Computer and Electronic Product Manufacturing

The computer and electronic product manufacturing subsector is by far the fastest growing in terms of economic activity. Its contribution to Texas GDP increased by a staggering 584 percent from 1997 to 2015, averaging an annual growth rate of 11.3 percent. The subsector experienced even greater economic expansion in the U.S. as a whole, with GDP rising 680 percent.

306,500

Direct & Indirect Employment

$8.6 Billion

State Subsector GDP

$120,000

Average Annual Wage

$47.1 Billion

Exports

Sources: U.S. Bureau of Economic Analysis, Regional Economic Models, Inc., Emsi, U.S. Department of Commerce International Trade Administration

ADVANCED INDUSTRIES LEAD INNOVATION

This subsector consists of six industries, all considered “advanced industries” by the Brookings Institution based on two criteria: R&D spending per worker that ranks in the top 20 percent of all industries, and a share of scientifically and technically trained workers that exceeds the national average.

| Description | Direct Jobs | Average Texas Salaries | Location Quotient |

|---|---|---|---|

| Subsector Totals / 2016 | 91,472 | $120,389 | 1.05 |

| Computer and Peripheral Equipment | 20,824 | $133,936 | 1.52 |

| Communications Equipment | 10,342 | $130,557 | 1.44 |

| Audio and Video Equipment | 732 | $86,977 | 0.45 |

| Semiconductor and Other Electronic Component | 38,721 | $125,092 | 1.27 |

| Navigational, Measuring, Electromedical and Control Instruments | 20,020 | $93,411 | 0.61 |

| Manufacturing and Reproducing Magnetic and Optical Media | 833 | $114,609 | 0.65 |

Sources: Emsi and Texas Comptroller of Public Accounts

REGIONAL INDUSTRY CLUSTERS

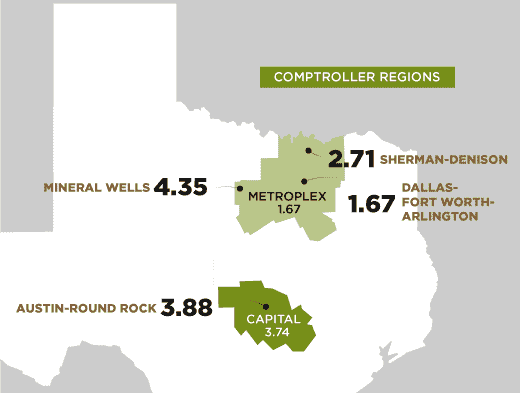

This subsector’s share of employment is higher in Texas than nationally, as measured by location quotient (LQ), a comparison of an industry’s share of jobs in a given region to its share of nationwide employment.

A higher LQ suggests a competitive advantage and the existence of a regional “industry cluster,” firms providing related products or services and sharing similar needs for workers and suppliers. The subsector’s LQ in Austin-Round Rock is 3.88, meaning its employment share is nearly four times higher than the national average.

SUBSECTOR EXPORTS

Subsector exports from Texas to Mexico nearly doubled between 2008 and 2016, and accounted for more than half of its exports in 2016.

Source: U.S. Department of Commerce International Trade Administration

Conclusion

Manufacturing continues to drive output and productivity in the Texas economy, creating jobs paying well above the statewide average. It also contributes significantly to job creation in other industries, particularly in services.

The computer and electronics subsector offers high-paying jobs and provides a considerable portion of the state’s exports. This subsector’s presence in Texas has spurred particularly strong growth in information technology services; the computer systems design and related services industry, for instance, added 64,000 TEXAS JOBS between 2010 and 2016, a gain of 63 percent.