Manufacturing in the Capital Region

The Capital Region of Texas includes 10 counties and stretches from Llano to San Marcos and from La Grange to Georgetown. The region encompasses the Austin-Round Rock-Georgetown Metropolitan Statistical Area (MSA), which includes Bastrop, Caldwell, Hays, Travis and Williamson counties. It also includes Blanco, Burnet, Fayette, Llano and Lee counties.

In 2019, the Capital Region had an estimated population of 2.4 million (nearly 8 percent of the state total) and accounted for 8.8 percent of the state’s total employment.

The region included more than 65,000 manufacturing jobs in 2019, about 6 percent of its total employment of more than 1.1 million. That the sector’s contribution to regional gross domestic product (GDP) and total wages was much larger, however, is a testament to the region’s high-value manufacturing production. The manufacturing sector’s regional GDP of $18.9 billion accounted for 11.5 percent of the total regional GDP of $164.8 billion. The Capital Region’s manufacturers paid more than $6.9 billion in wages in 2019, or nearly 10 percent of total regional wages of $71.7 billion. Annual wages for its manufacturing jobs averaged nearly $107,000 in 2019, compared to average wages of about $65,000 for all regional jobs.

In 2019, manufacturing activity in the region had the greatest effect on Williamson County, contributing 17.8 percent of the county’s total wages and 17.2 percent of its total GDP, results that far exceeded the regional averages. The county’s manufacturing jobs also had by far the highest average wages, at about $141,500 (Exhibit 1).

The region’s manufacturers include some of the world’s most innovative technology firms, including Samsung Austin Semiconductor, Apple, Dell Technologies, Oracle and many more. Its manufacturing sector — particularly its computer, electronics and semiconductor industries — is buoyed by an educated and skilled workforce and partnerships with research institutions including the University of Texas.

Exhibit 1: Manufacturing Overview by County, Capital Region, 2019

| County | Employment | Gross Domestic Product | Wages | ||||

|---|---|---|---|---|---|---|---|

| Total | Share | Total (millions) | Share | Total (millions) | Share | Average Annual Wages |

|

| Bastrop | 1,175 | 6.3% | $183 | 7.8% | $61 | 8.0% | $52,011 |

| Blanco | 338 | 9.9% | $40 | 10.2% | $16 | 9.2% | $45,921 |

| Burnet | 1,012 | 6.8% | $204 | 12.0% | $62 | 9.4% | $60,823 |

| Caldwell | 631 | 7.1% | $41 | 4.4% | $26 | 7.6% | $41,404 |

| Fayette | 925 | 10.0% | $85 | 5.4% | $37 | 9.3% | $39,518 |

| Hays | 4,907 | 6.7% | $718 | 9.7% | $292 | 9.6% | $59,479 |

| Lee | 454 | 5.7% | $51 | 5.3% | $25 | 5.8% | $55,943 |

| Llano | 158 | 3.3% | $22 | 2.9% | $8 | 4.4% | $52,365 |

| Travis | 41,350 | 5.3% | $13,526 | 10.8% | $4,412 | 8.1% | $106,707 |

| Williamson | 14,093 | 7.8% | $4,037 | 17.2% | $1,994 | 17.8% | $141,462 |

| Capital Region Total | 65,043 | 5.9% | $18,908 | 11.5% | $6,932 | 9.7% | $106,581 |

| Texas | 908,801 | 7.2% | $241,000 | 13.1% | $72,473 | 9.6% | $79,746 |

Sources: JobsEQ, U.S. Bureau of Economic Analysis and Texas Comptroller of Public Accounts

Long-Term Regional Trends

Between 2001 and 2019, manufacturing employment in the Capital Region fell by about 18 percent or nearly 14,000 jobs. Manufacturing’s share of total regional employment fell from 11.4 percent to 5.9 percent in this period (Exhibit 2).

Exhibit 2: Manufacturing Employment and Manufacturing Share of Total Employment, 2001 to 2019, Capital Region

| Year | Total Industry Jobs | Manufacturing Jobs | Manufacturing Share of Total Industry Jobs |

|---|---|---|---|

| 2001 | 695,274 | 78,989 | 11.4% |

| 2002 | 681,164 | 65,687 | 9.6% |

| 2003 | 675,636 | 60,770 | 9.0% |

| 2004 | 687,503 | 59,860 | 8.7% |

| 2005 | 720,492 | 59,739 | 8.3% |

| 2006 | 751,194 | 61,352 | 8.2% |

| 2007 | 788,202 | 62,823 | 8.0% |

| 2008 | 802,758 | 61,038 | 7.6% |

| 2009 | 781,042 | 51,368 | 6.6% |

| 2010 | 791,415 | 49,890 | 6.3% |

| 2011 | 816,312 | 52,159 | 6.4% |

| 2012 | 847,392 | 53,437 | 6.3% |

| 2013 | 880,901 | 54,901 | 6.2% |

| 2014 | 918,721 | 60,072 | 6.5% |

| 2015 | 960,421 | 60,672 | 6.3% |

| 2016 | 990,874 | 57,994 | 5.9% |

| 2017 | 1,022,982 | 59,922 | 5.9% |

| 2018 | 1,059,786 | 63,224 | 6.0% |

| 2019 | 1,102,735 | 65,043 | 5.9% |

Sources: JobsEQ and Texas Comptroller of Public Accounts

The region recovered some manufacturing jobs between 2009 and 2019, adding nearly 13,700 jobs for a 26.6 percent increase. By comparison, Texas and U.S. manufacturing jobs rose by 8.0 percent and 8.2 percent, respectively (Exhibit 3).

Exhibit 3: Percentage Change in Manufacturing Jobs, 2009 to 2019 (Indexed to 2009)

| Year | Capital Region Jobs | Capital Region Percent Change | Texas Jobs | Texas Percent Change | USA Jobs | USA Percent Change |

|---|---|---|---|---|---|---|

| 2009 | 51,368 | 0.0% | 841,353 | 0.0% | 11,854,159 | 0.0% |

| 2010 | 49,890 | -2.9% | 814,265 | -3.2% | 11,532,264 | -2.7% |

| 2011 | 52,159 | 1.5% | 840,195 | -0.1% | 11,748,311 | -0.9% |

| 2012 | 53,437 | 4.0% | 867,771 | 3.1% | 11,950,974 | 0.8% |

| 2013 | 54,901 | 6.9% | 877,534 | 4.3% | 12,040,273 | 1.6% |

| 2014 | 60,072 | 16.9% | 890,468 | 5.8% | 12,202,119 | 2.9% |

| 2015 | 60,672 | 18.1% | 881,291 | 4.7% | 12,339,571 | 4.1% |

| 2016 | 57,994 | 12.9% | 848,235 | 0.8% | 12,345,948 | 4.1% |

| 2017 | 59,922 | 16.7% | 854,385 | 1.5% | 12,456,179 | 5.1% |

| 2018 | 63,224 | 23.1% | 882,339 | 4.9% | 12,696,998 | 7.1% |

| 2019 | 65,043 | 26.6% | 908,801 | 8.0% | 12,828,307 | 8.2% |

Sources: JobsEQ and Texas Comptroller of Public Accounts

Between 2009 and 2019, the Capital Region added 455 manufacturing establishments, a 29 percent increase, compared to gains of 9 percent in Texas and 1 percent in the U.S. (Exhibit 4).

Exhibit 4: Total Manufacturing Establishments in Capital Region, 2009 to 2019

| Year | Capital Region (total) | Capital Region | Texas | USA |

|---|---|---|---|---|

| 2009 | 1,568 | 0.0% | 0.0% | 0.0% |

| 2010 | 1,544 | -1.5% | -1.4% | -2.5% |

| 2011 | 1,585 | 1.1% | -1.6% | -4.0% |

| 2012 | 1,612 | 2.8% | -1.9% | -4.7% |

| 2013 | 1,622 | 3.4% | -2.0% | -4.7% |

| 2014 | 1,656 | 5.6% | -1.4% | -3.9% |

| 2015 | 1,702 | 8.5% | 0.4% | -3.0% |

| 2016 | 1,786 | 13.9% | 1.7% | -2.2% |

| 2017 | 1,873 | 19.5% | 3.8% | -1.3% |

| 2018 | 1,955 | 24.7% | 5.7% | 0.0% |

| 2019 | 2,025 | 29.1% | 9.4% | 1.1% |

Sources: JobsEQ and Texas Comptroller of Public Accounts

The region’s manufacturing jobs paid average wages of $106,581 in 2019, far exceeding the Texas and U.S. averages. Between 2009 and 2019, its average wages rose by 38 percent, versus 32 percent in Texas and 27 percent in the U.S. (Exhibit 5).

Exhibit 5: Average Wages in Manufacturing Jobs, 2009 to 2019

| Year | Capital Region | Texas | USA |

|---|---|---|---|

| 2009 | $77,316 | $60,401 | $54,939 |

| 2010 | $83,733 | $63,310 | $57,595 |

| 2011 | $87,926 | $66,075 | $59,277 |

| 2012 | $88,759 | $68,491 | $60,553 |

| 2013 | $87,802 | $68,838 | $61,143 |

| 2014 | $89,950 | $71,171 | $63,024 |

| 2015 | $95,933 | $72,815 | $64,352 |

| 2016 | $92,941 | $73,125 | $64,922 |

| 2017 | $96,519 | $75,806 | $66,898 |

| 2018 | $97,523 | $77,647 | $68,585 |

| 2019 | $106,581 | $79,746 | $69,976 |

Sources: JobsEQ and Texas Comptroller of Public Accounts

The manufacturing sector’s GDP value for the Capital Region rose by an inflation-adjusted 62.6 percent between 2009 and 2019, for an average annual increase of 5 percent. The sector’s average annual GDP changes in Texas and the U.S., by comparison, were 2.6 percent and 1.9 percent, respectively (Exhibit 6).

Exhibit 6: Percentage Change in Real Gross Domestic Product, Manufacturing, 2009 to 2019 (Indexed to 2009)

| Year | Capital Region | Texas | USA |

|---|---|---|---|

| 2009 | 0.0% | 0.0% | 0.0% |

| 2010 | 16.9% | 10.8% | 5.4% |

| 2011 | 20.6% | 15.0% | 5.8% |

| 2012 | 6.8% | 10.9% | 5.1% |

| 2013 | 12.9% | 23.3% | 8.3% |

| 2014 | 13.8% | 11.3% | 10.2% |

| 2015 | 30.4% | 15.0% | 11.7% |

| 2016 | 34.0% | 11.7% | 10.9% |

| 2017 | 46.1% | 18.2% | 13.7% |

| 2018 | 50.2% | 24.4% | 18.5% |

| 2019 | 62.6% | 29.7% | 20.8% |

| 2009-2019 | 5.0% | 2.6% | 1.9% |

Sources: U.S Bureau of Economic Analysis and Texas Comptroller of Public Accounts

Pandemic Effects

All Texas industry sectors have been affected by the pandemic to some degree, and manufacturing is no exception. Monthly jobs data show that manufacturing jobs in the Austin-Round Rock-Georgetown metropolitan area fell by 900 (or -1.4 percent) in February 2021 compared to the previous year. This fall is less than manufacturing job declines in Texas (-6.0 percent) and the U.S. (-4.1 percent) in this period (Exhibit 7).

Exhibit 7: Changes in Manufacturing Jobs, February 2020 to February 2021

| Metro Area | Manufacturing Jobs | Percent Change (Manufacturing) | Percent Change (Total Employment) |

|---|---|---|---|

| Austin-Round Rock-Georgetown MSA | -900 | -1.4% | -3.0% |

| Texas | -54,200 | -6.0.% | -4.6% |

| United States | -524,000 | -4.1% | -6.0% |

Source: Texas Workforce Commission

Note: Not seasonally adjusted

Key Manufacturing Industries

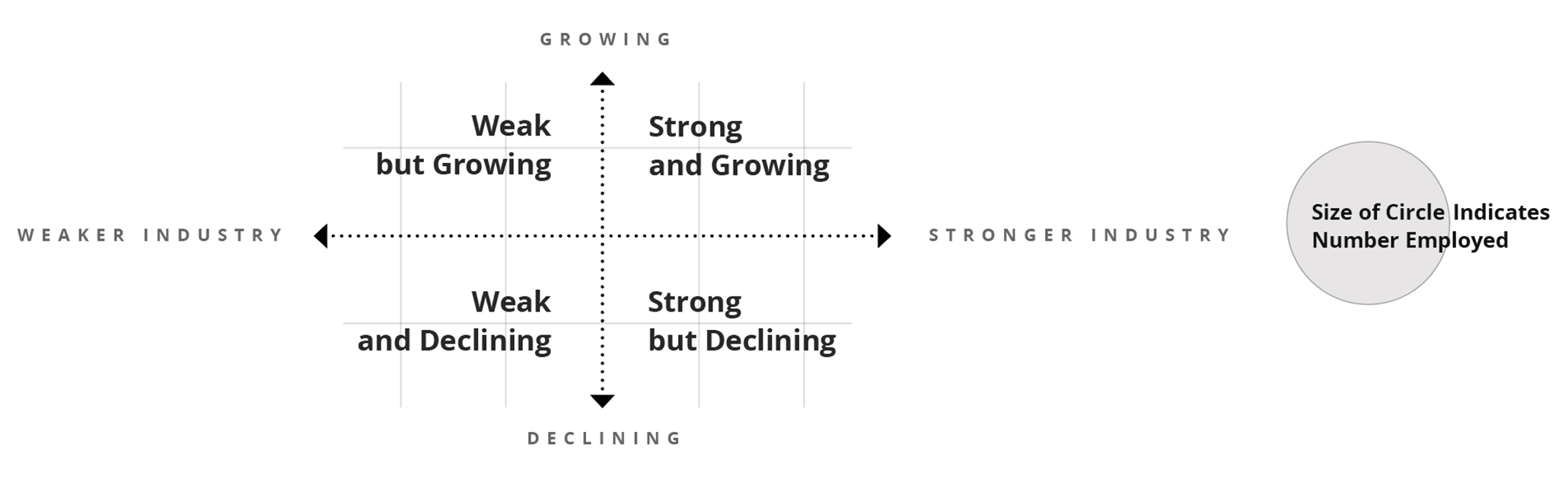

The interactive exhibit (Exhibit 8) reveals regional manufacturing industry strengths and weaknesses through the use of two common analytical tools that compare regional manufacturing employment trends to national averages. These tools serve as an educational resource to assess industry strengths and inform development prospects.

First, the location quotient (LQ) measures state and regional industry concentration levels by comparing an industry’s share of total regional employment to its share of total national employment. If the regional industry share exceeds the national share (an LQ greater than 1.00), the industry is more “concentrated” in the region than nationally. A score above 1.00 may indicate that the regional industry is strong and self-sufficient and that it exports its products or services outside of the region. Regional industries with below-average employment concentrations (LQs of less than 1.00) often import goods or services from other areas.

A second tool, shift-share analysis (SSA), measures regional industry job changes and assesses the role of local competitiveness on industry job gains or losses. The SSA uses national employment and industry trends to produce expected employment changes for a regional industry. If a regional industry’s actual employment changes exceed expected changes (a positive local competitiveness effect), the region may have a productive advantage in the industry. Between 2009 and 2019, SSA shows that manufacturing employment in the Capital Region exceeded expected changes by more than 12,000 jobs.

The Capital Region’s manufacturing industries plotted in the exhibit fall into one of four quadrants based on 2019 LQ values and SSA values between 2009 and 2019:

- Strong and growing: Industry has above-average concentration levels (2019 LQ value > 1.00) and industry job changes exceeded expected changes between 2009 and 2019 (positive competitiveness effect);

- Strong but declining: Industry has above-average concentration levels (2019 LQ value > 1.00) and industry job changes fell below expected changes between 2009 and 2019 (negative competitiveness effect);

- Weak but growing: Industry has below-average concentration levels (2019 LQ value < 1.00) and industry job changes exceeded expected changes between 2009 and 2019 (positive competitiveness effect); and

- Weak and declining: Industry has below-average concentration levels (2019 LQ value < 1.00) and industry job changes fell below expected changes between 2009 and 2019 (negative competitiveness effect).

While manufacturing isn’t highly concentrated in the Capital Region (2019 LQ = 0.68), it has competitive factors that allowed manufacturing employment to flourish; regional manufacturing jobs exceeded expected changes by more than 12,000 jobs between 2009 and 2019.

The region’s computer and electronic products industry is its most heavily concentrated manufacturing industry, with an LQ value of 3.5. (In other words, the industry’s share of Capital Region employment is 3.5 times as high as the industry’s nationwide share.) The industry was also one of the region’s most competitive, as employment exceeded expected gains by more than 5,400 jobs.

The computer industry is highly important to the region and the state — its 28,026 jobs in 2019 accounted for 43 percent of the Capital Region’s total manufacturing employment and 66 percent of its total manufacturing wages. The region also is home to 30 percent of the industry’s total Texas employment.

The levels of employment concentration for many of the region’s manufacturing industries remain below national averages, yet several show high levels of competitiveness, including medical equipment and food and beverage manufacturing. Such developments could identify emerging industries and prospects for further growth.

A note of caution: A positive competitive effect indicates that some economic advantages exist in a region, such as access to natural resources or access to a more productive labor pool, management or technologies. A positive competitive effect indicates some economic advantages exist but cannot identify the source of that advantage.

Exhibit 8: Manufacturing Industries in the Capital Region, Concentration Levels and Competitiveness

| Industry Title | NAICS | Employment, 2019 | Location Quotient, 2019 | Employment Changes due to Local Competitiveness, 2009-2019 |

|---|---|---|---|---|

| Food Manufacturing | 311 | 3,693 | 0.3 | 1,114 |

| Beverage and Tobacco Product Manufacturing | 312 | 2,320 | 1.08 | 1,321 |

| Textile Mills | 313 | 71 | 0.09 | 43 |

| Textile Product Mills | 314 | 208 | 0.25 | 104 |

| Apparel Manufacturing | 315 | 147 | 0.18 | 58 |

| Leather and Allied Product Manufacturing | 316 | 147 | 0.72 | 139 |

| Wood Product Manufacturing | 321 | 828 | 0.27 | -352 |

| Paper Manufacturing | 322 | 263 | 0.1 | 166 |

| Printing and Related Support Activities | 323 | 2,013 | 0.63 | 25 |

| Petroleum and Coal Products Manufacturing | 324 | 179 | 0.21 | 106 |

| Chemical Manufacturing (Resource-Intensive Commodities) | 3251-3253 | 301 | 0.14 | 76 |

| Pharmaceutical and Medicine Manufacturing | 3254 | 2,114 | 0.92 | 84 |

| Chemical Manufacturing (Locally Processed Goods) | 3255-3259 | 722 | 0.37 | 381 |

| Plastics and Rubber Products Manufacturing | 326 | 2,031 | 0.37 | 582 |

| Nonmetallic Mineral Product Manufacturing | 327 | 3,107 | 1 | 246 |

| Primary Metal Manufacturing | 331 | 525 | 0.18 | -20 |

| Fabricated Metal Product Manufacturing | 332 | 4,599 | 0.41 | 696 |

| Machinery Manufacturing | 333 | 4,727 | 0.56 | 62 |

| Computer and Electronic Product Manufacturing | 334 | 28,026 | 3.48 | 5,442 |

| Electrical Equipment, Appliance and Component Manufacturing | 335 | 3,012 | 1 | 1,129 |

| Motor Vehicle, Body and Parts Manufacturing | 3361-3363 | 636 | 0.09 | 184 |

| Aerospace Product and Parts Manufacturing | 3364 | 890 | 0.22 | 231 |

| Other Transportation Equipment Manufacturing | 3365-3369 | 65 | 0.04 | 58 |

| Furniture and Related Product Manufacturing | 337 | 1,622 | 0.56 | 215 |

| Medical Equipment and Supplies Manufacturing | 3391 | 1,409 | 0.58 | 486 |

| Other Miscellaneous Manufacturing | 3399 | 1,387 | 0.63 | -461 |

| Total – Manufacturing | 65,043 | 0.68 | 12,115 |

Sources: JobsEQ and Texas Comptroller of Public Accounts

Summary

Manufacturing employment in the Capital Region rose by nearly 27 percent between 2009 and 2019, greatly outpacing state and national growth. In the Austin-Round Rock-Georgetown MSA, manufacturing fell during the COVID-19 restrictions of 2020, but the drop was less than declines in Texas overall and in the U.S.

Regional manufacturing is led by computer and semiconductor manufacturing, an industry that invests heavily in design activities and research and development. Such activity boosts jobs in other industries, particularly related service providers. Regional employment in the computer systems design and related services industry, for example, rose by 26,154 jobs between 2009 and 2019, a 184 percent increase.