87th Legislature, Certification Revenue Estimate

November 4, 2021

Texas Comptroller Glenn Hegar Releases 2022-23 Certification Revenue Estimate

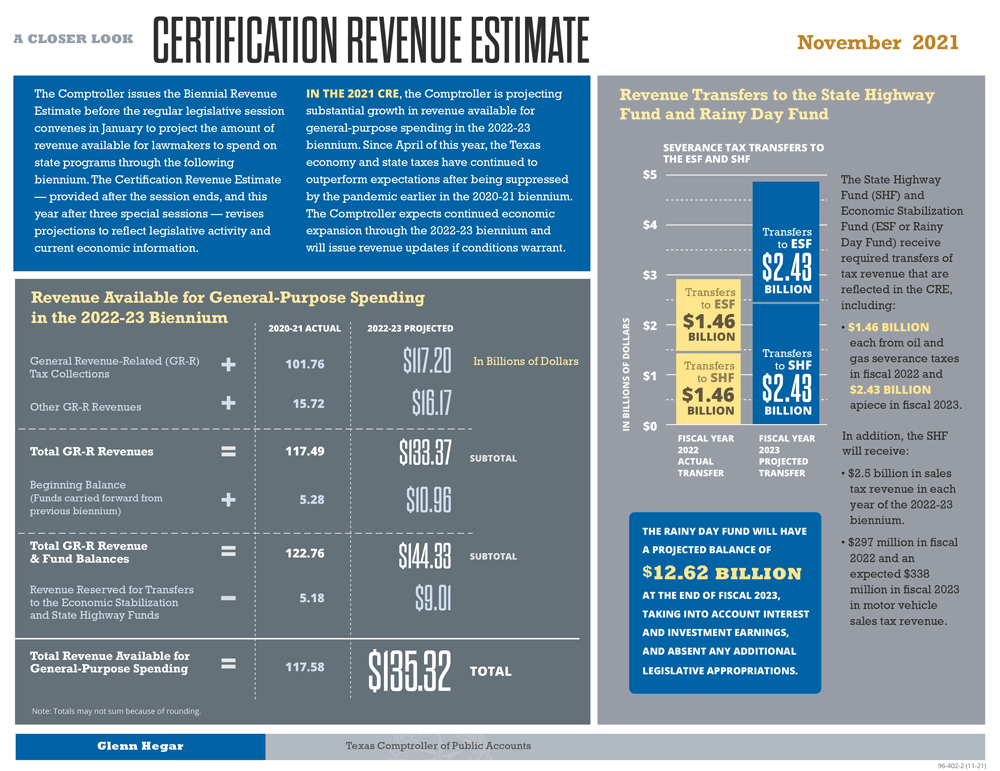

(AUSTIN) — Texas Comptroller Glenn Hegar announced today the release of the Certification Revenue Estimate (CRE) for the fiscal 2022-23 biennium. The Comptroller's office issues the CRE to provide the detailed basis by which the Comptroller certified the budget and any other bills making appropriations, to revise estimates in the Biennial Revenue Estimate to reflect legislative activity and current economic information, and to consider final revenue numbers for the recently ended fiscal year.

As a result of legislative actions and an updated economic forecast, the Comptroller's office now expects revenue available for general spending in 2022-23 to total about $135.32 billion, up 15.1 percent from the 2020-21 biennium. This revenue will support the $123.33 billion in general-purpose spending called for by the 87th Legislature and will result in a projected fiscal 2023 balance available for certification of $11.99 billion.

87TH LEGISLATURE, THIRD CALLED SESSION

REVENUE ESTIMATE

September 17, 2021

Texas Comptroller Glenn Hegar Releases Revenue Estimate for Third Called Session

At this time, I have made no changes to projected General Revenue-Related (GR-R) collections for the 2022-23 biennium from the estimates provided to you at the outset of the second called session. As a result of better than expected revenue collections in the final months of fiscal 2021 and some appropriations authorized for fiscal 2021 not being fully expended by the end of the fiscal year, the fiscal 2021 ending balance of GR-R funds available for certification was $11.23 billion. Adding that ending balance to our current forecast of 2022-23 GR-R collections results in a projected $129.25 billion in total GR-R available for certification.

After accounting for appropriations made through the 87th Legislature, Second Called Session, I now project a fiscal 2023 ending balance of $6.04 billion.

August 2021 Revenue Estimate, Second Called Session

Texas Comptroller Glenn Hegar Releases Revenue Estimate for Second Called Session

We continue to project a general revenue-related (GR-R) funds ending balance of $5.01 billion in fiscal 2021. We anticipate $123.02 billion available for general-purpose spending in the 2022-23 biennium. After adjusting for appropriations made by the 87th Legislature and gubernatorial vetoes, the projected fiscal 2023 ending balance is $7.85 billion.

July revenue collections were again strong and if repeated in August, the fiscal 2021 ending GR-R balance could exceed the amount projected in this forecast. Some of any revenue gain in excess of our estimate, however, would accrue to the Economic Stabilization Fund and State Highway Fund and not GR-R via allocations from severance and motor vehicle sales and rental taxes. We also will make the final transfer in August of this year’s sales tax allocation to the State Highway Fund, as anticipated in previous forecasts. While I remain optimistic about the trajectory of our economy, especially considering the unprecedented sales tax and motor vehicle sales and rental tax collections over the last four months, the continued uncertainty regarding labor constraints, supply chain disruptions, inflationary pressures and surging cases of the delta variant of the coronavirus weighs against an upward revision to our July estimate at this time.

July 2021 Revenue Estimate, First Called Session

Texas Comptroller Glenn Hegar Releases Revenue Estimate, Projects a Fiscal 2022-23 Ending Balance of $7.85 Billion

(AUSTIN) — Texas Comptroller Glenn Hegar today provided an estimate of revenue available for the 87th Legislature, First Called Session, and now projects 2022-23 revenue available for general-purpose spending to be $123.02 billion. Hegar projects a 2022-23 ending balance in General Revenue-Related (GR-R) funds of $7.85 billion.

As state leadership prepares for a special session of the 87th Legislature, Hegar said the estimate is based on surging revenue collections, savings from state agency budget reductions during the recently gaveled Regular Session of the 87th Legislature, and the replacement of eligible GR-R appropriations with federal relief funds.

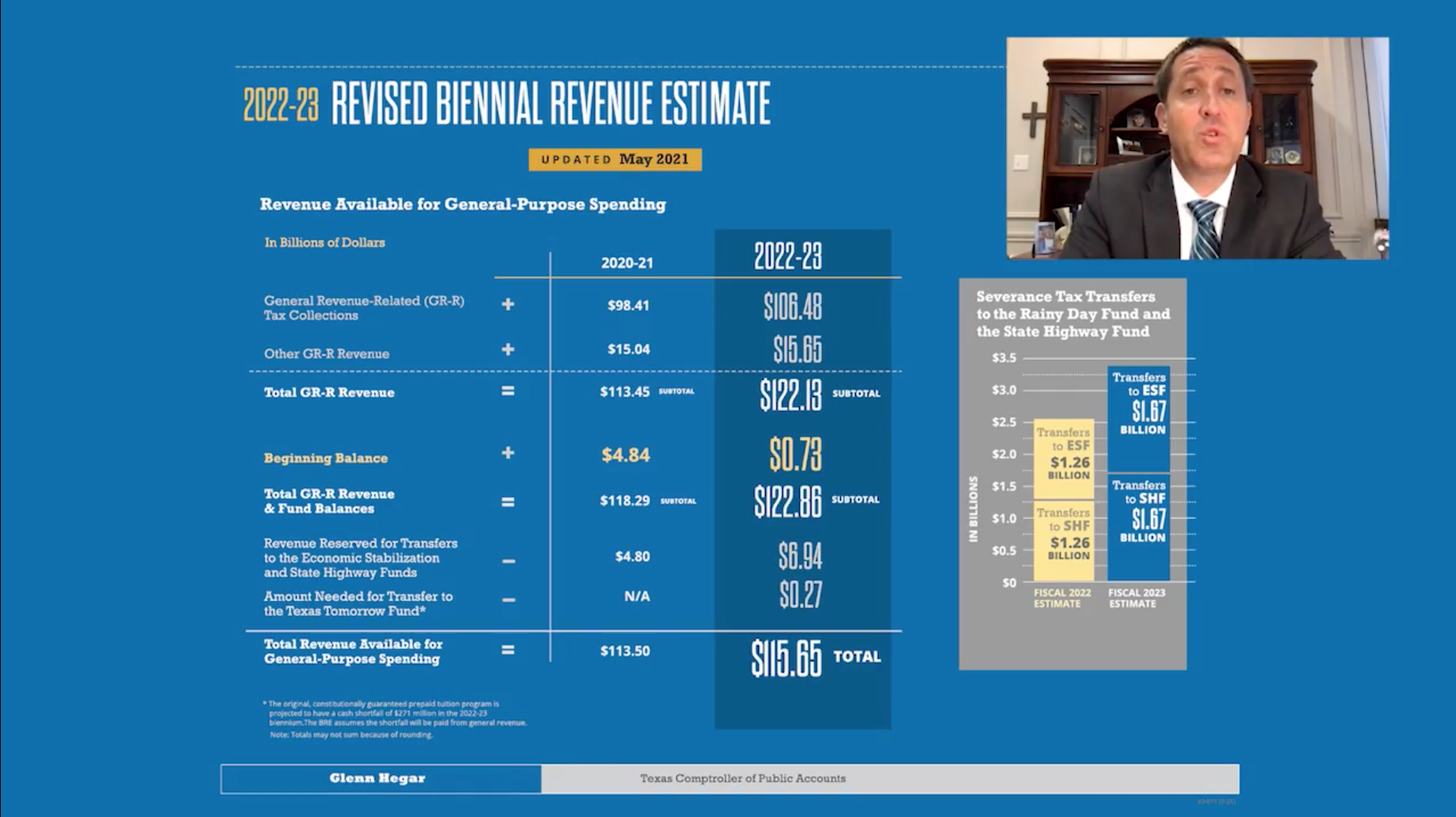

May 2021 Update to the

Biennial Revenue Estimate

Texas Comptroller Glenn Hegar Revises Revenue Estimate, Projects a Fiscal 2021 Ending Balance of $1.67 Billion More than January Estimate

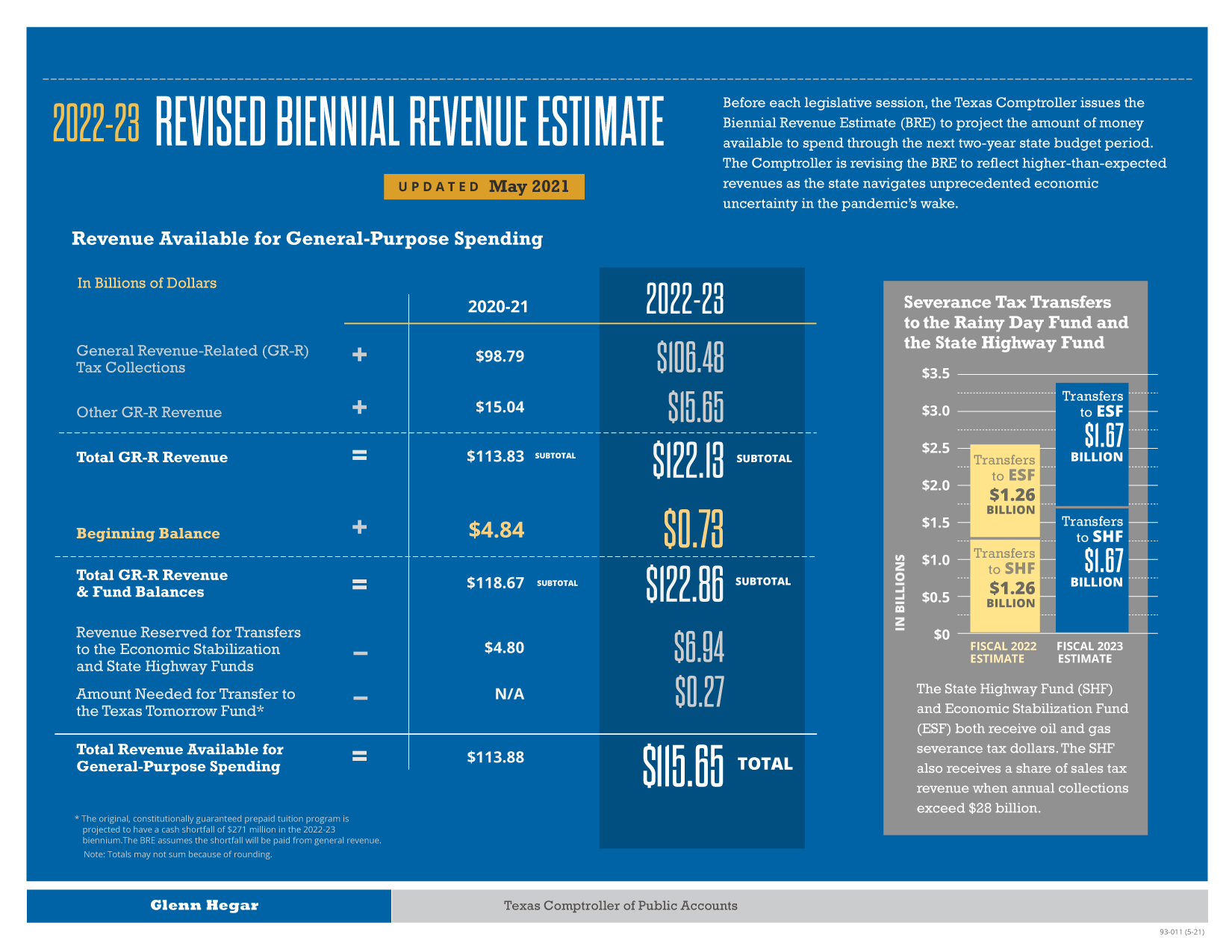

(AUSTIN) — Texas Comptroller Glenn Hegar today revised the Biennial Revenue Estimate (BRE) and now projects 2020-21 revenue available for general-purpose spending to be $113.88 billion and the ending balance in General Revenue-Related (GR-R) funds to be $725 million, an increase of $1.67 billion from the negative balance projected in the January 2021 BRE.

The increased ending balance, combined with upwardly revised projections of revenue collections for the 2022-23 biennium, results in an estimate of $115.65 billion available for general-purpose spending in 2022-23, an increase of $3.12 billion from the January BRE. Read more »

May 2021 Update to the Biennial Revenue Estimate (PDF)

Download the 2022-23 Biennial Revenue Estimate (PDF)

The Pandemic’s Impact on the Texas Economy

Economic contraction associated with the pandemic and the drop in energy prices warranted a revision of the Certification Revenue Estimate in July. While the budget outlook has improved since then, tremendous uncertainty still lingers regarding future COVID-related economic effects. Fiscal Notes examines the pressures that will affect the budget process in the 2021 legislative session.

Texas Government Finance and Economic Uncertainty

- Revised Certification Revenue Estimate, September 2020

- Texas Unemployment Still High, September 2020

- Recessions and Revenues, May 2020

- Pandemic Drives Record Unemployment, May 2020

Industry News and Hot Topics

- Chapter 313, November 2020

- Uninsured Texans, October 2020

- Texas’ International Trade, June/July 2020

The Making of the Biennial Revenue Estimate

Months of intense work go into the making of the BRE. It’s one of our constitutional responsibilities, and it’s an essential part of Texas’ budget process.

View Larger

View Larger