programs Criminal Investigation Division

Case Closed

The CID may not always get its man (or woman), but we do get quite a few. Here are some recent examples:

17 for Fuel Hijackers

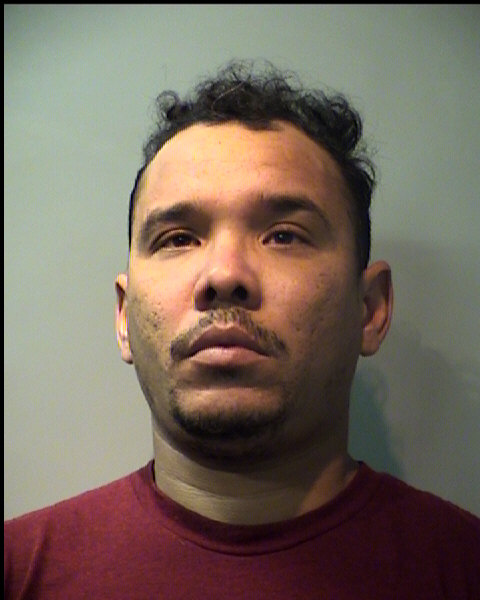

Santos-Legon

Benitez-Hernandez

Joxan Santos-Legon, 44, of Miami, Fla., and Julio Benitez-Hernandez, 31, of Tampa, Fla., were convicted of engaging in organized criminal activity.

In April 2023, the defendants along with two or more persons collaborated to evade the backup motor fuel tax liability on illegally appropriated diesel fuel by installing a manipulation device inside the fuel pump dispenser. An investigation determined that Santos-Legon and Benitez-Hernandez knowingly transported motor fuel without a cargo manifest or shipping documents.

A Franklin County district judge sentenced Santos-Legon and Benitez-Hernandez to 17 years’ incarceration for engaging in organized criminal activity, a first-degree felony punishable by five to 99 years in prison and a fine up to $10,000.

The sentences will be served in the institutional division of the Texas Department of Criminal Justice. Santos-Legon was credited with 310 days of jail time served. Benitez-Hernandez was credited with 306 days of jail time served.

Motor Fuel Thief Sentenced in Two Counties

Marlon Michel Cargallea-Prieto, 22, of Austin, was convicted for evading motor fuel tax, a second-degree felony punishable by two to 20 years in prison and a fine of up to $10,000, in two different counties.

In July 2023, the defendant illegally appropriated approximately 1,848 gallons of diesel fuel valued around $6,000 by tampering with the fuel dispenser's pulsar in Gonzales County.

A Gonzales County district judge sentenced Cargallea-Prieto to two years in prison.

In August 2023, the defendant illegally appropriated about 300 gallons of diesel fuel valued at $1,172 by using a pulsar manipulation device. The diesel fuel was delivered into an auxiliary fuel tank concealed under a rug on a bus floor.

A Burleson County district judge sentenced Cargallea-Prieto to four years’ incarceration at the Texas Department of Criminal Justice system.

Serving the Time for His Crime

In December 2022, the defendant intentionally and knowingly evaded a tax imposed on motor fuel by failing to pay the backup diesel tax liability. Valdes parked his van directly above an underground fuel tank, lowered a hose and syphoned approximately 218 gallons of illegally appropriated fuel.

A Dallas County district judge sentenced Valdes to two years of incarceration for the count, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000. The defendant will serve the sentence in the Texas Department of Criminal Justice system.

Probation Violation Leads to Jail Cell

Anyero Evelio Escalona, 27, of Dallas was fulfilling his three years’ probated sentence on a 10-year prison sentence for the second-degree felony offense of evading or attempting to evade motor fuel tax.

On or about July 17, 2023, the defendant committed the offense of evading arrest with a vehicle and abandoning/endangering a child.

Escalona violated his court-ordered community supervision as it relates to his original charge, and a Dallas County judge sentenced him to 6 years’ confinement in the Texas Department of Criminal Justice.

Serving the Time for His Crime

Jorge Ramirez Urtiaga, 33, of Port Arthur was convicted for evading motor fuel tax, transporting motor fuel without a cargo manifest and unlawful use of a criminal instrument.

In August 2021, the defendant intentionally and knowingly evaded a tax imposed on motor fuel by failing to pay the backup diesel tax liability and transporting without a cargo manifest or shipping documents. Urtiaga’s van was modified to receive, transport and dispense large quantities of motor fuel.

A Navarro County district judge sentenced Urtiaga to 12 years of incarceration for the first two counts, both second-degree felonies punishable by two to 20 years in prison and a fine up to $10,000. The judge sentenced Urtiaga to 10 years of incarceration for Count III, unlawful use of a criminal instrument (i.e., van), a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000.

The sentences will run concurrently, and the defendant will serve the sentence in the Texas Department of Criminal Justice system.

Gas-Powered Weapon Equals Fuel Tax Fraud Revocation

Adan Naranjo-Ramos, 31, of Odessa was serving five years’ probation for the second-degree felony offenses of motor fuel tax evasion and transporting motor fuel without shipping documents when a motion was filed to adjudicate both felonies for committing the offense of aggravated assault with a deadly weapon.

On or about June 19, 2023, the defendant committed the offense of aggravated assault with a deadly weapon against a family member by ramming the victim's vehicle with his vehicle, and on or about July 13, 2023, he committed the offense of theft of mail from 10 addresses or fewer.

Naranjo-Ramos pleaded true to violating terms of his probation, and an Ector County judge sentenced him to 12 years confinement in the Texas Department of Criminal Justice for the two probation revocations and to two years for aggravated assault. The sentences will run concurrently.

Seven for Siphoning

Gary Wayne Little, 34, of Gainesville was convicted of acquiring and unlawfully appropriating 100 gallons of diesel fuel.

In June 2022, the defendant confessed to siphoning approximately 100 gallons of diesel fuel from semi-trucks’ saddle tanks parked in a trucking yard and transporting the fuel in multiple storage containers. Little evaded motor fuel tax by failing to pay the backup tax as required for illegally appropriating diesel fuel and transporting motor fuel without a cargo manifest or shipping documents.

A Cooke County district judge sentenced the defendant to seven years’ incarceration for transporting motor fuel without a cargo manifest or shipping documents and evading or attempting to evade motor fuel tax, both second-degree felonies punishable by two to 20 years in prison and a fine up to $10,000.

The sentence will be served concurrently in the institutional division of the Texas Department of Criminal Justice. Little was credited with 180 days of jail time served.

Check Forger Sentenced to Prison

Bobby Dion Mitchell, 57, of Bastrop was convicted for forging a government treasury warrant.

In June 2020, the defendant forged and attempted to cash a state agency-issued warrant at two local gas stations. During a voluntary interview, Mitchell stated he was authorized to endorse the warrant, but further investigation revealed it was endorsed and cashed without the victim’s consent.

A Bastrop County district judge sentenced the defendant to six years’ confinement for forgery, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000. The sentence will be served concurrently in the institutional division of the Texas Department of Criminal Justice.

Convicted Red-Dyed Diesel Thief Serving Prison Time

Charles Brandon Wells, 34, of Hearne was convicted for acquiring and illegally transporting approximately 140 gallons of untaxed, red-dyed diesel fuel.

In June 2021, investigators observed the defendant dispensing stolen, red-dyed diesel fuel into the supply tank of the suspect vehicle. Wells departed the property in the suspect vehicle with two auxiliary fuel tanks in the bed of the vehicle. Officers made contact with the defendant. Wells admitted to stealing the fuel and storing it in the two fuel tanks. The vehicle was outfitted with a pump and two hoses to receive, transport and dispense fuel.

In Texas, non-taxable diesel is dyed red to distinguish it from taxable diesel. Red-dyed diesel is authorized almost exclusively for off-road, agricultural use by permit holders only.

A Robertson County district judge sentenced the defendant to three years’ confinement for evading or attempting to evade motor fuel tax and transporting motor fuel without shipping documents, both second-degree felonies punishable by two to 20 years in prison and a fine up to $10,000.

The sentence will be served concurrently in the institutional division of the Texas Department of Criminal Justice. Wells was ordered to pay $290 in court costs and credited with 86 days of jail time served.

Public Servant Threatened by Angry Taxpayer

Syed Zahed Hossain, 70, of Arlington pleaded guilty to making threats against and assaulting a public servant.

A CID investigator responded to the alleged aggravated assault against a Comptroller’s Enforcement Division tax compliance officer conducting official state business at the suspect’s business. The tax compliance officer was discussing the taxpayer’s account when Hossain forced unwanted contact with physical assault, according to reports.

The tax compliance officer planned to de-escalate the confrontation by leaving the premises in her vehicle, when the suspect attempted to prevent her from leaving by threatening her with a knife. The victim safely left the business despite the danger.

Hossain was originally charged with aggravated assault against a public servant, a first-degree felony punishable by five to 99 years in prison and a fine up to $10,000. He pleaded guilty to the lesser offense of assault on a public servant, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000.

A Tarrant County district judge sentenced him to 4 years deferred adjudication, a $400 fine and 240 hours of community supervision.

Twenty to Do

Pedro Serrano-Echevarria, 43, of Dallas was arrested on a motion to adjudicate guilt warrant for violating terms of his original five years’ deferred probation for evading motor fuel tax and transporting motor fuel without a shipping manifest.

In April 2021, the defendant violated the terms of his probation by being arrested for a new penal code offense in Wise County. In March 2023, a Cooke County district judge sentenced Serrano-Echevarria to 20 years in the institutional division of the Texas Department of Criminal Justice after adjudicating his guilt on the original charges of evading motor fuel tax and transporting motor fuel without a shipping manifest, both second-degree felonies punishable by two to 20 years in prison and a fine up to $10,000.

Court documents revealed that the defendant violated the terms of his deferred sentence by being charged with fraudulent use/possession of identifying information of no more than five items. He also failed to complete the required community service hours.

Combo Sentence for Fuel Thief

Nilson Quintanilla Rodriguez, 32, of Katy was convicted for evading motor fuel tax, fraudulent possession of credit card or debit card information and unlawful use of a criminal instrument.

In September 2022, the defendant used counterfeit cards to illegally purchase 119 gallons of diesel fuel worth $525 from a chain convenience store in League City. Rodriguez’s flatbed truck was modified with the bed as the actual fuel tank itself, capable of holding hundreds of gallons of fuel. The vehicle was equipped with an electric pump, hose, nozzle and meter.

A Galveston County district judge sentenced Rodriguez to two years’ confinement for evading or attempting to evade motor fuel tax and fraudulent possession or use of more than 10 but fewer than 50 items of credit/debit card information, both second-degree felonies punishable by two to 20 years in prison and a fine up to $10,000, and unlawful use of a criminal instrument (i.e., flatbed truck), a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000.

The sentences will run concurrently, and the defendant will serve two years for the three charges in the institutional division of the Texas Department of Criminal Justice. Rodriguez was ordered to pay $921 in court costs and fees. He was also credited with 154 days of jail time served.

Not The First Rodeo for Fuel Theft

Luis Ochoa Cabrera, 61, of Houston was convicted for evading motor fuel tax and credit card or debit card abuse.

In February 2021, the defendant was observed using a counterfeit card to purchase diesel fuel and Cabrera confirmed that he was not carrying any permits. A motor fuels tax inspection revealed that the entire bed of his truck was retrofitted to conceal a 350-gallon fuel tank. The vehicle was outfitted with a pump, fuel hose, fuel nozzle and digital meter to deliver fuel to another vehicle, according to reports.

A Lee County district judge sentenced Cabrera to five years’ confinement for evading or attempting to evade motor fuel tax, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000, and one year for credit card or debit card abuse, a felony punishable by confinement in a state jail for six months up to two years and a fine up to $10,000.

The two sentences will run concurrently and be served in the institutional division of the Texas Department of Criminal Justice. Cabrera was ordered to pay $2,000 in fines along with $355 in court costs and fees. He was also credited with 308 days of jail time served.

Cabrera is under indictment with prosecution still pending in multiple Texas counties for similar crimes.

Illegal Fuel Transporters Receive Incarceration

Lopez

Martinez-Smith

Carla Castillo Lopez, 24, of Port Arthur and Adrian Gumersindo Martinez-Smith, 31, of Houston were convicted of evading motor fuel tax, transporting motor fuel without a cargo manifest or shipping documents and unlawful use of a criminal instrument.

In August 2021, the defendants attempted to evade the backup motor fuel tax liability on illegally appropriated diesel fuel. An investigation determined that Lopez and Martinez-Smith knowingly transported 238 gallons of motor fuel without a cargo manifest or shipping documents. Their vehicles were modified to receive, transport and dispense fuel.

A Navarro County district judge sentenced Lopez and Martinez-Smith to six years’ incarceration for evading or attempting to evade motor fuel tax and transporting motor fuel without a cargo manifest or shipping documents, second-degree felonies punishable by two to 20 years in prison and a fine up to $10,000, and unlawful use of a criminal instrument, a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000.

The sentences will run concurrently and be served in the institutional division of the Texas Department of Criminal Justice. Lopez was credited with 245 days of jail time served. Martinez-Smith was credited with 423 days of jail time served.

Clay County Tax Assessor Resigns, Pleads Guilty to Misapplication of Fiduciary Property

Maribel Longoria, 40, of Henrietta recently resigned from office and pleaded guilty for failing to maintain the required records related to motor vehicle sales tax and registration fees as the elected Clay County tax assessor-collector.

From 2018 to 2021, an audit revealed that the defendant routinely filed late reports and remitted late tax payments. A criminal investigation determined that Longoria was not filing reconciliations of accounts with the county auditor and failing to make deposits as required by the Texas Local Government and Tax codes, causing a substantial risk of loss to the state.

A Clay County district judge granted Longoria deferred adjudication and sentenced her to three years’ probation. Under a plea agreement, the four counts of misapplication of fiduciary property greater than $300,000 were reduced to misapplication of fiduciary property greater than $2,500 but no more than $30,000, a felony punishable by confinement in a state jail for six months to two years and a fine up to $10,000. Longoria was ordered to pay $327 in court costs and fees.

Probation Violation Leads to Jail Cell

Adrian Diaz, 36, of Dallas was convicted of engaging in organized criminal activity, transporting motor fuel without shipping documents and engaging in a motor fuel transaction without a permit or license.

After pleading guilty in January 2021, he was sentenced to five years’ probation for all three charges. Diaz was arrested on June 4, 2022, by Dallas PD for other charges that violated the terms of his probation.

A Dallas County district judge sentenced Diaz to five years for engaging in organized criminal activity, a first-degree felony punishable by five to 99 years in prison and a fine up to $10,000; two years for transporting motor fuel without a cargo manifest or shipping documents, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000; and two years for engaging in a motor fuel transaction without a permit or license, a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000, as part of a plea agreement.

The three sentences will run concurrently and be served in the institutional division of the Texas Department of Criminal Justice. Diaz was ordered to pay $1,061 in court costs and credited with 320 days of jail time served.

Third Time's a Charm Lands Fuel Thief in Texas Prison

Osley Alvarez-Morales, 35, of Irving was convicted of evading motor fuel tax, transporting motor fuel without shipping documents and possession/use of a criminal instrument.

In August 2020, the defendant attempted to evade the backup motor fuel tax liability on illegally appropriated diesel fuel using counterfeit credit/debit cards. In December 2021, Dallas PD observed him illegally appropriate a large quantity of diesel fuel with counterfeit credit/debit cards and deliver it to a residence. In March 2022, he knowingly transported 900 gallons of motor fuel without a cargo manifest or shipping documents. His box truck was modified to receive, transport and dispense fuel.

A Dallas County district judge sentenced Alvarez-Morales to five years’ incarceration for evading or attempting to evade motor fuel tax and transporting motor fuel without a cargo manifest or shipping documents, second-degree felonies punishable by two to 20 years in prison and a fine up to $10,000, and unlawful use of a criminal instrument, a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000. Additional motor fuel tax felonies were dismissed as part of a plea deal.

The sentences will run concurrently and be served in the institutional division of the Texas Department of Criminal Justice. Alvarez-Morales was ordered to pay $286 in court costs and credited with 137 days of jail time served.

Charge Card Thief Doing Time

Erasmo Millan Roldan, 28, of Houston admitted to using re-encoded cards to illegally purchase diesel fuel from a Katy chain grocery store.

In February 2021, Katy police witnessed the defendant acquiring the fuel and determined that he was not carrying any permits or licenses. His pickup truck was outfitted with a large tank mounted in the bed along with pumps, hoses and nozzles. The vehicle had been modified to receive, transport and dispense motor fuel. Officers confiscated numerous counterfeit cards that did not belong to him.

A Harris County district judge sentenced him to two years in prison for the second-degree felony of fraudulent use/possession of credit/debit card information of more than 10 but less than 50 items. The sentence will be served in the institutional division of the Texas Department of Criminal Justice. He was credited with one year jail time served. The charge of attempting to evade motor fuel tax was dismissed as part of his plea agreement.

CID assisted Katy police with this investigation.

Fuel Tax Cheat Convicted for Felony Fraud

Leobardo Rodriguez, 48, of Pecos was arrested on a motion to adjudicate guilt capias warrant for violating terms of his original six years’ deferred probation for motor fuel tax evasion while using red dyed diesel fuel to operate a motor vehicle on public highways.

In September 2021, Rodriguez pleaded true to violating the terms of his probation. A Reeves County district judge sentenced him to 10 years in the institutional division of the Texas Department of Criminal Justice probated for six years for motor fuel tax evasion, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000.

The court documents revealed that Rodriguez violated terms of his deferred sentence by being charged with allegedly committing theft of property over $750 but less than $2,500 by the Reeves County Sheriff’s Office. He also failed to comply with the terms of his probation by not notifying his probation officer of his arrest, paying all his fines and court costs and completing the required community service hours.

Out-of-State Tourist Serving Texas Stint

Chery Morin-Alarcon, 48, of Hialeah, Fla., will spend time in prison for unauthorized purchases of diesel fuel.

In February 2020, Baytown police detained the defendant for using a counterfeit card in large, fraudulent transactions to obtain a sizable volume of diesel fuel. His pickup truck bed was modified with an auxiliary fuel tank to receive, transport and dispense motor fuel.

A Harris County district judge sentenced him to five years in prison for fraudulent use/possession of credit/debit card information of more than 10 but less than 50 items, a second-degree felony, and three years for credit/debit card abuse against the elderly, a third-degree felony. Both sentences will be served concurrently in the institutional division of the Texas Department of Criminal Justice. He was credited with eight months’ jail time served. The charge of engaging in a fuel transaction without a license was dismissed as part of his plea agreement.

Probation Violator Sentenced to Time

Maikel Orlans Abad-Suarez, 41, of Pasadena was serving three years’ probation for the second-degree felony offense of evading motor fuel tax when he found himself back in court.

In November 2020, Abad-Suarez was jailed for violating the terms of his probation. He had allegedly violated a protective order and committed assault with bodily injury (family violence) — both Class A misdemeanors — as well as allegedly found fraudulently possessing more than 10 but less than 50 counterfeit credit or debit cards, a second-degree felony.

He pleaded true to violating terms of his probation and a Harris County judge sentenced him to two years in the institutional division of the Texas Department of Criminal Justice for the felony offense of motor fuel tax fraud. He pleaded guilty to the new felony offense of fraudulent use/possession of credit or debit cards and will also serve two years on this charge. Both sentences will be served concurrently. He was also sentenced to 310 days in the Harris County jail for violating a protective order. The assault charge was dismissed as part of the plea deal.

CID Leads Crackdown on Illegal Craigslist Motor Fuel Sales

Illegally selling tax-free motor fuel didn’t put Blake Blaha, 29, of Highland Village behind bars — at first.

In July 2014, after learning of a Craigslist ad for motor fuel, CID conducted a sting operation in Midland, Texas. Together with officers from the Permian Basin’s FBI Oilfield Theft Task Force, an undercover officer purchased diesel fuel from the defendant at a convenience store.

Further investigation revealed Blaha was using a stolen fuel fleet card from his previous employer to unlawfully acquire and then sell the motor fuel without collecting motor fuel tax.

Blaha was originally given community supervision. However, after violating the terms of his probation a Midland County judge sentenced him to three years for evading motor fuel tax, a second-degree felony, and to nine months for credit card abuse. Both sentences will be served in the institutional division of the Texas Department of Criminal Justice.

Ganging Up on Gas Stations Backfires Big Time on Fuel Thief

A Dallas man will spend several years behind bars for using gas pump skimmers and “cloned” charge cards to acquire and resell large quantities of diesel fuel to truckers.

On July 9, a Dallas County district judge sentenced Eddy Xavier Burgos-Torres, 25, to five years in prison for engaging in organized criminal activity. In his judicial confession, he admitted to committing motor fuel tax fraud with three or more individuals. Consequently, the offense was enhanced from the original second-degree felony to a first-degree felony punishable by five to 99 years in prison and a fine up to $10,000.

Burgos-Torres and a co-defendant were indicted last fall for using re-encoded charge cards to fraudulently obtain more than 100 gallons of diesel fuel from various fueling locations in and near Grand Prairie in late July 2020.

The defendants obtained diesel fuel using counterfeit credit card information and delivered it for use in semi-tractor trailers located at a Grand Prairie truck yard.

Dismissed in the plea agreement were additional charges of transporting motor fuel without a cargo manifest or shipping documents and fraudulent use or possession of more than 10 but fewer than 50 items of identifying information, both second-degree felonies punishable by two to 20 years in prison and a fine up to $10,000; and engaging in a motor fuel transaction without a permit or license, a third-degree felony pun