Property Tax Today

Quarterly Property Tax News

Volume 10 | October 2019

Property Tax Today features content regarding upcoming deadlines, action items and information releases.

Please let us know what you would like to see in future editions by sending property tax questions and/or suggested topics to ptad.today@cpa.texas.gov. We will gladly address property tax matters under our authority.

Message from the Comptroller

Glenn Hegar

Texas Comptroller

Over the summer, agency executives and I visited New York City for our annual meeting with representatives of the "big four" credit rating agencies. I am pleased to announce that Texas has once again received the highest short-term credit rating on Texas Tax and Revenue Anticipation Notes. These high ratings, along with maintenance of our AAA long-term ratings, help keep Texas' borrowing costs low and save taxpayer dollars as we manage our cash flow. Our creditworthiness reflects our conservative approach to financial management, a diverse economy and a growing employment base.

The Property Tax Assistance Division (PTAD) also kept busy over the summer. PTAD staff represented our agency by attending and presenting at industry conferences and meetings across the state; certified the final 2018 Property Value Study results to the commissioner of education on Aug. 15; and released the preliminary Methods and Assistance Program (MAP) reports to 125 appraisal districts on Sept. 12.

PTAD continues working to implement new mandates and changes resulting from the 86th Texas Legislature. The 2019 Tax Code and 2019 Property Tax Laws books will soon be available for sale. You will be able to place an order by forwarding an order form and required payment to PTAD. Additionally, PTAD will soon publish the 2019 Law Changes publication, summarizing property tax laws that changed due to legislation passed during the 86th Legislature. Remember to attend the Property Tax Institute (PTI) in Austin, Dec. 10-11, to stay current on property tax matters in Texas.

2018 PVS Final Results

On Aug. 15, 2019, the Comptroller's office certified the total 2018 value of all taxable property in each school district to the commissioner of education as required by Government Code Chapter 403. The 2018 PVS final taxable value findings are available on PTAD's Property Value Study and Self Reports webpage.

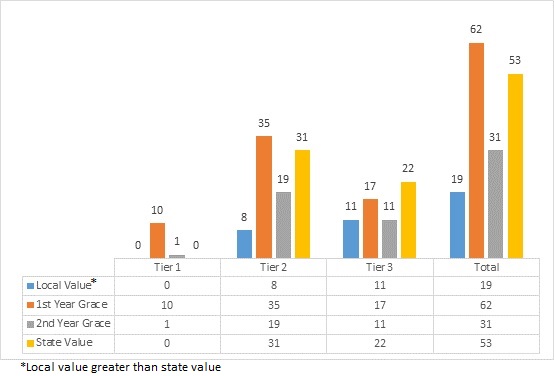

The chart above shows the breakdown of the 2018 PVS final findings. In this cycle, 62 school districts qualified for year one of the grace period; 31 qualified for year two of the grace period; 53 received state value; and 19 had local value that was greater than state value. Broken down by tiers:

- Tier 1 had 11 eligible school districts: 10 that qualified for year one of the grace period and one that qualified for year two of the grace period.

- Tier 2 had 93 eligible school districts: 35 that qualified for year one of the grace period; 19 that qualified for year two of the grace period; 31 that received state value; and eight that had local value that was greater than state value.

- Tier 3 had 61 eligible school districts: 17 that qualified for year one of the grace period; 11 that qualified for year two of the grace period; 22 that received state value; and 11 that had local value that was greater than state value.

The three PVS tiers referenced above are the same as the MAP tiers, based on the following total county population ranges:

- Tier 1 = population of 120,000 or more

- Tier 2 = population of less than 120,000 to 20,000

- Tier 3 = population of less than 20,000

MAP Reviews

PTAD sent 2020-21 MAP review draft questions and guidelines to chief appraisers on Aug. 22, 2019 with a Sept. 20 due date for comments. PTAD considers all written comments, makes appropriate changes and posts the final 2020-21 questions on the Methods and Assistance Program webpage.

Upon finalization of the 2020-21 MAP documents, PTAD sends notice to appraisal districts scheduled to receive a MAP review in 2020, together with the request for data.

PTAD released the preliminary 2019 MAP reports to 125 appraisal districts on Sept. 12, 2019. The total number of recommendations made during this review cycle was 1,790.

This marks the completion of five cycles of the MAP review process and the 10-year anniversary of the program. During this time, PTAD made nearly 17,000 preliminary recommendations and referred 89 appraisal districts to the Texas Department of Licensing and Regulation for failure to implement recommendations in a timely manner.

Appraisal Review Board (ARB) Surveys, Comments and Suggestions

The Comptroller's office is preparing the annual report summarizing property owners' comments and suggestions about ARBs received through our survey. Because surveys may only be submitted electronically, information from any handwritten surveys completed at the appraisal district office must be entered into the electronic survey no later than Dec. 1, 2019.

Additionally, taxpayer liaison officers in counties with populations exceeding 120,000 (as defined by the 2010 U.S. Census) must submit to the Comptroller's office a list of verbatim comments and suggestions received from property owners, agents or chief appraisers about the model ARB hearing procedures or any other matter related to the fairness and efficiency of the ARB. Please submit comments and suggestions received pertaining to these matters only in the appropriate Excel spreadsheet template (XLS) no later than Dec. 31, 2019.

Chief Appraiser Eligibility

All chief appraisers must notify the Comptroller's office in writing no later than Jan. 1 of each year as to whether they are eligible to be appointed or serve as chief appraiser. Tax Code Section 6.05(c) provides that to be eligible to serve as chief appraiser, a chief appraiser must either be a certified Registered Professional Appraiser (RPA) or have the appropriate professional designation (Member Appraisal Institute (MAI), Assessment Administration Specialist (AAS), Certified Assessment Evaluator (CAE) or Residential Evaluation Specialist (RES)). A chief appraiser who is not an RPA but who has an MAI, AAS, CAE or RES designation must obtain an RPA certification within five years of his or her appointment or beginning of service as chief appraiser.

Chief appraisers must submit written notification using the newly updated Form 50-820, Notice of Chief Appraiser Eligibility. Submissions for 2020 must be submitted on the updated version of this form. Please email completed forms to ptad.cpa@cpa.texas.gov.

Tax Bills

Taxing units usually mail their tax bills in October. Tax bills are due upon receipt, and the deadline to pay taxes is usually Jan. 31. Taxes become delinquent, with penalty and interest charges added to the original amount beginning on Feb. 1. Failure to receive a tax bill does not affect the validity of the tax, penalty or interest due, the delinquency date, the existence of a tax lien or any procedure the taxing unit institutes to collect the tax.

More information regarding payment of taxes, including deadlines, consequences for failure to pay and instances when a waiver of penalty or interest may apply, is located on PTAD's Paying Your Taxes webpage.

Payment Options

Information regarding payment options is located on PTAD's Payment Options webpage. Tax collection offices are required to offer certain, but not all, payment options. Contact your local tax collection office to determine what local payment options may be available, such as:

- Credit card payment (Tax Code Section 31.06)

- Deferral (Tax Code sections 33.06 and 33.065)

- Discounts (Tax Code Section 31.05)

- Escrow agreement (Tax Code Section 31.072)

- Installment payment (Tax Code sections 31.031 and 31.032)

- Split payment (Tax Code Section 31.03)

- Partial payment (Tax Code Section 31.07)

- Work contract (Tax Code sections 31.035 – 31.037)

Operations Survey Data

Our office recently published the responses to the Appraisal District Operations Survey for the 2018 Tax Year on PTAD's Property Tax Survey Data and Reports webpage. PTAD will post the updated visualization tool that presents Operations Survey data in the near future.

Proposed Constitutional Amendments

On Nov. 5, 2019, Texas voters will decide whether to approve the following property tax related Constitutional amendments:

- A property tax exemption of precious metal held in a precious metal depository located in Texas.

- A temporary property tax exemption of property located in a Governor-declared disaster area.

For more information on proposed constitutional amendments, please refer to the Texas Secretary of State's website.

Event News

Comptroller Glenn Hegar delivered the keynote address to open the Texas Association of Assessing Officer's 2019 Annual Conference in San Antonio, Aug. 25 – 28. We were pleased to have Comptroller Hegar representing our agency to a diverse group of industry professionals in attendance. PTAD staff in attendance included Korry Castillo, Shannon Murphy, Stephanie Mata, Lori Fetterman, Emily Hightree and Heather Hampton.

PTAD truth-in-taxation (TNT) subject matter expert Craig Williams presented at a Tax Assessor-Collectors Association (TACA) regional meeting in Gonzales on Sept. 12, 2019. Craig provided insight on PTAD's implementation of TNT legislation passed by the 86th Texas Legislature.

PTAD's Jennifer Garcia and Doug Kubecka presented at the annual oil and gas industry meeting held Aug. 15, 2019.

Action Items

Below is an action item for the fourth quarter of 2019. You can find a full list of important property tax law deadlines for appraisal districts, taxing units and property owners on PTAD's website.

- Oct. 18 – Farm and Ranch Survey responses due

- Nov. 1 – Final MAP documents for 2019 reports due

- Dec. 1 – ARB survey comments due

- Dec. 31 – Taxpayer liaison officer comments received due

- Jan. 1 – Chief appraiser eligibility forms due

If one of the deadlines is on Saturday, Sunday or a legal or state holiday, the act is timely if performed on the next regular business day.

Well Done!

This quarter we turn our spotlight on Chief Appraiser Brett McKibben and the Brown County Appraisal District for efforts in providing opportunities for property owner engagement. Brett participates in speaking appearances at local community functions and regularly appears on local radio station KOXE to answer property owner questions and provide information on exemptions, renditions, agriculture and other topics. Way to go Brett and Brown County Appraisal District!

Congratulations

We congratulate Assistant Director Shannon Murphy and Information and Customer Service Supervisor Stephanie Mata! Shannon and Stephanie received recognition at the Institute of Certified Tax Administrators (ICTA) Luncheon on Aug. 25 for earning the Certified Tax Administrator (CTA) designation!

Please be advised that the information in this newsletter is current as of the date of its publication and is provided solely as an informational resource. The information provided neither constitutes nor serves as a substitute for legal advice. Questions regarding the meaning or interpretation of any information included or referenced herein should be directed to legal counsel and not to the Comptroller's staff.