WHAT IS A TAX ABATEMENT?

A tax abatement is a local agreement between a taxpayer and a local taxing unit that exempts all or part of the increase in the value of property from taxation for a period not to exceed 10 years.

The purpose of tax abatements is to assist cities, counties and special purpose districts:

- attract new industries;

- encourage the retention and development of businesses; and

- promote capital investment by easing the property tax burden on certain projects.

Tax abatements are an economic development tool available to cities, counties and special districts to attract new industries and to encourage the retention and development of existing businesses through property tax exemptions or reductions.

School districts may not enter into abatement agreements.

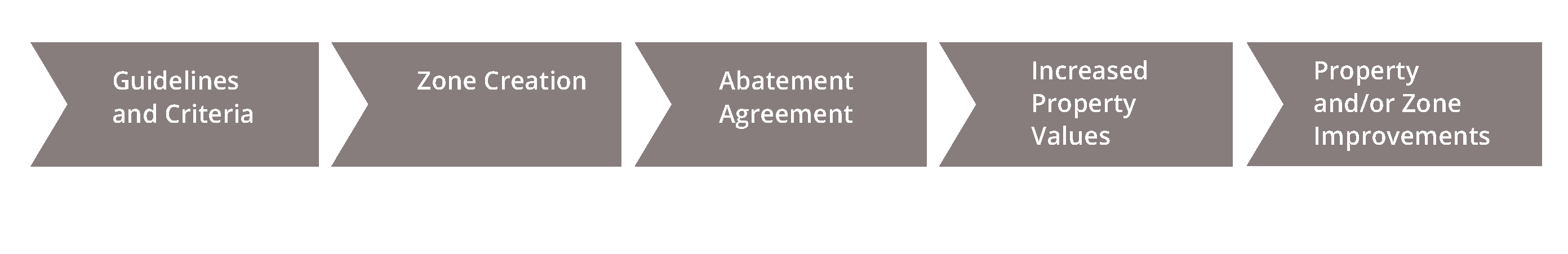

The Process of Abated Property Valuations

- Step 1: Adopt Guidelines and Criteria

-

The first step is to create and approve guidelines and criteria about what a local taxing unit will offer in an abatement agreement. According to Tax Code, Section 312.002: “The guidelines applicable to property other than property described by Section 312.211(a) must provide for the availability of tax abatement for both new facilities and structures and for the expansion or modernization of existing facilities and structures.”

- Step 2: Designate a Reinvestment Zone

-

The city or county governing body may designate an area as a reinvestment zone after the guidelines and criteria have been approved and a public hearing has been held.

- Provide Notice of Public Hearing: Before a public hearing may be conducted, a city or county governing body must provide a seven-day notice in a newspaper that is in general circulation in the city or county in which the hearing will take place, as well as a seven-day written notice to other taxing units in the proposed area. Notice to other taxing units is considered delivered when addressed properly to the correct presiding officer for each taxing unit and mailed or sent via registered or certified mail with a return receipt received.

- Hold a Public Hearing: A city or county governing body shall hold a public hearing to ascertain if the designated area qualifies as a reinvestment zone under Section 312.201 or Section 312.401, Tax Code. At the hearing, members of the public are permitted to speak and present support for or against the designation of the reinvestment zone.

- Treatment of Enterprise Zones: An enterprise zone created under Chapter 2303, Government Code, is identified as a reinvestment zone pursuant to Sections 312.2011 and 312.4011, Tax Code.

- Adoption of an Ordinance or Order: Once findings in favor of creating a zone have been made, a city ordinance or county order may be adopted by the governing body to designate the area as a reinvestment zone. The ordinance or order must describe the zone's boundaries and designate whether the zone is eligible for residential tax abatement, commercial-industrial tax abatement or tax increment financing. A reinvestment zone designation created under the Tax Abatement Act (i.e., Chapter 312, Tax Code) expires after five years and may be renewed for periods not to exceed five years.

- Step 3: Statement of Abatement Eligibility

A taxing unit cannot enter into an abatement agreement until it adopts a resolution stating that the taxing unit elects to become eligible to participate in a tax abatement (Section 312.002(a), Tax Code). This action should be taken with plenty of lead time before the consideration and vote on an actual abatement agreement, so the public and other local taxing units with jurisdiction over the same property can consider approving an abatement to the same business that is working with the lead taxing unit.

- Step 4: Public Notice

-

Once a taxing unit creates a reinvestment zone, there are three steps to implementing a tax abatement agreement.

- Provide 30 Days Public Notice of Meeting: Section 312.207(d), Tax Code, requires at least 30 days public notice of the meeting on the approval of a tax abatement agreement. Notice should be provided in accordance with the Open Meetings Act. Among other requirements, the notice must contain:

- The property owner's name and the applicant's name in the agreement.

- The name and location of the reinvestment zone subject to the agreement.

- A general description of the nature of the improvements or repairs in the agreement.

- The estimated cost of the improvements or repairs.

- Approval of Agreement at Public Hearing: By a majority vote, the governing body may approve a tax abatement agreement when it determines the agreement terms and property meet the pertinent guidelines and criteria governing tax abatement agreements.

- Notice to Other Taxing Units and Agreement Execution: Before the agreement is executed, written notice to other taxing units and a copy of the proposed agreement are required to be sent at a minimum of seven days in advance. Notice is considered delivered when addressed properly to the correct presiding officer for each taxing unit and placed in the mail. Failure to deliver the notice does not affect the validity of the agreement. Other taxing units eligible under Section 312.002, Tax Code, may enter into a tax abatement agreement as described in Sections 312.206 and 312.402, Tax Code.

The tax abatement must be contingent on the property owner making specific improvements or repairs to the property, and only the increase in the value of the property may be exempted. The property owner may not exempt the real property's current value. The current value of real property is the taxable value of the real property and any fixed improvements as of Jan. 1 of the year in which the tax abatement agreement is executed.

- Provide 30 Days Public Notice of Meeting: Section 312.207(d), Tax Code, requires at least 30 days public notice of the meeting on the approval of a tax abatement agreement. Notice should be provided in accordance with the Open Meetings Act. Among other requirements, the notice must contain:

- Step 5: Entering into a Tax Abatement Agreement

-

When a reinvestment zone is created, the city or county governing body may enter into a tax abatement agreement with the property owners for a period not to exceed 10 years as set forth in Sections 312.204 and 312.402, Tax Code. Once the governing body authorizes the agreement at a regularly scheduled meeting, it may be enacted after giving notice to other taxing units.

Section 312.205(a), Tax Code, sets out seven prerequisites for a tax abatement agreement. The agreement must:

- List the kind, number and location of all proposed improvements to the property.

- Provide access to and authorize the taxing unit to inspect the property to ensure compliance with the agreement.

- Limit the property's use consistent with the taxing unit's development goals.

- Provide for recapturing property tax revenues that are lost if the owner fails to make the improvements or repairs as provided in the agreement.

- Include each term that was agreed upon with the property owner.

- Require the owner to annually certify compliance with the terms of the agreement to each taxing unit.

- Allow the taxing unit to cancel or modify the agreement at any time if the property owner fails to comply with the terms of the agreement.

For example:

A business owns property valued at $500,000 as of Jan. 1 of the year the tax abatement agreement is executed. The business agrees to significantly enlarge the facility, increasing its valuation to $800,000. The taxing unit may abate from taxation up to $300,000 of the property value (the portion of the value that exceeds the base value of $500,000).

The agreement may also abate all or part of the value of tangible personal property the business brings onto the site after the execution of the agreement. A taxing unit may not abate the value of personal property that was already located on the real property before the agreement took effect. The abatement for personal property may not exceed 10 years. The percentage of the tax abatement for either real or personal property may not exceed the total increase in property value.

NOTE: Abated property could include tangible real property or personal property. However, whether a property is tangible real or personal property, there is some limited usage of tax abatements for purposes other than industrial or commercial projects, such as for residential area improvements and/or development.

- Step 6: Mandatory Reports to the Comptroller's Office

-

The Comptroller's office maintains the central registry of all designated reinvestment zones and executed ad valorem tax abatement agreements under the Tax Abatement Act.

Refer to Post-abatement Valuation Reports and Reporting Requirements.

A taxing unit can create a reinvestment zone that includes one or more real or personal property lots with specified account numbers assigned by the appraisal district. The properties that fall within the boundaries of the reinvestment zone must meet the statutory criteria outlined in Tax Code, Section 312.202.

The local taxing unit then enters into an abatement agreement with an individual or business, abating personal tangible and/or real property up to 100 percent for a period of up to 10 years.

Over this 10-year period, the abated properties’ values will adjust annually and should increase. These factors may increase value:

- other businesses moving into the area;

- other economic incentives encourage moves into the area;

- public project improvements may made by the local taxing unit, increasing the area’s attractiveness due to its infrastructure, social venues, lifestyle options available; and

- inflation may grow property values.

These increased values after the abatement expires allow the local taxing unit to potentially capture more ad valorem taxes and provide better services to the citizens.

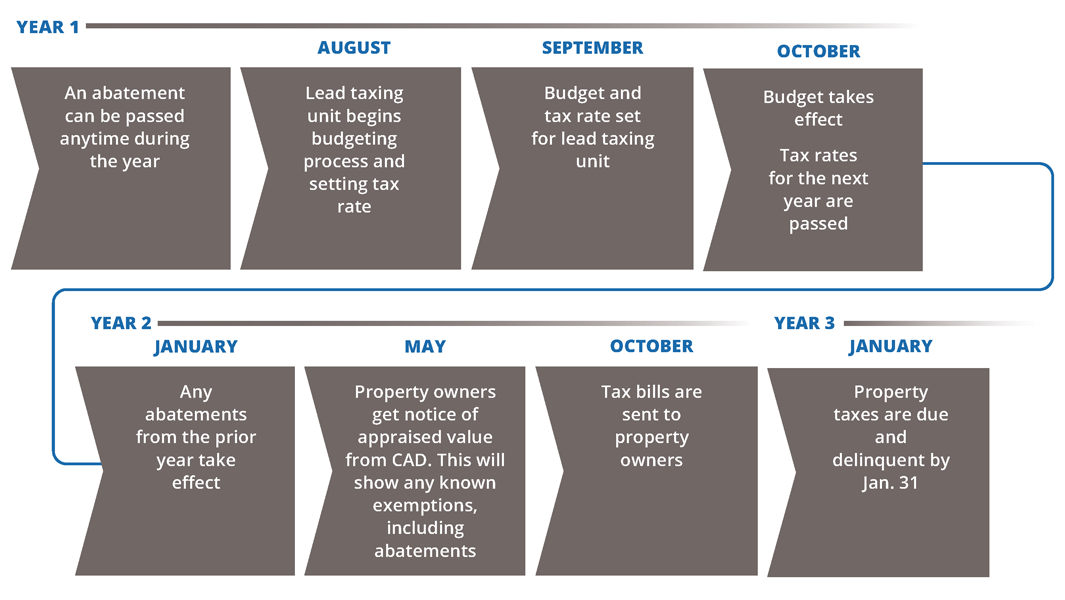

Abatements and Tax Collections, Remitting & Processing Timeline

The abatement will take effect after the terms are agreed to and signed at a designated date during the calendar year.

Typically, local government taxing units begin the annual budget process and hold hearings between July and September to set the tax rate for the next fiscal year.

In September, the local government taxing unit approves the budget and the tax rate.

On Oct. 1, the approved budget and the tax rate take effect for the new fiscal year.

On Jan. 1 of the next calendar year, any approved abatement agreement takes effect.

By May 1 during the following calendar year, property owners will get a notice from the appraisal district regarding their property’s appraised value. This notice will show exemptions, including abatements on the property that were reported to the appraisal district from the local taxing unit. Failure to report this information to the CAD by the local taxing unit in a timely manner can impact the abatement agreement’s implementation.

In October, tax bills are sent to the property owners including those with abatements.

Taxes on the property will be due Jan. 31. Taxes may be reduced in part or in whole depending on the amount of the abatement and whether it includes some or all property (real and/or personal tangible property).

If taxes are not paid, this account would be considered delinquent, which could incur penalties and potentially abrogate the abatement agreement. When abatements are given to a property owner within a reinvestment zone, this may spur new economic development, create new business spin-offs and/or attract more people to move into the area.

These factors could increase the abated property’s valuation. The amount due can be mitigated in part or in total, depending on the terms of the abatement.

Need Help?

For additional information, contact the Data Analysis and Transparency Division.