The Texas share of national GDP in auto-related industries rose from 3.1 percent in 1997 to 8.5 percent in 2015.

Automobile-Related Manufacturing

Auto-related industries and jobs make important and growing economic contributions in Texas. Auto-related industries are highly advanced and spur innovation, exports and high-paying jobs. These industries have strengthened Texas’ economy, particularly following the 2008 recession; the state’s auto-related manufacturing GDP rose by an inflation-adjusted 450 percent from 2009 through 2015.

106,300

Direct & Indirect Employment

$13.9 Billion

State Subsector GDP

$60,672

Average Annual Wage

$13.7 Billion

Exports

Sources: U.S. Bureau of Economic Analysis, Regional Economic Models, Inc., Emsi, U.S. Department of Commerce International Trade Administration

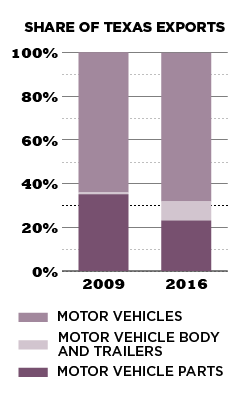

BODY AND TRAILERS LEAD EXPORT GAINS

Auto-related exports from Texas totaled $13.7 billion in 2016, up from $9.2 billion in 2009. Exports of motor vehicle bodies and trailers rose from $134 million to $1.1 billion during this period, accounting for 8 percent of all U.S. auto-related exports in 2016.

| Industry | 2009 | 2016 |

|---|---|---|

| Motor Vehicles | 35% | 23% |

| Motor Vehicle Body and Trailers | 1% | 8% |

| Motor Vehicle Parts | 64% | 68% |

| Description | Direct Jobs 2016 | Job Change 2010-2016 | Average Texas Salaries 2016 | Location Quotient 2016 |

|---|---|---|---|---|

| Subsector Totals | 38,836 | 35% | $60,672 | 0.49 |

| Motor Vehicle Manufacturing | 10,813 | 26% | $89,237 | 0.61 |

| Motor Vehicle Body and Trailer Manufacturing | 8,059 | 33% | $44,305 | 0.64 |

| Motor Vehicle Parts Manufacturing | 19,964 | 41% | $51,809 | 0.41 |

Source: Emsi

Sources: U.S. Bureau of Economic Analysis and Texas Comptroller of Public Accounts

All auto-related manufacturing industries are considered “advanced” as defined by the Brookings Institution — their research and development spending per worker ranks in the top 20 percent of industries and their share of workers with high levels of scientific and technical knowledge exceeds the national average.

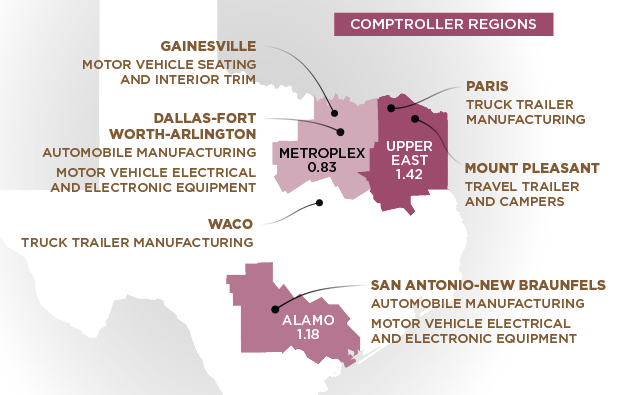

REGIONAL SUBSECTOR LQs AND AREAS OF INDUSTRY SPECIALIZATION BY METRO AREA

Location quotient (LQ) compares an industry’s share of jobs in a specific region with its share of nationwide employment.

The share of auto-related employment in the Alamo and Upper East regions is higher than in the U.S. as a whole, indicating the presence of a regional “industry cluster.” These regional clusters are spurred by initiatives such as the Texas-Mexico Automotive Super Cluster region, which markets its workforce and location globally to increase automotive investments in Texas and four states in northern Mexico.

Sources: Emsi, Texas Comptroller of Public Accounts

- Upper East Region LQ 1.42

- Paris: Truck Trailer Manufacturing

- Mount Pleasant: Travel Trailer and Campers

- Alamo Region LQ 1.18

- San Antonio, New Braunfels: Automobile Manufacturing, Motor Vehicle Electrical and Electronic Equipment

- Metroplex Region LQ 0.83

- Gainesville: Motor Vehicle Seating and Interior Trim

- Dallas, Fort Worth, Arlington: Automobile Manufacturing, Motor Vehicle Electrical and Electronic Equipment

- Other Regions

- Waco: Truck Trailer Manufacturing

Conclusion

The state’s favorable business climate and incentive programs have attracted automotive manufacturers and foreign investment. Automobile-related manufacturers face some challenges in Texas and the United States. Demand for motor vehicles fluctuates and is highly dependent on general economic conditions, consumer confidence, personal discretionary spending, interest rates and credit availability. And auto manufacturers are being forced to adapt to the increased popularity of ride-hailing services. Despite such challenges, automobile manufacturing has buoyed recent gains in total manufacturing economic output and employment growth in Texas and nationwide.