 2.8% | 1.8% | (1.1%) | (0.5%) | 0.8% | 2.3% | 3.3% | 3.1% | 2.4% | 0.0% | 1.0% | 2.4% |

| Resident Population (Thousands) |

20,507.1 | 20,900.4 | 21,291.0 | 21,679.0 | 22,041.9 | 22,409.5 | 22,808.1 | 23,379.5 | 23,840.7 | 24,283.6 | 24,710.4 | 25,236.9 | 25,779.3 |

| Annual Percentage Change in resident population | 2.0% | 1.9% | 1.9% | 1.8% | 1.7% | 1.7% | 1.8% | 2.5% | 2.0% | 1.9% | 1.8% | 2.1% | 2.1% |

| Unemployment Rate (%) | 4.8% | 4.4% | 4.7% | 6.1% | 6.7% | 6.3% | 5.5% | 5.1% | 4.5% | 4.4% | 6.6% | 6.7% | 6.5% |

| Oil Price (per Barrel) | $12.91 | $25.16 | $27.73 | $21.91 | $28.59 | $32.48 | $46.89 | $61.17 | $59.02 | $98.53 | $50.28 | $39.55 | $47.31 |

| Natural Gas Price (per MCF) | $1.71 | $2.63 | $4.89 | $2.53 | $4.31 | $4.83 | $5.87 | $7.50 | $6.34 | $7.67 | $5.79 | $5.06 | $5.63 |

| Indicator | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008* | 2009* | 2010* | 2011* |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Real Gross Domestic Product (Billions, 2000 $) |

$9,361.9 | $9,762.8 | $9,885.1 | $10,002.4 | $10,208.3 | $10,593.4 | $10,917.1 | $11,227.3 | $11,457.8 | $11,678.5 | $11,571.2 | $11,689.2 | $12,022.9 |

| Annual Percentage Change in Real Gross Domestic Product | 4.4% | 4.3% | 1.3% | 1.2% | 2.1% | 3.8% | 3.1% | 2.8% | 2.1% | 1.9% | (0.9%) | 1.0% | 2.9% |

| Consumer Price Index (1982-84 = 100) | 165.5 | 170.7 | 176.2 | 178.9 | 183.1 | 187.4 | 193.5 | 200.6 | 205.3 | 214.4 | 213.7 | 217.0 | 223.7 |

| Annual Percentage Change in Consumer Price Index | 1.9% | 3.2% | 3.2% | 1.5% | 2.4% | 2.3% | 3.3% | 3.7% | 2.3% | 4.4% | (0.4%) | 1.6% | 3.1% |

| Prime Interest Rate (%) | 7.9% | 9.0% | 8.0% | 4.9% | 4.2% | 4.1% | 5.7% | 7.6% | 8.2% | 6.0% | 3.7% | 3.9% | 6.0% |

* 2008 through 2010 values are estimated or projected.

SOURCES: Susan Combs, Texas Comptroller of Public Accounts; and IHS Global Insight, Inc.

Economic Downturn to Span Two Biennia

In fiscal 2008, Texas remained largely untouched by the sharp national slowdown caused by the housing-induced mortgage crisis and a freeze in credit markets. Texas added 252,000 jobs that year, ranking first among the states. This was ten times the number of jobs added by the second-ranked state, Maryland. In contrast, the nation as a whole lost 279,000 jobs over the same period.

With the steep drop in oil prices and the financial market implosion that occurred in September 2008, the downward trend in national economic indicators that began in 2008 is expected to accelerate, implying that Texas will remain hobbled by the national recession deep into fiscal 2009 before slowly emerging as fiscal 2010 progresses.

As such, when compared to 2008-09, the next biennium is expected to show some significant economic declines. Texas job growth in 2008-09 is on track to average 2.0 percent per year. For 2010-11, the average annual growth rate is expected to drop to 1.1 percent.

On the positive side, Texas can be expected to maintain a comparative advantage over the nation as a whole in 2010-11. While Texas employment is expected to decline by 111,000 jobs in the first two quarters of calendar 2009, this decline should reverse in the fourth quarter of calendar 2009, with employment growth accelerating throughout fiscal 2010 and into 2011. As such, our state should continue to add jobs throughout the upcoming biennium, while the nation’s job count is projected to decline by an average 0.3 percent per year.

Turning to the unemployment rate, in fiscal 2008 U.S. unemployment jumped to 6.1 percent from 4.7 percent a year earlier. The increase in Texas was more subdued: to 5.0 percent from 4.3 percent. The state and national rates of unemployment are likely to trend upward during the remainder of fiscal 2009, pushing the average 2008-09 Texas unemployment rate to 5.6 percent. Because the Texas economy is not expected to reach its low point until fiscal 2010, the state’s unemployment rate should climb even higher in 2010-11, averaging 6.6 percent per year.

The story for income growth will parallel that for employment. As a consequence of robust increases in 2008, Texas personal income growth remains on track to average 5.2 percent per year over 2008-09, but the growth rate is expected to average 3.7 percent during 2010-11. Nevertheless, total personal income in Texas is still expected to climb by 10.8 percent, fiscal 2011 over fiscal 2009. The non-wage component (e.g., proprietors’ income, dividends, interest, royalties, and property income) should grow nearly a full percentage point faster than the wage-based component.

Net migration to Texas is expected to increase moderately, simply because the state’s economy will be healthier than that of the rest of the nation. Slightly more than half of Texas’ population growth in 2010-11 will flow from net migration, with natural increase (births minus deaths of residents) accounting for the remainder. Population growth is expected to step up from its 2008-09 pace (1.8 percent per year), increasing by 1,069,000 in 2010-11, for an average annual increase of 2.1 percent. The state’s total population is expected to average 25,779,000 in fiscal 2011.

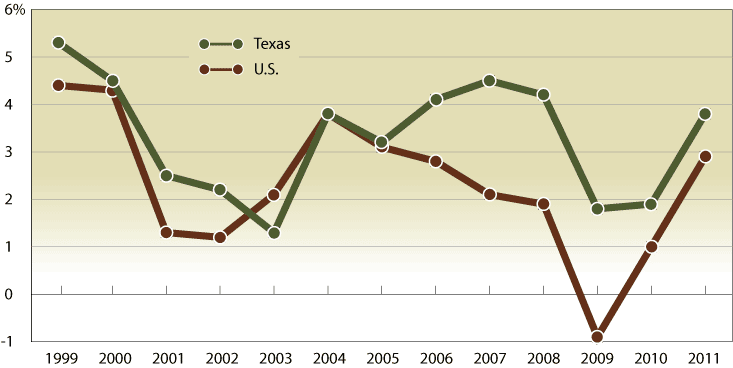

FIGURE 2:

Texas and U.S. Economic Growth, Fiscal Years 1999-2011

(Percentage Change in Gross Product)

Notes: Fiscal years 2008 through 2011 are estimated or projected.

Source: Texas Comptroller, Winter 2008-09 Economic Forecast.

Texas Industrial Performance: Leading Sectors Fall Behind

The hot spots in the Texas economy will likely shift radically as Texas enters a new biennium. Going into fiscal 2008, the state’s most vibrant industries included construction (particularly as related to public, nonresidential, and large multi-family housing projects) and energy. Both sectors are now facing substantial retrenchment. The aforementioned rapid declines in oil and natural gas prices will chill future exploration and hiring, while the confluence of tighter credit, stock market losses, and a national recession will exert a similar effect on construction activity.

Natural resources and mining constituted the state’s fastest-growing major industry in 2008-09. Over the next biennium, it is forecasted to become the weakest. In contrast, the transportation industry, which experienced net job losses in 2008-09 in response to higher fuel prices for the trucking and airline industries, is expected to post annual job increases of more than 3 percent in 2010-11 as fuel costs moderate and the economy picks up steam. The professional and business service industry meanwhile is expected to show healthy growth rates in both biennia, but the underlying source of jobs will shift from those related to energy, construction, and finance to those tied to transportation, health care, and government.

Texas industries that lost jobs in 2008-09 included, in addition to transportation, manufacturing, information, and trade. While manufacturing output actually grew, the industry registered net job losses consequent to outsourcing and net worker productivity growth. Employment in the information industry continued to shrink in response to severe price competition and technological changes. Although retail and wholesale trade employment registered gains in 2008, significant cutbacks in fiscal 2009 are expected to cause a net biennial job loss in this industry relative to 2006-07.

In 2010-11, the Texas industries that are projected to lose jobs include, once again, manufacturing and information, as well as construction and natural resources and mining.

Overall, the strongest growth is expected in professional and business services, with an anticipated 4.5 percent average annual leap in jobs; and the weakest growth will occur in natural resources and mining, with an 8.1 percent annual loss.

Exports and Manufacturing: On Hold

With five consecutive years of double-digit growth in value, exports have helped insulate the Texas economy from the nation’s recent economic shocks. The total value of Texas exports reached $190 billion in fiscal 2008, more than double the value in fiscal 2002.

As Europe has slipped into recession, the dollar’s value has risen markedly in international markets: by 16 percent against the euro and more than 25 percent against the British pound and Canadian dollar over the last year. The stronger dollar has adversely affected Texas manufacturing exports. In addition, our exports are vulnerable to weakening economies abroad, particularly Europe, the Americas, and, to a lesser extent, Asia.

After rising by 16 percent in fiscal 2008 and an estimated 1 percent in fiscal 2009, the value of Texas exports is forecasted to decline by 1 percent in 2010 before exhibiting a strong recovery – about 9 percent – in 2011. As a percentage of the Texas GSP, exports will decline to 15.1 percent in 2010-11, from 15.7 percent in 2008-09.

Oil & Gas: A Reversal of Fortunes

Texas is the headquarters for many of the world’s energy companies. The natural resources and mining industry’s share of Texas personal income is more than five times the national share. This industry, which is predominately based in oil and natural gas activity in Texas, will count 27,200 more jobs in 2008-09 than in the previous biennium. This is on top of the 34,400 jobs added during the previous two years, for an average annual growth rate of 8.7 percent over the four-year period. Because 2010-11 oil and natural gas prices are projected to fall about one-third below their 2008-09 levels, Texas can expect to lose 21,100 jobs in this industry in 2010-11, an average annual decline of 5 percent.

Construction: Recent Job Gains Now Lost

The Texas construction industry exhibited strong employment growth in 2008-09, adding 43,800 jobs. Several major utility and refinery projects, highway and bridge construction, and multi-family residence projects accounted for most of the growth.

Over the past two years, Texas fared far better than those states caught in the throes of plummeting home values and rising foreclosure rates, but our state is not immune from the world credit crunch, stock devaluations, and residential overbuilding, all of which have started to take their toll here. Compared to 2008-09, single-family residential building starts in Texas are expected to drop by 36 percent in 2010-11, with multi-family starts shrinking by 10 percent. Nonresidential construction will be hit even harder, falling 42 percent; and non-building construction (such as roads and highways) will decline by 23.5 percent. As a consequence, all of the jobs gained during the previous biennium are expected to be erased in 2010-11.

Service Industries: A Spot of Good Cheer

With the exception of the information industry, every Texas service industry added jobs in 2008-2009. Professional and business services, the fastest growing industry, added jobs at an average annual rate of 3.6 percent and accounted for nearly one-fourth of all Texas jobs gained during the biennium. In 2010-11, this industry’s employment growth is expected to remain solid, averaging 3.1 percent per year, with most of the job gains in fiscal 2011.

Texas’ education and health services industry is forecast to add jobs at an average annual rate of 3.3 percent in 2010-11, about the same as in 2008-09. Health services will account for nine-tenths of the sector’s 89,000 new jobs in 2010-11.

Job growth in the trade, transportation, and utilities industry is also expected to remain relatively stable in 2010-11. Looked at more closely, however, this “stability” will cloak significant retail and wholesale trade job losses in fiscal 2009 and 2010, sandwiched between gains in fiscal 2008 and 2011. Automobile sales will suffer for the same reasons as other “big ticket” purchases that are affected by loan availability. Utilities employment will stay flat over the forecast horizon. Transportation employment, while flat in fiscal 2010, will register gains in 2011.

Texas’ information industry has been losing jobs since 2001. Intense price competition is still pressuring the telecommunications sector, as well as Internet service providers. Traditional news outlets, such as television and newspapers, have continued to lose jobs in the face of technological changes. The downturn in the state’s overall economy in the near future will exert further pressure on the information industry, which is expected to shed jobs at a rate of 2.6 percent per year during the upcoming biennium.

With respect to the financial activities industry, banks and savings institutions in Texas have remained better off than the nationwide averages, based on the percentage of profitable institutions reported by the Federal Deposit Insurance Corporation. With respect to the housing finance crisis, one in 1,176 households were in foreclosure in Texas in November 2008, compared to one in 218 in California, one in 198 in Arizona, and a whopping one in 76 in Nevada. Overall, the monthly mortgage foreclosure rate in Texas is much lower than the national rate. Although Texas accounts for 8 percent of the nation’s population, the number of Texas mortgage foreclosures accounted for only 3.5 percent of the national total in October 2008. But “better than the national average” does not translate into strong bottom lines, and it provides scant solace to those unfortunate Texans now caught up in the mortgage crisis.

After climbing moderately over the past several years, the price of an existing single-family house in Texas has started to slip. Depository institutions, investment organizations, and real estate operators are expected to suffer a down year in fiscal 2009, adding but a handful of jobs between 2008-09 and 2010-11. Overall, the financial activities industry is forecast to grow at an average annual rate of 0.5 percent per year in 2010-11, generating a total of 6,400 jobs statewide during the biennium.

The leisure and hospitality industry will continue to expand in Texas in 2010-11, although at a moderated rate consequent to slower disposable income growth. Nearly 80 percent of this industry’s employment is in restaurants and bars, about 10 percent in hotels and motels, and a relatively small proportion in the entertainment sectors that are more sensitive to income trends. Job growth in leisure and hospitality, averaging 2.9 percent per year in 2010-11, is expected to markedly outpace the state’s overall employent growth.

Government employment growth is largely countercyclical to private sector job growth. This is because slow economies tend to increase demands for federal, state, and local government services. Local government is expected to account for over 80 percent of the new government jobs in 2010-11, because of continued growth in public school employment and anticipated cutbacks in military spending. The upcoming biennium should continue to see government services that are the closest to home growing the fastest. Local government employment is expected to increase by 2.2 percent per year, state government jobs by 1.5 percent, and federal government jobs by 0.3 percent. In total, all levels of government in Texas will add 65,000 jobs during 2010-11.

Forecast Concerns: Things Could Grow Worse

Weak national and international economies and the freezing of credit in financial markets will play a crucial role in the outlook for the Texas economy over 2010-11. Housing remains a major drag on the national economy, which has stagnated into recession. The headwinds generated by the fast-falling national economy are certainly being felt in Texas. The only question now is for how long and how severely. Economic consultant IHS Global Insight, Inc. expects the nation’s real gross domestic product to decline by 1.7 percent during Texas’ 2009 fiscal year.

Because exports have become a major factor behind the state’s recent economic health, any further strengthening of the U.S. dollar – coupled with the recessionary forces gripping Texas’ major trading partners – will severely weaken what has grown to be one of the state’s most important economic drivers. National forecasters believe that European markets are likely to enter recession and that China and other Asian markets will continue to slow markedly. As the nation’s largest exporting state, Texas’ export trade is vulnerable to substantial declines. The telecommunications, biotech, and electronics industries could be particularly exposed to export losses.

Energy prices and the bottoming out of investment markets offer the last major question marks. Not only do national forecasters have mixed opinions as to whether oil and natural gas prices will weaken even more before they begin their inevitable rise in response to demand, the timing of such changes – whether up or down – remains unknown. The same question applies to the outlook for stock and bond markets.

U.S. automakers are suffering to the point of struggling to continue operations, and General Motors’ Arlington, Texas truck/SUV plant – while still producing – remains vulnerable. Not only would Texas firms that supply automobile parts be subject to disruption if any of the “Big Three” U.S. automakers ceased operations, but the effect on franchised dealers – and the communities in which they are located – would be severe if not catastrophic. With a projected economic impact in the hundreds of billions of dollars nationally, a single bankruptcy among the nation’s automobile manufacturers would have profound repercussions on the Texas economy and revenues.

Finally, it should be noted that, as usual, this economic forecast relies on current consensus estimates for oil and gas prices. In the event that worldwide demand fails to rebound – or worse, continues to fall – such that oil prices remain at depressed levels – this could have far-reaching negative consequences for our energy sector and the Texas economy as a whole, in terms of lost jobs and associated business activity. Although sustained low prices would certainly benefit the driving public, the transportation sector, and petroleum feedstock-dependent industries, it is feared that a significant portion of the industry, particularly small producers and entrepreneurs, would not be able to weather a sustained period of low prices, implying that some capacity, production, investment, and jobs would vanish and thus be unavailable for the next – inevitable – upswing.