Skip navigation

Top navigation skipped

Certification Revenue Estimate: A Closer Look (PDF)

Certification Revenue Estimate A CLOSER LOOK

Prior to the legislative session, the Comptroller issues a Biennial Revenue Estimate (BRE) to tell lawmakers how much they can spend over the next two years. After the legislative session, the Comptroller issues a Certification Revenue Estimate (CRE) to reflect legislative activity and the most current economic information, as well as to take into account final revenue numbers for the recently ended fiscal year.

Revenue Available for General Purpose Spending in the 2018-19 Biennium (In Billions of Dollars)

| Revenue | Biennial Revenue Estimate January 2017 |

Certification Revenue Estimate October 2017 |

Notes | |

|---|---|---|---|---|

| General Revenue-Related (GR-R) Revenues from Sales Taxes (Before allocation to State Highway Fund) | $61.97 | $62.31 | ||

| Sales Taxes Allocated to State Highway Fund | minus$4.71 | minus$3.23* | * Legislative action during the 85th Regular Session deferred one transfer payment into the 2020-21 biennium. |

|

|

* Legislative action during the 85th Regular Session deferred one transfer payment into the 2020-21 biennium. |

||||

|

Net GR-R Revenues from Sales Taxes |

equals$57.26 | equals$59.08 | ||

| Other GR-R Revenues | plus$49.21 | plus$49.52 | ||

| Total GR-R Revenues | equals$106.47 | equals$108.6 | SUBTOTAL | |

| Beginning Balance (Funds carried forward from 2017) | plus$1.53 | plus$0.88 | ||

| Change in GR-Dedicated Account Balances from the BRE | plusN/A | plus$1.22 | ||

| Total GR-R Revenue &Fund Balances | equals$108.00 | equals$110.70 | SUBTOTAL | |

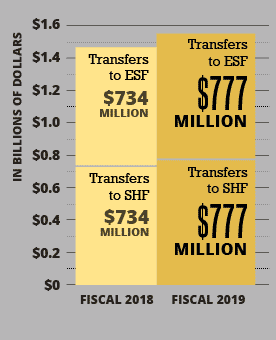

| Revenue Reserved for Transfers to the Economic Stabilization and State Highway Funds | minus$3.13 | minus$3.37 | ||

| Total Revenue Available for General-Purpose Spending | equals$104.87 | equals$107.33 | TOTAL | |

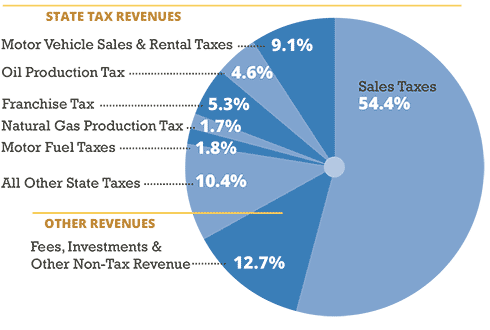

Projected General Revenue-Related Revenues

| Revenue Source | Percent of Total |

|---|---|

| Motor Vehicle Sales and Rental Taxes | 9.1% |

| Oil Production Tax | 4.6% |

| Francise Tax | 5.3% |

| Motor Fuel Taxes | 1.8% |

| Natural Gas Production Tax | 1.7% |

| All Other State Taxes | 10.4% |

| Sales Taxes | 54.4% |

| Fees, Investments and Other Non-Tax Revenue | 12.7% |