ENERGY STAR® and Water-Efficient Products Sales Tax HolidaysMemorial Day Weekend

May 25-27, 2019

Get more information on all of Texas’ sales tax holidays.

The Texas Comptroller’s office estimates shoppers will save about $12.6 million in state and local sales taxes during the Memorial Day weekend sales tax holidays.

“Inefficient appliances and outdated water systems can put a tremendous strain on our power grids and water supplies. By taking advantage of these sales tax holidays, Texans can make upgrades that will help alleviate those pressures and lower their utility bills — while saving money on state and local sales taxes.”

– Comptroller Glenn Hegar

Additional Details

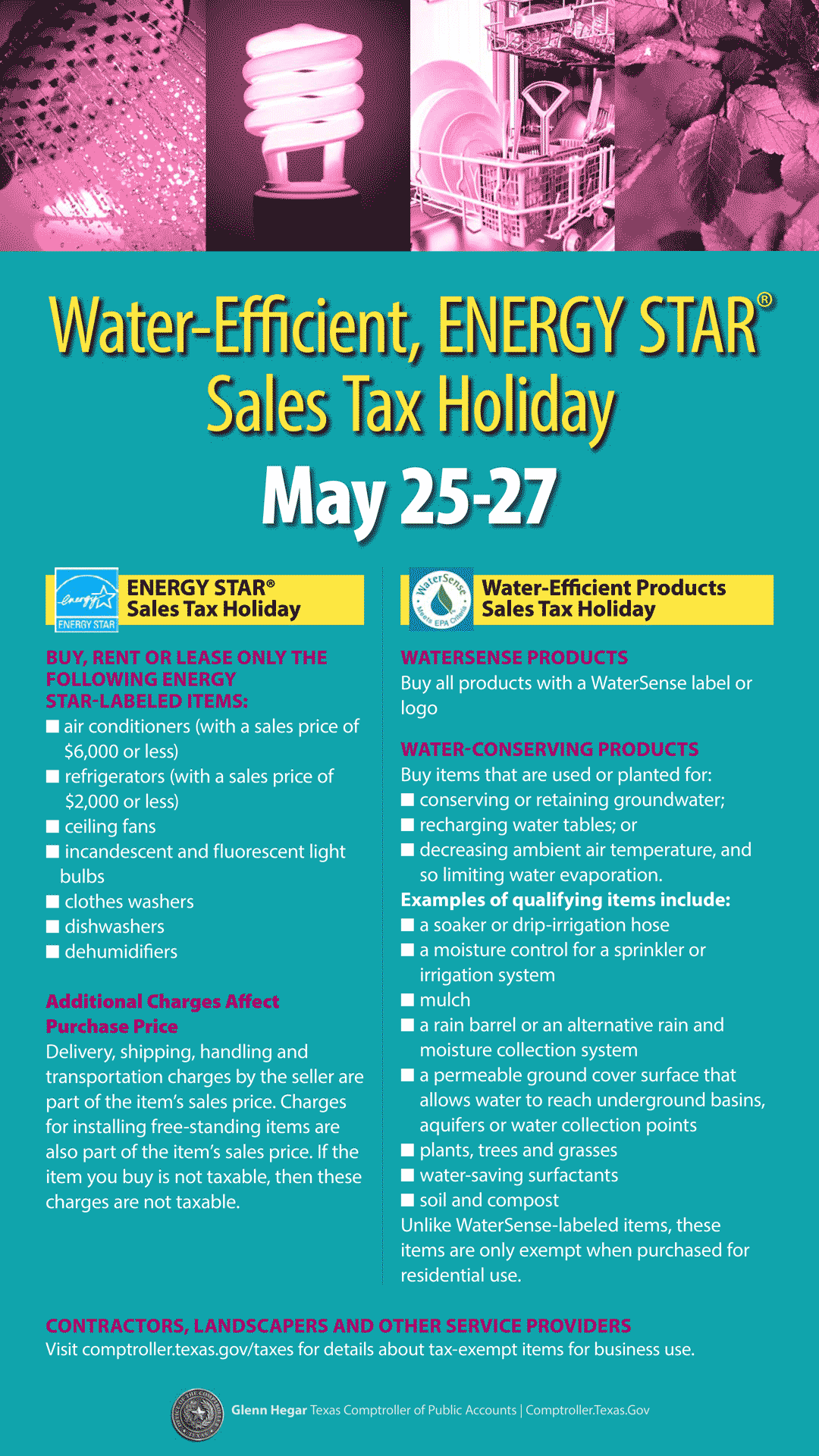

Water-Efficient, ENERGY STAR® Sales Tax Holiday, May 25 through 27

ENERGY STAR® Sales Tax Holiday

Buy, rent or lease only the following ENERGY STAR-labeled items:

- air conditioners (with a sales price of $6,000 or less)

- refrigerators (with a sales price of $2,000 or less)

- ceiling fans

- incandescent and fluorescent light bulbs

- clothes washers

- dishwashers

- dehumidifiers

Additional Charges Affect Purchase Price

Delivery, shipping, handling, and transportation charges by the seller are part of the item's sales price. Charges for installing free-standing items are also part of the item's sales price. If the item you buy is not taxable, then these charges are not taxable.

Water-Efficient Products Sales Tax Holiday

WaterSense Products

Buy all products with a WaterSense label or logo

Water-Conserving Products*

Unlike WaterSense-labeled items, these items are only exempt when purchased for residential use.

Buy items that are used or planted for:

- conserving or retaining groundwater;

- recharging water tables; or

- decreasing ambient air temperature, and so limiting water evaporation.

Examples of qualifying items include:

- a soaker or drip-irrigation hose

- a moisture control for a sprinkler or irrigation system

- mulch

- a rain barrel or an alternative rain and moisture collection system

- a permeable ground cover surface that allows water to reach underground basins, aquifers or water collection points

- plants, trees and grasses

- water-saving surfactants

- soil and compost

Contractors, landscapers and other service providers: View details about tax-exempt items for business use.

Glenn Hegar

Texas Comptroller of Public Accounts

Comptroller.Texas.Gov