Property Tax Today

Quarterly Property Tax News

Volume 12 | April 2020

Property Tax Today features content regarding upcoming deadlines, action items and information releases.

Please let us know what you would like to see in future editions by sending property tax questions and/or suggested topics to ptad.communications@cpa.texas.gov. We will gladly address property tax matters under our authority.

Message from the Comptroller

Glenn Hegar

Texas Comptroller

At the Comptroller's office, the health and well-being of our taxpayers, employees and communities is our top priority. We understand the concern and uncertainty you may be experiencing surrounding coronavirus (COVID-19) and are committed to being responsive to the needs of our taxpayers as the situation evolves.

On March 13, Governor Greg Abbott declared a state of disaster for all counties in Texas. Due to this declaration, an appraisal district may be entitled to receive a Limited Scope Methods and Assistance Program (MAP) review if certain criteria are met. More information regarding Limited Scope MAP reviews is included in this newsletter.

In the wake of various federal, state and local guidelines on social distancing, we canceled all in-person appraisal review board (ARB) training. We are working on a remote training option that still meets the legal requirements for completion of the ARB training.

Prior to the challenges presented by COVID-19, the Property Tax Assistance Division (PTAD) had an active first quarter, continuing to update property tax information, publications, forms and videos to reflect law changes from the 2019 legislative session that were effective Jan. 1, 2020. I also appointed the new 15-member Property Tax Administration Advisory Board (PTAAB), which held its first meeting on Feb. 13.

In addition to ongoing legislative implementation, PTAD certified the property value study (PVS) preliminary findings to the commissioner of education and released the final 2019 MAP reports.

Finally, I would like to note that with the dawning of the second quarter comes numerous property tax deadlines. With all the concerns surrounding COVID-19, I encourage taxpayers, appraisal districts and taxing entities to review the statutes imposing deadlines, as many provide for flexibility when meeting a deadline is not practicable. A list of important property tax deadlines, including the new rendition deadlines, can be found on PTAD's Property Tax Laws Deadlines webpage.

Notes from the Field

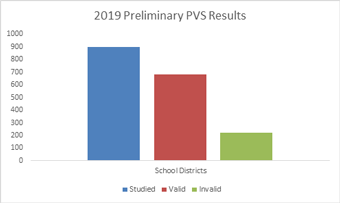

We certified amended 2019 PVS preliminary findings to the Texas Education Association (TEA) commissioner of education on Feb. 12, 2020, and posted the findings to our website. Of the 901 school districts evaluated for the 2019 PVS, we certified valid preliminary findings for 681 (76 percent), which means we will certify their locally reported appraised values to TEA later this year for use in determining local school funding.

We certified amended 2019 PVS preliminary findings to the Texas Education Association (TEA) commissioner of education on Feb. 12, 2020, and posted the findings to our website. Of the 901 school districts evaluated for the 2019 PVS, we certified valid preliminary findings for 681 (76 percent), which means we will certify their locally reported appraised values to TEA later this year for use in determining local school funding.

Currently, we are working on 150 PVS protests to the PVS preliminary findings. The protestors include school districts, eligible property owners and authorized appraisal districts in districts for which we assigned a value other than local value to property. The deadline to file protest petitions for the 2019 PVS preliminary findings was March 23, 2020, the 40th day after the date the Comptroller's office certified the amended preliminary findings to TEA. The informal protest process will continue through May 31, 2020.

Methods and Assistance Program

In January, PTAD released 2019 final MAP reviews and notified chief appraisers whose districts received reviews. You can learn more about MAP reviews and download copies of reports for submission to your boards of trustees by accessing the Methods and Assistance Program webpage. PTAD also referred 20 appraisal districts to the Texas Department of Licensing and Regulation (TDLR) for failure to complete the recommendations included in their 2018 final MAP review. TDLR will work with these districts over the next year on the recommendations.

On March 13, 2020, the governor declared a state of disaster in all counties. Your appraisal district may be entitled to receive a Limited Scope MAP review if certain criteria are met:

- Your appraisal district is required to undergo a MAP review this year.

- Your MAP review has not yet started or is currently underway.

- Your appraisal district is established in a county located wholly or partly in an area declared by the governor to be a disaster area.

- The disaster caused:

- a building used by the appraisal district to conduct business to be destroyed or inaccessible or damaged to the extent that it is unusable for at least 30 days;

- the appraisal district's records to be destroyed or unusable for at least 30 days;

- the appraisal district's computer system to be destroyed or unusable for at least 30 days; or

- the appraisal district not to have the resources to undergo a review under this section unless the review is limited in scope.

Please contact us via email to request a Limited Scope Review if you meet the criteria above.

Depreciation, Trend Factors and Life Expectancy

PTAD typically updates its depreciation schedule, trend factors and life expectancy charts in March each year. The 2020 charts are located in the resources section on PTAD's Property Value Study and Self-Reports webpage.

- Business Personal Property Depreciation Schedule (PDF)

- Business Personal Property Trend Factors (PDF)

- Common Furniture, Fixture, Machine and Equipment Life Expectancies (PDF)

Operations Survey

Due to the challenges presented by COVID-19, we are extending the deadline for responses to the Appraisal District Operations Survey for the 2019 Tax Year to April 30, 2020. It is important that we receive the operations data from last year to help inform policymakers.

Due to the challenges presented by COVID-19, we are extending the deadline for responses to the Appraisal District Operations Survey for the 2019 Tax Year to April 30, 2020. It is important that we receive the operations data from last year to help inform policymakers.

Unless otherwise noted, all responses deal with information from the 2019 tax year. A non-fillable PDF version of the survey is available upon request for use as a working copy only.

If you are unable to comply with the extended deadline, need a non-fillable PDF version of the survey or if you have any questions, please contact Alison Gilliam by email or at 800-252-9121 (press 1 to access the agency directory and then enter 5-0427).

Rendition Statements and Property Report Deadlines

Rendition statements and property report deadlines depend on property type or location. The statements and reports must be delivered to the chief appraiser after Jan. 1 and no later than the deadline indicated below. Allowed extensions also vary by property type or location as referenced below.

Due to COVID-19, some appraisal districts have automatically extended rendition deadlines. Contact your local appraisal district regarding deadlines and/or extensions.

| Rendition Statements and Reports | Deadline | Allowed Extension(s) |

|---|---|---|

| Property generally | April 15 |

|

| Property regulated by the Public Utility Commission of Texas, the Railroad Commission of Texas, the federal Surface Transportation Board or the Federal Energy Regulatory Commission (Tax Code §22.23(d)) | April 30 |

|

ARB Training

In the wake of various federal, state and local guidelines on social distancing, we canceled all in-person appraisal review board (ARB) training. This month we will debut a remote training option that still meets the legal requirements for completion of the ARB training.

In the wake of various federal, state and local guidelines on social distancing, we canceled all in-person appraisal review board (ARB) training. This month we will debut a remote training option that still meets the legal requirements for completion of the ARB training.

Please be aware that any remote option will require ARB training attendees to access the training via the internet. We will provide phone and email assistance to the attendees and the supporting staff; we ask that ARB chairs and ARB coordinators also provide support to their members who may need technical assistance in accessing the training.

We will send additional information as soon as it is available.

Exemption and Application Deadlines

The last day for property owners to file most exemption and special appraisal applications is April 30. Certain property owners may late file homestead exemption applications, as indicated below:

- A property owner may file an age 65 or older exemption application up to two years after the date on which he or she became age 65.

- A property owner may file a donated residence homestead of a partially disabled veteran exemption application for up to two years after he or she qualifies.

- A property owner may file a homestead exemption application up to two years after the date the taxes become delinquent.

- A property owner may file a disabled veteran exemption application up to five years after the date the taxes become delinquent.

A religious organization denied a Tax Code Section 11.20 exemption because of its charter must amend the charter and file a new application by May 31 or before the 60th day after the date of notification of the exemption denial, whichever is later.

A private school denied a Tax Code Section 11.21 exemption because of its charter must amend the charter and file a new application by June 30 or the 60th day after the date of notification of the exemption denial, whichever is later.

Taxpayer Rights and Remedies

Property owners are entitled to an explanation of the remedies available when they are dissatisfied with the appraised value of their property. The deadline for property owners to file most protests with the ARB is May 15 or by the 30th day after delivery of the notice of appraised value, whichever is later. The Comptroller's publication Property Taxpayer Remedies (PDF) provides an explanation of the remedies available to taxpayers and procedures to follow in seeking remedial action.

Binding Arbitration Information

Tax Code Chapter 41A gives property owners meeting certain criteria the option to request binding arbitration as an alternative to appealing an ARB decision to district court.

Tax Code Chapter 41A gives property owners meeting certain criteria the option to request binding arbitration as an alternative to appealing an ARB decision to district court.

In the wake of COVID-19, we encourage property owners, appraisal districts and arbitrators make every effort to schedule telephone hearings and exchange evidence electronically.

You can find information regarding binding arbitration, including frequently asked questions, forms, fee schedule and arbitrator registry, on PTAD's Arbitration Information webpage.

Event News

Texas Association of Appraisal Districts (TAAD) Conference

Texas Association of Appraisal Districts (TAAD) Conference

PTAD proudly participated in TAAD's 2020 Annual Conference, Feb. 23-26, in Dallas. PTAD Assistant Director Shannon Murphy, PVS Manager Bill Messick and MAP Supervisor Lori Fetterman presented and led a discussion with audience members. PTAD attendees also included Casey Bean, Andrew Belcher, Emily Hightree and Lorraine Miller.

Texas Oil and Gas Association (TXOGA) Conference

We were pleased to have Comptroller Hegar speak at this year's TXOGA conference, Feb. 19-20, in San Antonio. PTAD presenters also included Director Korry Castillo and Property Tax Data Analysis Manager Rick Parker. Also in attendance from PTAD were Doug Kubecka and Michael Walior.

Texas State Association of Fire and Emergency Districts (SAFE-D) Conference

PTAD truth-in-taxation (TNT) subject matter experts, Catie Burleigh and Craig Williams, also hit the road in February, making a stop in Galveston on Feb. 21 to present at the SAFE-D Conference. Their session covered Senate Bill 2 changes to the TNT process.

Repealed Rule 9.100

Property Value Study Advisory Committee

Property Tax Administration Rule §9.100, Property Value Study Advisory Committee was repealed effective April 7, 2020.

Visit our Property Tax Rules webpage for more information on rule proposals.Cap Rate

In 2020, appraisal districts must use a cap rate of 10 percent for appraising agricultural or open-space land and a cap rate of 7.28 percent for appraising timberland. For more cap rate information, see our website.

Please be advised that the information in this newsletter is current as of the date of its publication and is provided solely as an informational resource. The information provided neither constitutes nor serves as a substitute for legal advice. Questions regarding the meaning or interpretation of any information included or referenced herein should be directed to legal counsel and not to the Comptroller's staff.