Projected

ending

shortfall of

$4.58

BILLION

The 2020-21 Certification Revenue Estimate Update Transmittal Letter

July 20, 2020

The Honorable Greg Abbott, Governor

The Honorable Dan Patrick, Lieutenant Governor

The Honorable Dennis Bonnen, Speaker of the House

Members of the 86th Legislature

Ladies and Gentlemen:

The economic contraction associated with the spread of COVID-19 and recent volatility in oil markets warrants an update to the Certification Revenue Estimate (CRE) we published in October 2019. We now estimate the state will have $110.19 billion in General Revenue-related (GR-R) funds available for general-purpose spending for the 2020-21 biennium, down $11.57 billion, or 9.5 percent, from our October estimate. This results in a projected fiscal 2021 ending deficit of $4.58 billion, a substantial downward revision from our previously projected surplus of $2.89 billion.

The $7.47 billion reduction to the projected ending balance from the October CRE is $4.1 billion less than the $11.57 billion decline in estimated available GR-R, primarily due to revised projections of GR-R costs to fund the Foundation School Program (FSP). Estimates provided by the Texas Education Agency and the Legislative Budget Board reduced the GR-R costs for the FSP due to federal funding from the Coronavirus Aid, Relief, and Economic Security (CARES) Act and increased projections of local funding from property tax revenues. GR-R costs for the FSP also were partly offset by our upward revision of estimated revenue accruing to the Tax Relief and Excellence in Education Fund from sales taxes collected by online marketplace providers.

The federal government has provided significant funding to help state and local governments cover costs associated with COVID-19, but not to replace tax revenue lost as businesses were forced to close or reduce capacity to help slow the virus’s spread. As of this writing, no additional federal legislation has been enacted extending benefits or providing more flexible assistance to states, and therefore this forecast does not assume any such assistance.

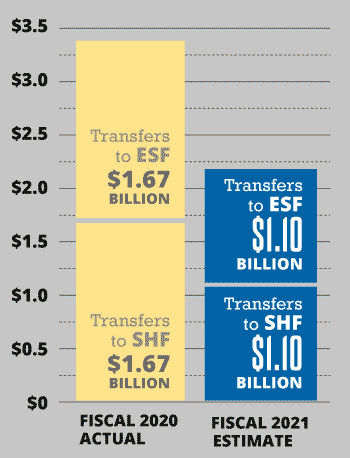

In fiscal 2021, the Economic Stabilization Fund (ESF) and State Highway Fund (SHF) each will receive $1.1 billion in transfers from the General Revenue Fund for severance taxes collected in fiscal 2020. After accounting for appropriations and investment and interest earnings, we project an ESF fiscal 2021 ending balance of $8.79 billion. We expect severance tax collections in fiscal 2021 to drop significantly from fiscal 2020, resulting in smaller fiscal 2022 transfers to the ESF and SHF of about $620 million each. The SHF also will receive $2.5 billion from sales taxes collected in each year of the biennium, although the final transfer from fiscal 2021 collections will not occur until September 2021, the first month of fiscal 2022.

This revised estimate carries an unprecedented amount of uncertainty. We have had to make assumptions about the economic impact of COVID-19, the duration and effects of which remain largely unknown. Our forecast assumes restrictions will be lifted before the end of this calendar year, but that economic activity will not return to pre-pandemic levels by the end of this biennium. The state’s economic output, employment and revenues will not return to pre-pandemic levels until consumers and businesses are confident the spread of the virus has been controlled. Even then, it likely will take some time to recover from the economic damage done by the deep recession.

Our outlook is clouded further by recent volatility in oil prices and production, which have been unpredictable even by the standards of the industry. Collapsing demand for oil, combined with a dispute between Saudi Arabia and Russia that led to an increase in supply, caused prices to plummet in March. Oil price futures even turned sharply negative on April 20, an unprecedented occurrence. Although prices have partially recovered from April lows, they remain well below where they were at the start of this year. It also is unclear when Texas producers might resume production that was recently reduced, and whether and how much bankruptcies, reductions in capital expenditures and business failures might hinder production in the coming months.

Nor do we yet know whether, and to what extent, further federal assistance might be provided to individuals, businesses and state and local governments. Federal legislation — including stimulus payments, expanded unemployment benefits and the Paycheck Protection Program — almost certainly prevented business and consumer spending from dropping even further, but many of these benefits have expired or will do so in the coming weeks.

Our office will, of course, provide a new estimate for this biennium, along with our forecast for the 2022-23 biennium, when we publish the Biennial Revenue Estimate in January, prior to the start of the 87th Regular Session of the Texas Legislature. In the meantime, I will continue to closely monitor the Texas economy and state revenues, and will keep you informed of any significant events as they arise.

Sincerely,

Glenn Hegar

Enclosure

cc: Jerry McGinty, Legislative Budget Board

A closer look

Certification Revenue Estimate

July 2020

Prior to the legislative session, the Comptroller issues a Biennial Revenue Estimate (BRE) to tell lawmakers how much they can spend over the next two years. After the legislative session, the Comptroller issues a Certification Revenue Estimate (CRE) to reflect legislative activity and the most current economic information, as well as to take into account final revenue numbers for the recently ended fiscal year. The CRE may be updated as warranted by economic circumstances.

Revenue Available for General Purpose Spending in the 2020-21 Biennium (In Billions of Dollars)

| Revenue | CRE October 2019 |

CRE July 2020 |

Notes |

|---|---|---|---|

| General Revenue-Related (GR-R) Tax Collections | $108.14 | $94.12 | |

| Other GR-R Revenues | $14.99 | $14.71 | |

| Total GR-R Revenues | $123.13 | $108.83 | |

| Beginning Balance (Funds carried forward from 2019) | $4.72 | $4.72 | |

| Change in GR-Dedicated Account Balances from the BRE | $0.39 | $0.07 | |

| Total GR-R Revenue & Fund Balances | $128.24 | $113.62 | SUBTOTAL |

| Revenue Reserved for Transfers to the Economic Stabilization and State Highway Funds | $6.48 | $3.44 | |

| Total Revenue Available for General-Purpose Spending | $121.76 | $110.19 | TOTAL |

Note: Totals may not sum because of rounding.

Severance Tax Transfers to the Rainy Day Fund and the State Highway Fund

The State Highway Fund (SHF) and Economic Stabilization Fund (ESF) both receive oil and gas severance tax dollars. The SHF also receives a share of sales tax revenue when annual collections exceed $28 billion.

Monthly Sales Tax Collections Percent Change

from Previous Year/All Funds Fiscal 2020

| Month | Percent Change from Previous Year |

|---|---|

| Sept | 1.24 |

| Oct | 6.98% |

| Nov | 6.17% |

| Dec | 4.85% |

| Jan | 8.87% |

| Feb | 3.51% |

| March | 2.86% |

| April | -9.29% |

| May | -13.16% |

| June | -6.51% |