San Antonio leads all U.S. metro areas in footwear manufacturing employment.

Textiles, Apparel and Leather Products

Manufacturing

U.S. and Texas manufacturers of textiles, apparel and leather have incurred significant job losses as production moves overseas to cheaper labor markets. Some areas of Texas, such as El Paso, still maintain a large presence of textile and apparel jobs, but these areas, too, have experienced heavy job losses within these subsectors.

22,200

Direct & Indirect Employment

$1.1 Billion

State Subsector GDP

$36,200

Average Annual Wage

$2.8 Billion

Exports

Sources: U.S. Bureau of Economic Analysis, Regional Economic Models, Inc., Emsi, U.S. Department of Commerce International Trade Administration

SUBSECTOR PRESENCE IN TEXAS

Texas had about 17,100 textile, apparel and leather manufacturing jobs in 2016. The average annual wage for these jobs was about $36,200. The top occupations within these subsectors include sewing machine operators, knitting and weaving machine setters and shoe and leather workers and repairers.

The leather and allied product subsector’s share of total employment is 1.80 times greater in Texas than in the U.S., as measured by location quotient.

| Description | Direct Jobs 2016 | Average Texas Salaries 2016 | Location Quotient 2016* |

|---|---|---|---|

| Subsector Totals | 17,120 | $36,227 | 0.53 |

| Textile Mills | 1,590 | $44,168 | 0.17 |

| Textile Product Mills | 5,836 | $33,689 | 0.61 |

| Apparel Manufacturing | 5,318 | $37,632 | 0.5 |

| Leather and Allied Products | 4,376 | $35,017 | 1.8 |

*Location quotient compares an industry’s share of jobs in a specific

region with its share of nationwide employment.

Source: Emsi

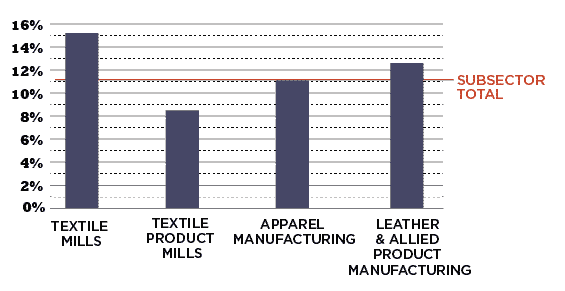

Texas Employment Projections By Subsector, 2014 to 2024

| Subsector | Number Change 2014 to 2024 | Percent Growth 2014 to 2024 |

|---|---|---|

| Textile Mills | 320 | 15.2% |

| Textile Product Mills | 520 | 8.5% |

| Apparel Manufacturing | 520 | 11.1% |

| Leather and Allied Product Manufacturing | 540 | 12.6% |

| TOTAL | 1900 | 11.1% |

Source: Texas Workforce Commission

Despite heavy job losses in these four subsectors during the past few decades, the Texas Workforce Commission does project some future job growth. Overall, the four subsectors are projected to rise by about 11 percent from 2014 through 2024.

Source: The U.S. Cluster Mapping Project

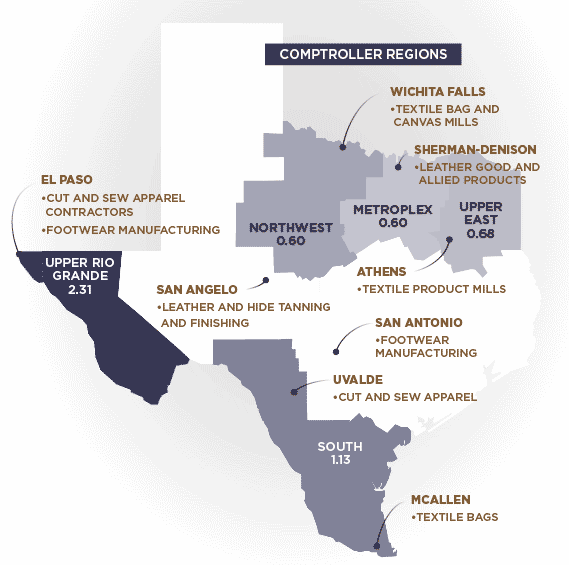

Regional Subsector LQs and Areas of Industry Specialization by Metro Area

The Upper Rio Grande and South regions maintain a high concentration of employment in these subsectors compared to the national average.

- Metroplex Region LQ 0.60:

- Sherman-Denison - Leather Good and Allied Products

- Northwest Region LQ .60

- Wichita Falls - Textile Bag and Canvas Mills

- Upper East Region LQ 0.68

- Athens - Textile Product Mills

- South Region LQ 1.13

- Uvalde - Cut And Sew Apparel

- McAllen - Textile Bags

- Upper Rio Grande LQ 2.31

- El Paso - Cut And Sew Apparel Contractors and Footwear Manufacturing

- West Region

- San Angelo - Leather and Hide Tanning and Finishing

- Alamo Region

- San Antonio - Footwear Manufacturing

Sources: Emsi, Texas Comptroller of Public Accounts

Conclusion

Manufacturing continues to drive output and productivity in the Texas economy, creating jobs paying well above the statewide average. It also contributes significantly to job creation in other industries, particularly in design operations and services.

U.S. and Texas jobs in the textiles, apparel and leather manufacturing subsectors fell by 62 percent from 2001 through 2016. These developments were expected and have occurred in other advanced economies, as production moves to cheaper labor markets.