The 2020-21 Certification Revenue EstimateTransmittal Letter

October 10, 2019

The Honorable Greg Abbott, Governor

The Honorable Dan Patrick, Lieutenant Governor

The Honorable Dennis Bonnen, Speaker of the House

Members of the 86th Legislature

Ladies and Gentlemen:

In accordance with Texas Government Code Section 403.0131, I hereby present the detailed tables for the revenue estimate I used to certify the General Appropriations Act for the 2020-21 biennium and other appropriations bills approved by the 86th Legislature. The estimates in this document include actual revenue collections and disbursements through August 31, 2019, and the estimated fiscal impact of all legislation passed by the 86th Legislature.

After accounting for statutory transfers, balances on hand at the close of the 2018-19 biennium and expected revenue collections and adjustments, the state will have a total of $121.76 billion in General Revenue-related funds available for the 2020-21 biennium. This revenue will support general-purpose spending of $118.86 billion for the 2020-21 biennium, resulting in an expected ending General Revenue-related certification balance of $2.89 billion.

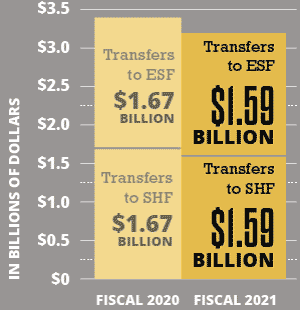

In fiscal 2020, the Economic Stabilization Fund (ESF) and State Highway Fund (SHF) each will receive $1.67 billion in transfers from the General Revenue Fund from severance taxes collected in fiscal 2019 and a transfer of $1.59 billion in fiscal 2021 from severance taxes collected in fiscal 2020. After accounting for interest and investment earnings by the ESF, along with expenditures authorized by appropriations made in recent legislative sessions, we project a fiscal 2021 ending ESF balance of $9.35 billion.

In 2015, the Legislature passed and voters approved a constitutional amendment that requires

a transfer of sales tax revenue to the SHF. As a result, $2.5 billion of state sales tax revenue

will be deposited to the SHF in each year of the 2020-21 biennium. That same constitutional

amendment also stipulated that a portion of motor vehicle sales tax revenue in excess of

$5 billion collected in any fiscal year also be transferred to the SHF. We project that the

threshold will be met for the first time in fiscal 2020 and that $35 million will be transferred

to the SHF from motor vehicle sales tax collections in the 2020-21 biennium.

In fiscal 2019, the Texas economy continued to grow at rates among the highest in the nation. We are projecting continued expansion of the Texas economy in this biennium. The most likely scenario is one of steady expansion at a pace below that of the 2018-19 biennium. Risks to this estimate include ongoing uncertainty about trade and national economic policy, slowing global economic growth, and volatility in energy prices resulting from instability and potential conflict in the Middle East.

I will continue to monitor the Texas economy and state revenues closely, and will keep you informed of any significant events as they arise.

Sincerely,

Glenn Hegar

Enclosure

cc: Legislative Budget Board